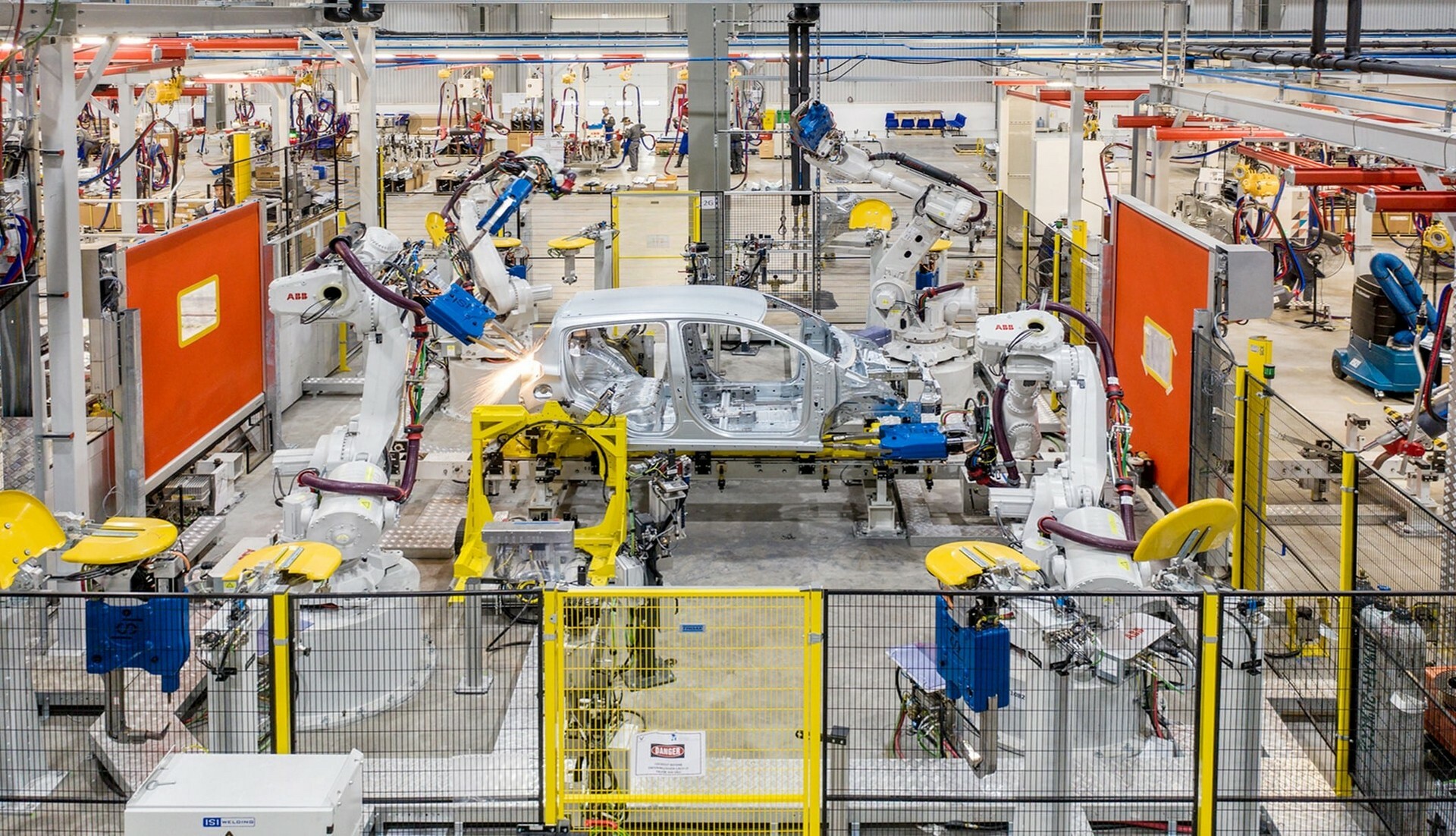

Vietnamese electric vehicle (EV) manufacturer VinFast acknowledged on Thursday that it delivered nearly 35,000 cars in 2023, just below its target of at least 40,000 units. The company cited slow EV adoption in certain regions, fierce competition, and economic uncertainties as contributing factors.

“We saw a significant ramp up in vehicle deliveries in the fourth quarter of 2023 compared to previous quarters,” said Tran Mai Hoa, VinFast’s Deputy CEO of sales and marketing. “However, against a challenging market backdrop, EV adoption rate in certain regions has been slow, leading to fewer deliveries than we anticipated.”

See also: VinFast Unveils Mid-Sized Electric Pickup, VF Wild, Targeting the U.S. Market

The deliveries in the final quarter of 2023 marked a 35% increase compared to the third quarter, totaling 13,513 units.

