Indonesia Battery Corporation (IBC) has set its sights on capturing up to 30% of the local electric motorbike market, according to the firm’s CEO Toto Nugroho. This comes as the Indonesian government seeks to drive the adoption of electric vehicles, aiming to reach 2 million electric motorbike sales by 2025.

Despite Indonesia’s rich nickel reserves, the country sold fewer than 40,000 electric motorbikes between 2019 and 2022. Total motorbike sales in 2022 alone reached 5.22 million units, highlighting the country’s challenge to transition to electric vehicles.

To boost sales, the government plans to contribute 7 million rupiah ($459.92) towards the purchase of each electric scooter, taking inspiration from China’s successful EV sales incentive scheme. IBC has acquired a majority stake in PT Wika Industri Manufaktur, producer of electric scooters Gesits, which currently has an annual production capacity of 40,000 units. This is set to rise to 75,000 to 100,000 units in the coming years, according to Nugroho.

See also: Foxconn invests US$100 billion in Indonesia to build an electric vehicles ecosystem

IBC faces several obstacles in achieving its target market share, with pricing, charging infrastructure, and higher interest rates on EV loans among the main concerns of potential buyers, according to a company study.

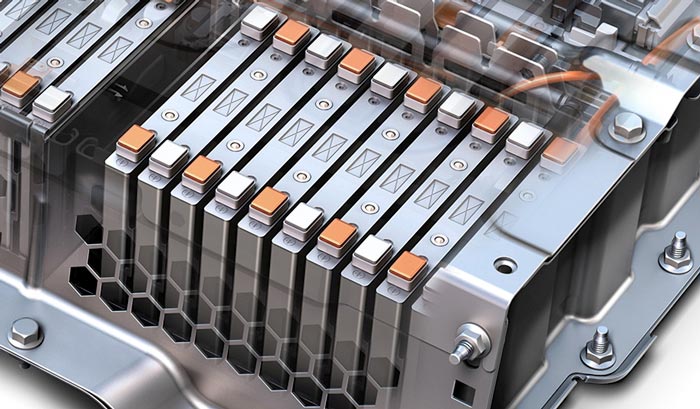

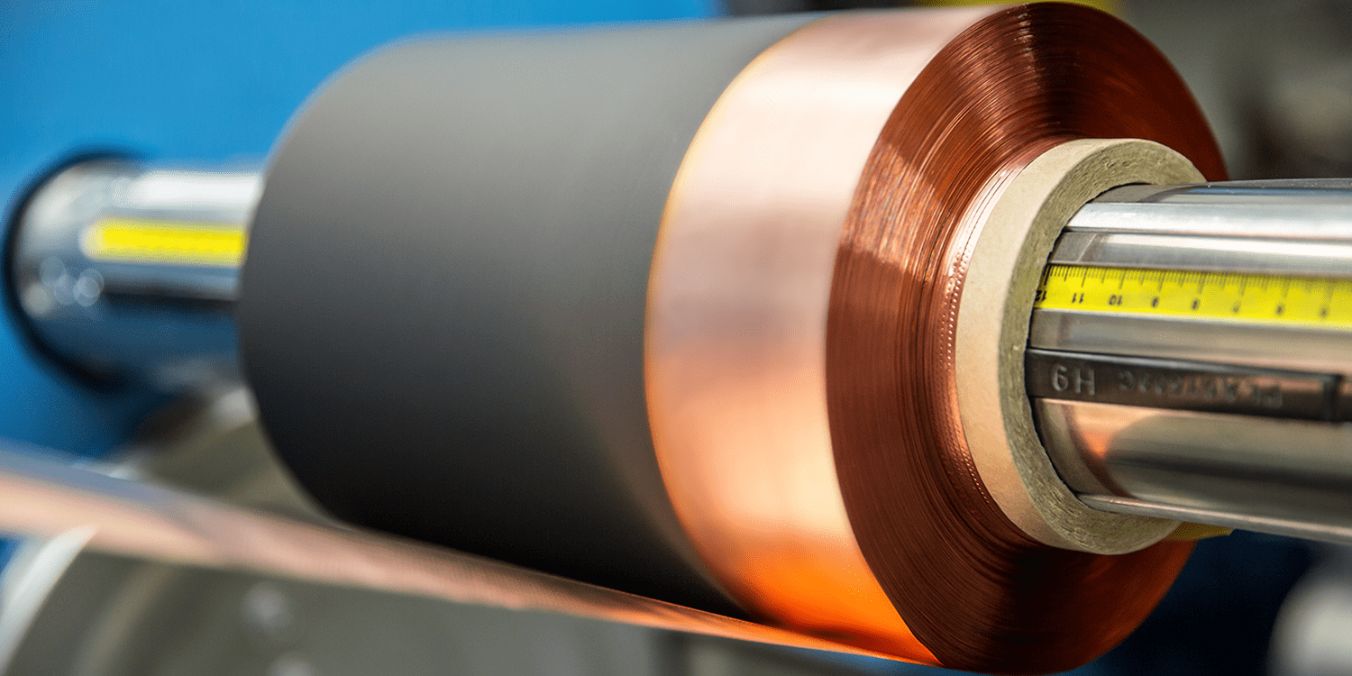

However, IBC is well-placed to tackle these issues, having acquired a local partner status for major battery makers, including CATL and LG, which plan to develop battery facilities in Indonesia. LG is currently constructing a $1.1 billion battery plant in the country, which will have a capacity of 10 gigawatt-hours, sufficient to power 200,000 electric cars or up to 2.5 million electric scooters.

See also: Hyundai plans for build electric vehicle battery plants in Indonesia next year

To help bring down prices, IBC will also assemble its own battery packs, which could reduce the cost of its electric bikes by around 15%. Nugroho is optimistic about IBC’s prospects and believes the firm’s target of 25% to 30% of the market is achievable. With government incentives, partnerships with global battery makers, and plans for increased production capacity, IBC is well-positioned to drive the growth of electric vehicles in Indonesia.