Funds managed by Goldman Sachs (GS.N) will write off nearly $900 million after Swedish lithium-ion battery producer Northvolt filed for Chapter 11 bankruptcy protection earlier this week, according to a report from the Financial Times. The Goldman private equity funds, which were the second-largest shareholders in Northvolt, plan to write down their $896 million investment to zero by the end of the year, the report revealed, citing letters to investors.

In a statement, Goldman Sachs acknowledged the disappointment of its investors, saying, “While we are one of many investors disappointed by this outcome, this was a minority investment through highly diversified funds. Our portfolios have concentration limits to mitigate risks.”

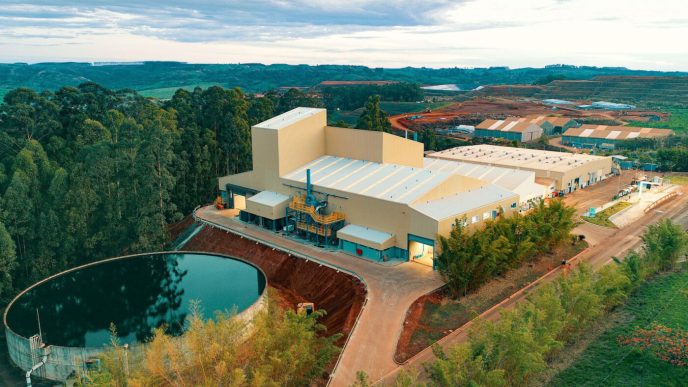

Northvolt, once seen as Europe’s key player in the energy transition, has faced significant challenges, including production issues and dwindling funds. The company’s trajectory shifted dramatically in recent months from being a promising leader in the sector to struggling to stay afloat.

Peter Carlsson, Northvolt’s CEO and co-founder, resigned on Friday, one day after the company filed for Chapter 11 bankruptcy protection in the U.S. Northvolt had raised $1 billion in equity capital in November 2019, with major backing from Germany’s Volkswagen and Goldman Sachs, to build Europe’s largest lithium-ion battery plant.

Source: Financial Times