Recent data from Goldman Sachs reveals a positive trend in the realm of electric car battery prices, signaling a decline after a temporary surge alongside inflation. Contrary to recent years where battery prices experienced an uptick due to increased metal costs and general inflation, the latest insights from Goldman Sachs suggest a faster-than-expected reversal in this trend.

The electric vehicle (EV) revolution witnessed a significant catalyst in the form of declining lithium battery prices over the past two decades. However, this trend faced a disruption in recent years with prices on the rise. Now, Goldman Sachs predicts a return to decreasing battery prices, and notably, at an accelerated pace.

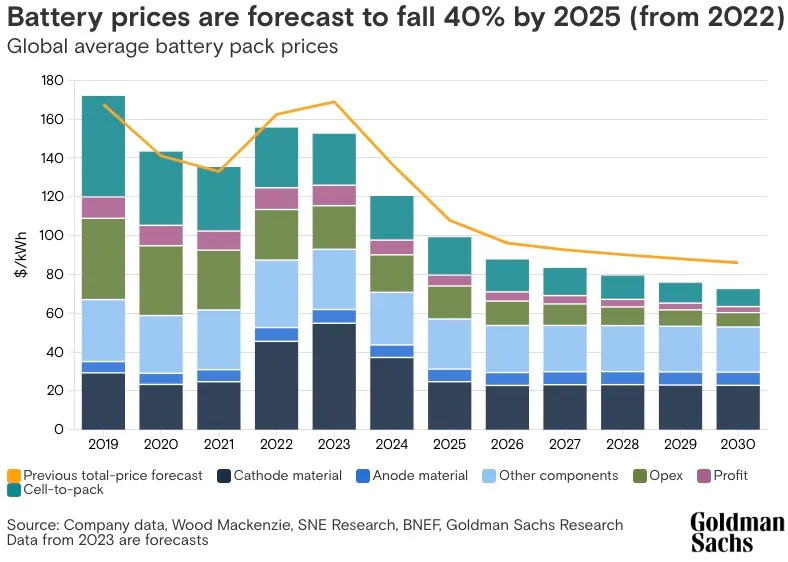

Updating its battery price forecast, Goldman Sachs Research anticipates a drop to $99 per kilowatt-hour (kWh) of storage capacity by 2025. This represents a substantial 40% decrease from the 2022 levels, surpassing the previous forecast of a 33% decline. Analysts attribute almost half of this expected decline to the lowering prices of EV raw materials, including lithium, nickel, and cobalt.

Crucially, Goldman Sachs underscores that its assessment is at the pack level, not the cell level, acknowledging the significant variation in prices within the EV industry. Different automakers employ diverse strategies in battery pack production, resulting in considerable price disparities.

While some automakers may already operate below the reported current level of $140 per kWh, and others above, the forecasted average drop to $100 per kWh within the next two years is poised to exert a substantial impact on the EV industry as a whole. This reduction in battery costs is anticipated to translate into more competitive pricing for electric vehicles, fostering increased consumer adoption and stimulating further growth in the overall addressable markets for both EVs and batteries.

Nikhil Bhandari, co-head of Goldman Sachs Research’s Asia-Pacific Natural Resources and Clean Energy Research, emphasized the potential outcomes of this reduction in battery costs, stating that it could lead to more competitive EV pricing, broader consumer adoption, and an expansion of the total addressable markets for EVs and batteries. As the industry braces for these changes, the forecasted decline in battery prices signifies a positive trajectory for the future of electric mobility.