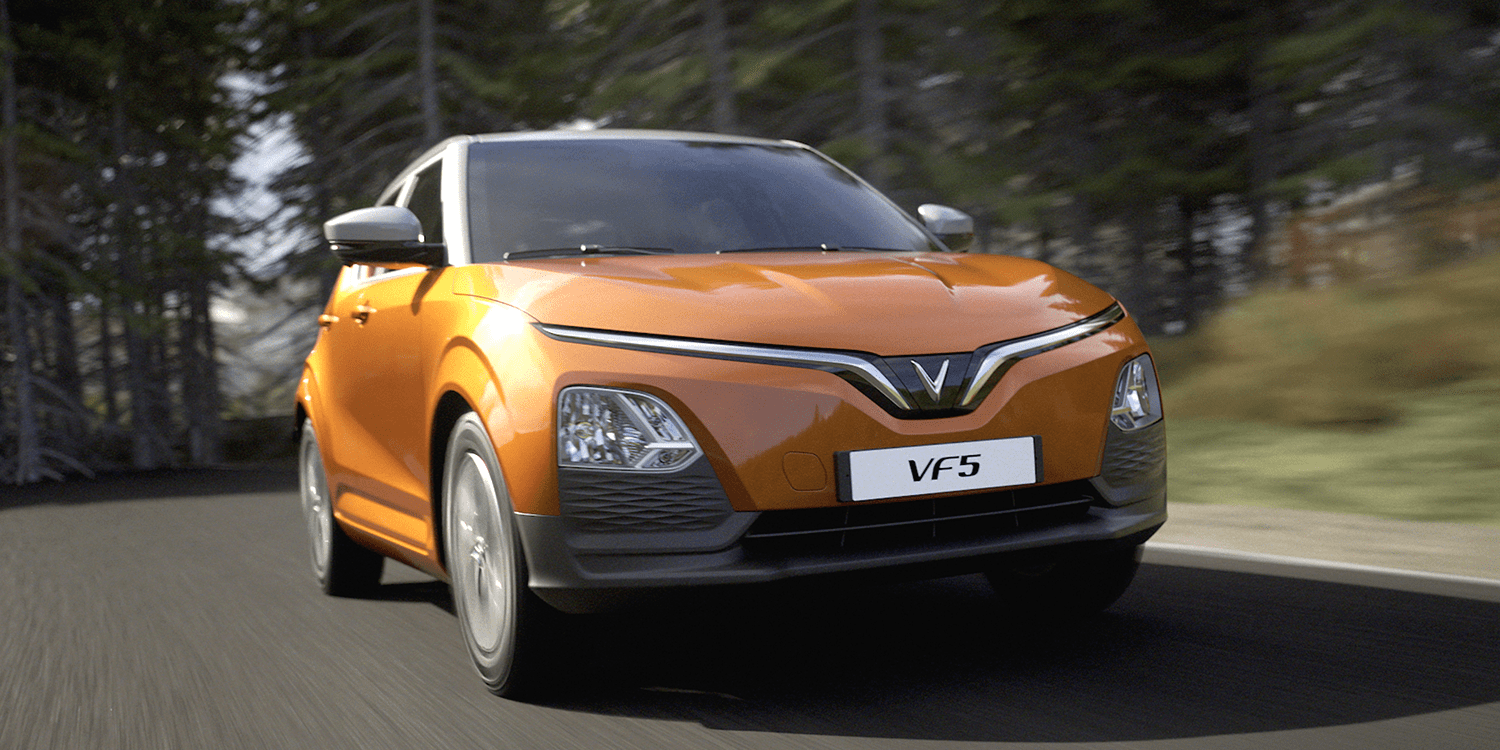

VinFast, which introduced its sport utility vehicle (SUV) VF 8 in California in March, recently revealed plans to establish manufacturing and battery facilities in India. The company also aims to broaden its presence in markets across the Middle East, Latin America, and Asia, with a specific focus on Indonesia.

“Although we faced challenges, we remain committed to our expansion plans,” stated Tran Mai Hoa. “The slow adoption of EVs in specific regions has impacted our delivery numbers, but we are optimistic about the potential in new markets.”

See also: VinFast and Tamil Nadu State Government Sign $2 Billion MOU for Electric Vehicle Facility

While VinFast did not provide a detailed breakdown of sales by markets in its Thursday announcement, approximately 60% of the deliveries in the second and third quarters were directed to Green SM (GSM), an affiliate of VinFast. GSM is a Vietnam-based taxi operator and leasing provider, predominantly owned by VinFast’s CEO, Pham Nhat Vuong.

In October, a senior VinFast official told Reuters, “We are looking to further expand our sales to GSM in the upcoming year.”

VinFast, yet to achieve profitability, entered the EV market amidst a period of pricing pressure, led by reductions from market leader Tesla and notable Chinese companies like BYD.