Vietnamese electric vehicle (EV) manufacturer VinFast has revealed its second-quarter financial results, marking its performance since its debut on the Nasdaq stock exchange last month. The company, which enjoys the backing of Vietnam’s largest conglomerate, Vingroup, has seen a substantial increase in revenue, largely driven by domestic sales.

VinFast’s remarkable journey on the stock market garnered it a valuation of approximately $85 billion, surpassing that of established U.S. automaker Ford. However, the company’s shares have experienced a 54% decrease in value since trading began on August 15, following its merger with a blank-check company.

In the second quarter, VinFast’s revenue surged by an impressive 131.2%, reaching a total of $327 million. Despite this substantial growth, the company reported a net loss of $526.7 million for the same period, although this loss had narrowed by 8.2% compared to the previous year.

VinFast’s Chief Executive, Le Thi Thu Thuy, expressed optimism during an earnings call, stating, “In the next couple of years, we should be able to be profitable.” Previously, the company’s founder and primary financial supporter, Pham Nhat Vuong, had anticipated achieving profitability by the end of the next year.

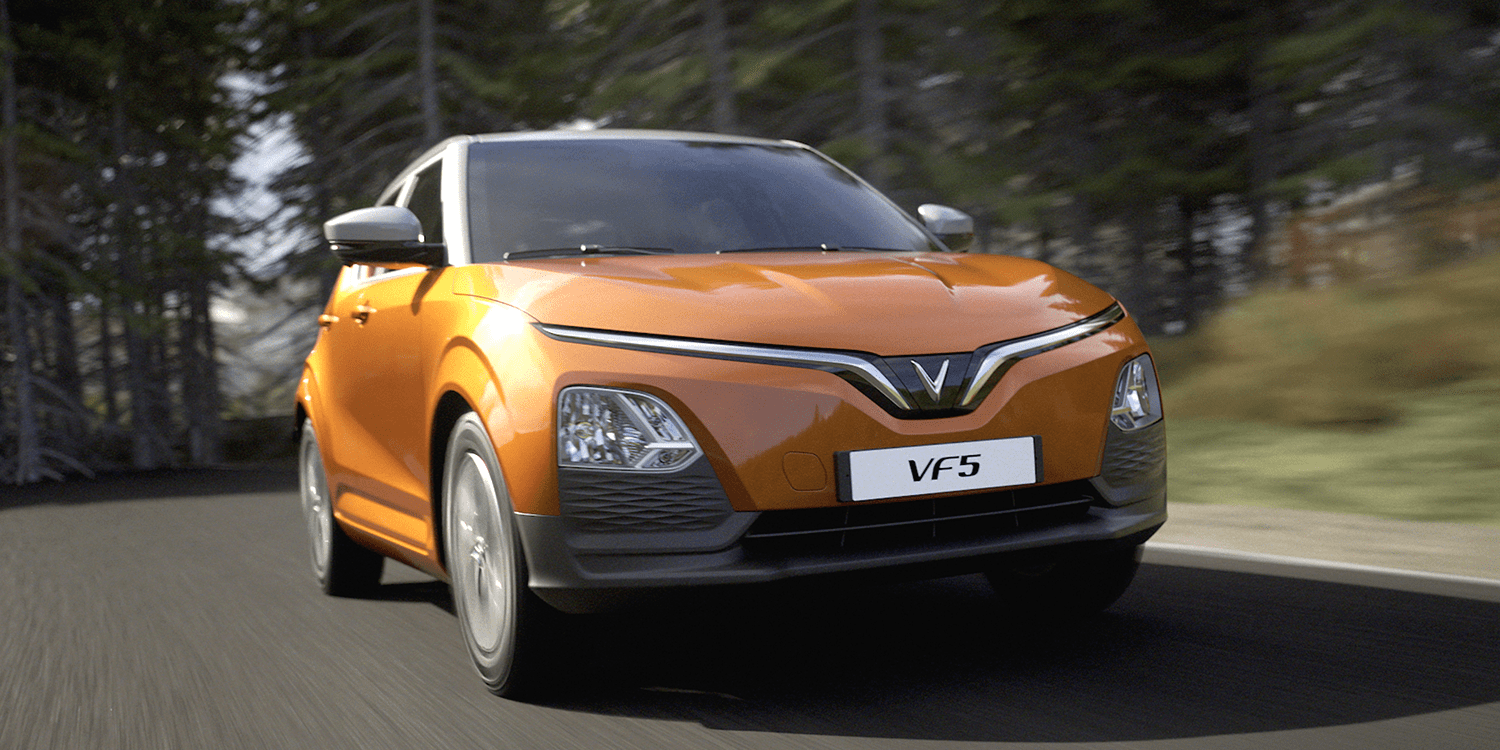

While specific sales breakdowns by market were not provided by VinFast, a significant portion of the revenue surge can be attributed to the sale of EVs in the domestic market, particularly through an initiative converting their cars into green taxis in Vietnam’s major cities. Additionally, VinFast has shipped nearly 3,000 units of its VF8 model to North America and has committed to delivering the larger VF9 EV by the end of this year.

However, the U.S. market has posed challenges for VinFast. David Byrne, an analyst at Third Bridge, commented, “U.S. sales aren’t expected to improve any time soon. The reputational issues caused by the launch of the VF8 will not be solved by the VF9.” The VF8 model received negative reviews in the U.S. due to quality concerns, leading the company to voluntarily recall the initial batch of 999 cars to rectify a software glitch.

To boost sales in the United States, Thuy revealed that VinFast is in discussions with multiple dealers and plans to announce dealership partnerships soon.

Since its establishment in 2017, VinFast has unveiled ambitious plans for EV expansion on the global stage. Last week, the loss-making automaker disclosed its intention to establish an assembly factory in Indonesia, a region rich in nickel resources, a critical material for EV batteries. Additionally, VinFast plans to deliver the first 3,000 VF8 cars to European customers this year, a move that coincides with the European Union’s consideration of imposing tariffs on Chinese EV rivals.