NIO recently held a battery partners forum in Hefei, Anhui province, where its factories are located. The event was attended by NIO’s founder, chairman, and CEO, William Li, as well as leading companies from upstream and midstream in the battery chain, including mining giants Tsingshan Holding Group, Zijin Mining Group, and Shenzhen Chengxin Lithium Group.

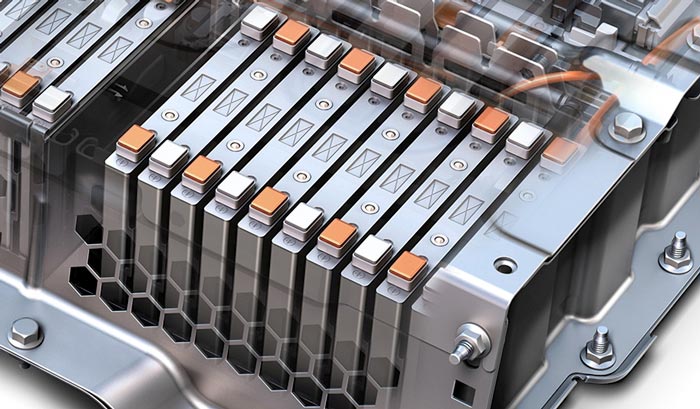

The forum showcased NIO’s commitment to developing its own batteries, with ambitions not only for battery packs but also for cells. Earlier this week, Reuters reported that NIO plans to build its first battery factory to produce large cylindrical cells, similar to those used by Tesla.

See also: NIO to Build First Battery Plant, Reducing Supplier Reliance and Boosting In-House Capabilities

The plant will have an annual battery capacity of 40 GWh and could power about 400,000 long-range EVs. The factory will be located next to a major manufacturing center in Hefei, a move to reduce the company’s reliance on suppliers such as CATL.

Li confirmed in a June 9, 2022 earnings call that the company will develop its own batteries, saying at the time that NIO has a battery team of more than 400 people to research areas including battery materials, cells, and battery management systems to fully establish battery system development and industrialization capabilities. The company’s new battery pack, which will go into production in 2024, will support 800V high-voltage fast charging, according to Li.

However, NIO may need to strike a delicate balance between its relationship with CATL and developing its own batteries. According to a 36kr report last week, CATL has been pushing a program to several strategic customers, including NIO, Li Auto, Huawei, and Zeekr, to reduce their battery procurement costs.

The core terms of the partnership include that CATL will settle with car companies for a portion of their power battery supply at a price of RMB 200,000 per ton of lithium carbonate for the next three years. EV makers that sign the partnership will need to commit about 80 percent of their battery purchases to CATL.

See also: CATL Offers Discounts on Battery Costs to Select EV Makers

The Paper reported that their reporters have asked NIO several times over the past week whether it has signed an agreement with CATL on the program, but the sources at the EV maker said they can’t give a yes or no answer. Several industry sources said the new car makers may still be on the fence at this point.

CATL’s concessions do not involve baseline price negotiations, and battery pricing is still based on a base price and an additional cost linked to lithium carbonate prices, the report said, citing analysis by Huachuang Securities analyst Huang Lin’s team. CATL’s proposed concession plan actually amounts to a price cut of about 4 percentage points, while it previously offered an average of 10 percent higher than second-tier battery makers, according to the team.