General Motors (GM.N) announced on Wednesday that it is introducing incentives of $7,500 on its electric vehicles (EVs) following the recent loss of a U.S. government tax credit. Simultaneously, Ford Motor (F.N) revealed plans to raise prices on select F-150 EVs by up to $10,000.

The U.S. Treasury issued guidelines in December, outlining new battery sourcing requirements designed to reduce dependence on the Chinese EV supply chain. These guidelines came into effect on Monday.

Last month, GM declared that all its EVs, except the Chevrolet Bolt, would temporarily lose eligibility for the tax credit. The Cadillac Lyriq and Chevy Blazer EVs were cited as ineligible due to two minor components.

See also: Chevrolet Bolt EV: Priced at $19,995 with New Tax Credit Structure

Ford had previously stated that its E-Transit and Mach-E would lose the $3,750 tax credit, while the F-150 EV Lightning pickup truck and the Lincoln Corsair Grand Touring SUV would retain credits.

On Wednesday, Ford announced a price hike of $5,000 to $10,000 on its entry-level F-150 EVs, while premium models would see reductions of up to $7,000. In October, the automaker temporarily cut one shift at its F-150 Lightning EV plant, and in December, informed suppliers of a production adjustment to about 1,600 electric F-150 Lightning EV trucks per week, down from the initially planned 3,200.

GM assured its dealers that it would provide the equivalent EV tax credit purchase amount for vehicles affected by the new guidelines. The company anticipates that the Lyriq and Blazer EVs will regain eligibility in early 2024. It also stated that the Chevrolet Equinox EV, Chevrolet Silverado EV, GMC Sierra EV, and Cadillac OPTIQ produced after the sourcing change would be eligible for the full incentive.

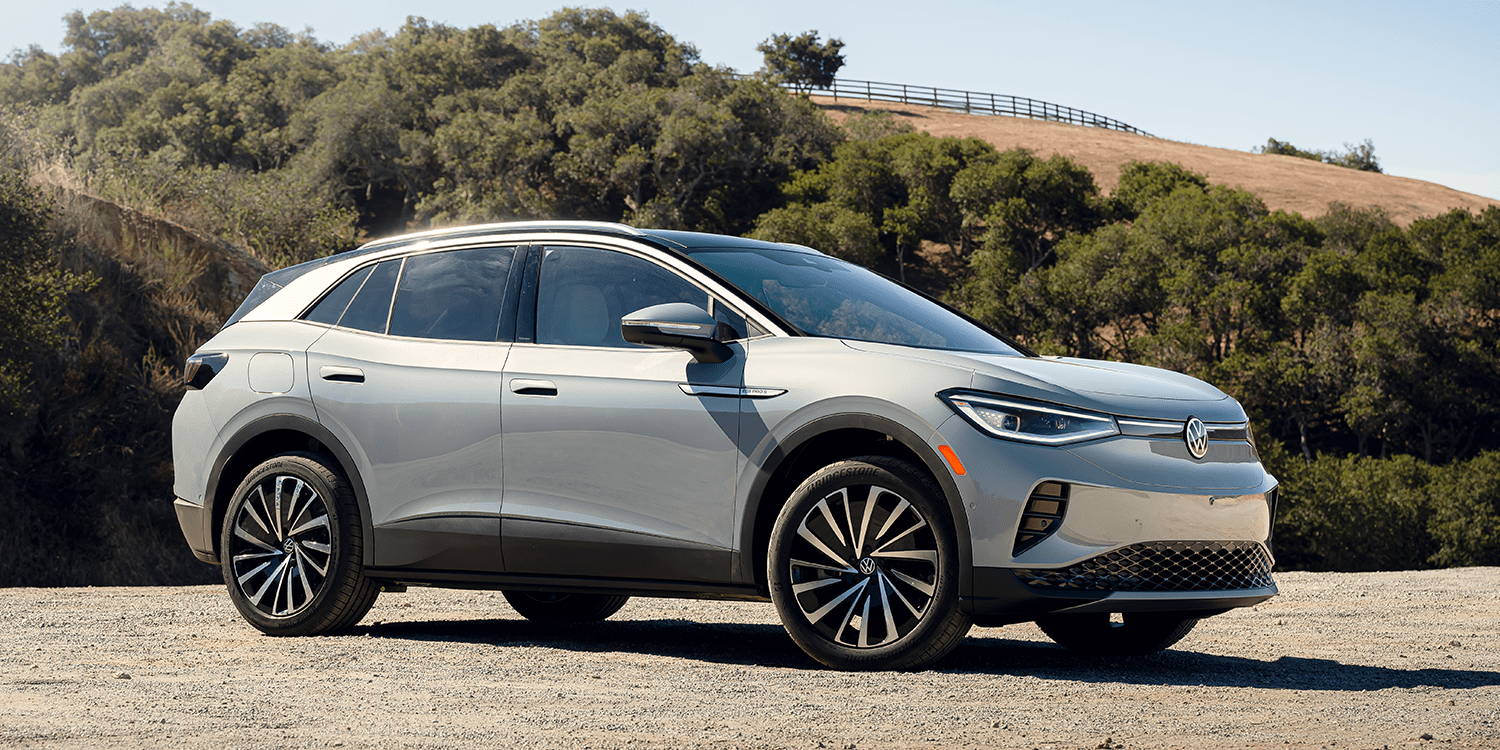

The U.S. Treasury noted that other vehicles losing the credit include the Volkswagen (VOWG_p.DE) ID.4, Nissan (7201.T) Leaf, some Tesla (TSLA.O) Model 3s, and Ford Mach-E. The number of EV models qualifying for U.S. EV tax credits has decreased from 43 to 19.

See also: Chevrolet Introduces Lease Promotions for the 2024 Blazer EV

The new regulations permit buyers to claim tax credits of up to $7,500 at participating dealerships during the sale. These tax credits have set limits on vehicle price and buyer income for qualification.

Volkswagen stated on Monday that it is “in the process of confirming eligibility for a federal EV tax credit for vehicles” after January 1.

The 2022 Inflation Reduction Act law brought reforms to the EV tax credit, requiring vehicles to be assembled in North America to qualify, eliminating nearly 70% of eligible models at that time. However, the IRA rules allow leased EVs to qualify for $7,500 tax credits without the battery or North America assembly requirements.