In the wake of the rising popularity of electric vehicles (EVs), the United Kingdom finds itself grappling with the intricate challenges of tax systems. The government is currently deliberating the balance between the environmental benefits of EVs and the potential risks associated with regressive taxation.

Similar to many other jurisdictions worldwide, the UK is primarily concerned with the loss of revenue resulting from EVs, particularly the decline in fuel tax contributions. According to Bloomberg, the nation presently generates approximately £32 billion ($40 billion USD) annually from fuel taxes.

As EVs continue to gain traction, they will not contribute to this revenue stream, and it is projected that by the end of the decade, the UK could experience a loss of nearly one-third, equivalent to £10 billion ($12.5 billion USD) per year, as determined by the Resolution Foundation, a research group specializing in this matter.

Jonny Marshall, a senior economist at the Resolution Foundation, emphasized the urgency of updating the road taxation system to align with the present and future vehicle landscape. “Unless we modernize road taxation to reflect the cars that are on our streets today and in the future, we risk putting even more pressure on public finances and exacerbating congestion,” Marshall stated. “Our tax system needs to keep pace with the Electric Vehicle transition in a way that safeguards low- and middle-income households.”

To address these concerns, the Resolution Foundation has proposed implementing a “road duty” that levies charges based on the mileage driven by EVs. This concept has been previously suggested by other governments, including certain states in the United States, such as Washington. In contrast, states like Texas have introduced an annual fee payable upon vehicle registration renewal.

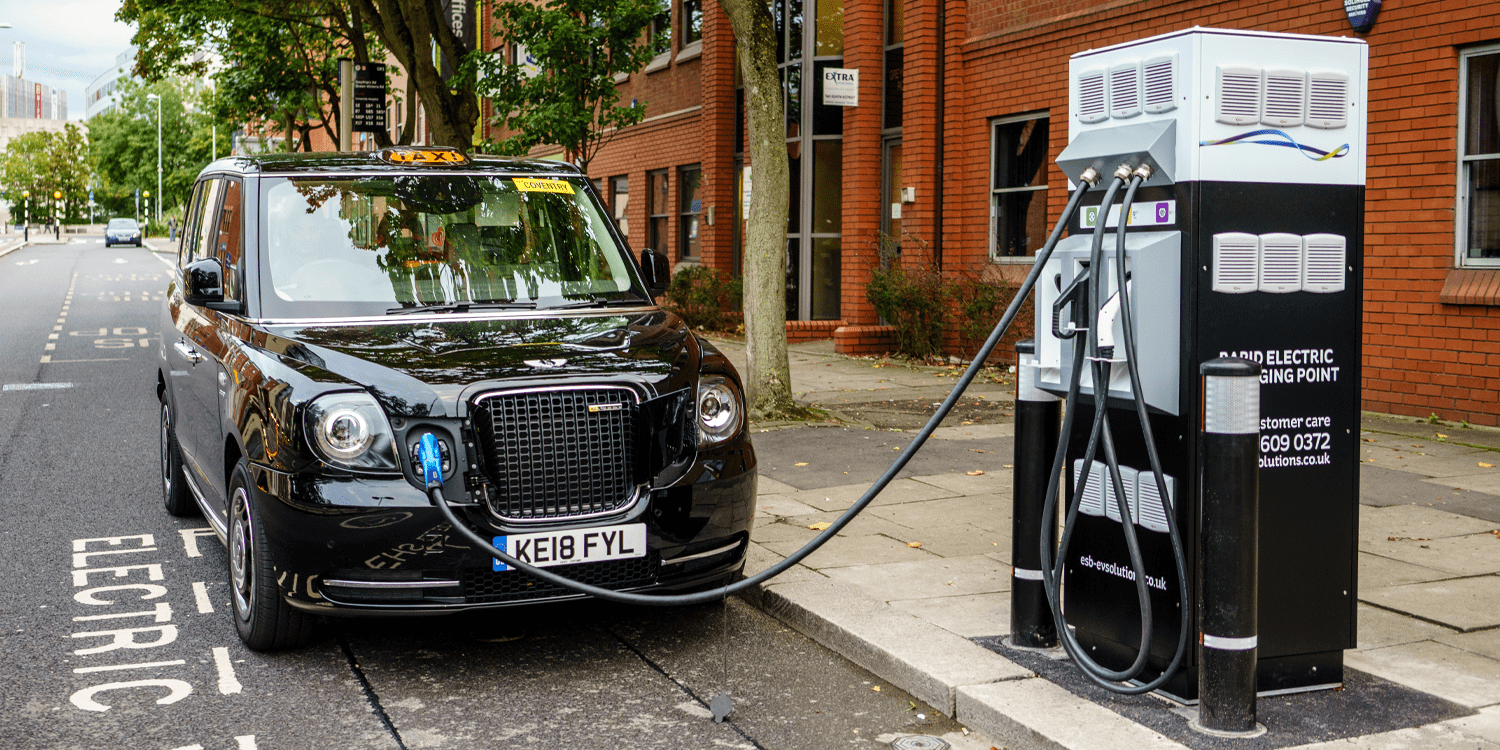

Nevertheless, a direct equivalent to fuel duty, such as a per kilowatt charge, may not necessarily be a more progressive alternative. Presently, the UK applies a 20 percent value-added tax (VAT) at public charging points. The Resolution Foundation highlights that this disproportionately affects lower-income EV drivers. Wealthier individuals, who can afford private garages and home charging, are subject to a reduced VAT of just five percent, a situation the researchers describe as a “pavement tax” and recommend eliminating.

While concerns persist that additional taxes may hinder the adoption of EVs, the Resolution Foundation counters this by underscoring that in the UK, the wealthiest 20 percent of households account for two-thirds of new car purchases. Consequently, the failure to devise a fairer taxation system for EVs could be interpreted as an unintended tax advantage for the affluent.

In light of these intricate considerations, the UK faces the crucial task of striking a delicate balance between fostering electric vehicle adoption and maintaining a sustainable tax revenue model. The outcome of this ongoing debate will shape the future landscape of EV taxation, influencing the affordability and accessibility of electric vehicles for citizens across the nation.