In a notable development for electric vehicle enthusiasts, the landscape of the used EV market has received a potential reshaping as the Internal Revenue Service (IRS) appears to signal a shift in its stance towards used Teslas qualifying for the $4,000 electric vehicle tax credit. This transformation was unveiled through a discreet update to the IRS website on August 3, 2023, replacing the list of qualified manufacturers with a direct link to the Environmental Protection Agency (EPA)’s website.

The electric car tax credit, an integral component of the Inflation Reduction Act, garnered substantial attention as it could provide a financial incentive of up to $4,000 to individuals purchasing used electric vehicles (EVs), plug-in hybrid electric vehicles (PHEVs), and fuel cell electric vehicles (FCEVs) priced under $25,000. However, a noticeable absence on the list of qualified vehicles was used Teslas, leading to discussions about the automaker’s apparent oversight in filing the requisite paperwork for their inclusion.

Clean Technica’s automotive analyst, Paul Fosse, had pointed out in a prior report that used Teslas were conspicuously absent from the list due to a lack of filing by the automaker. This omission led to conjecture that used Teslas wouldn’t be eligible for the tax credit, a speculation that seems to have evolved in light of the recent developments.

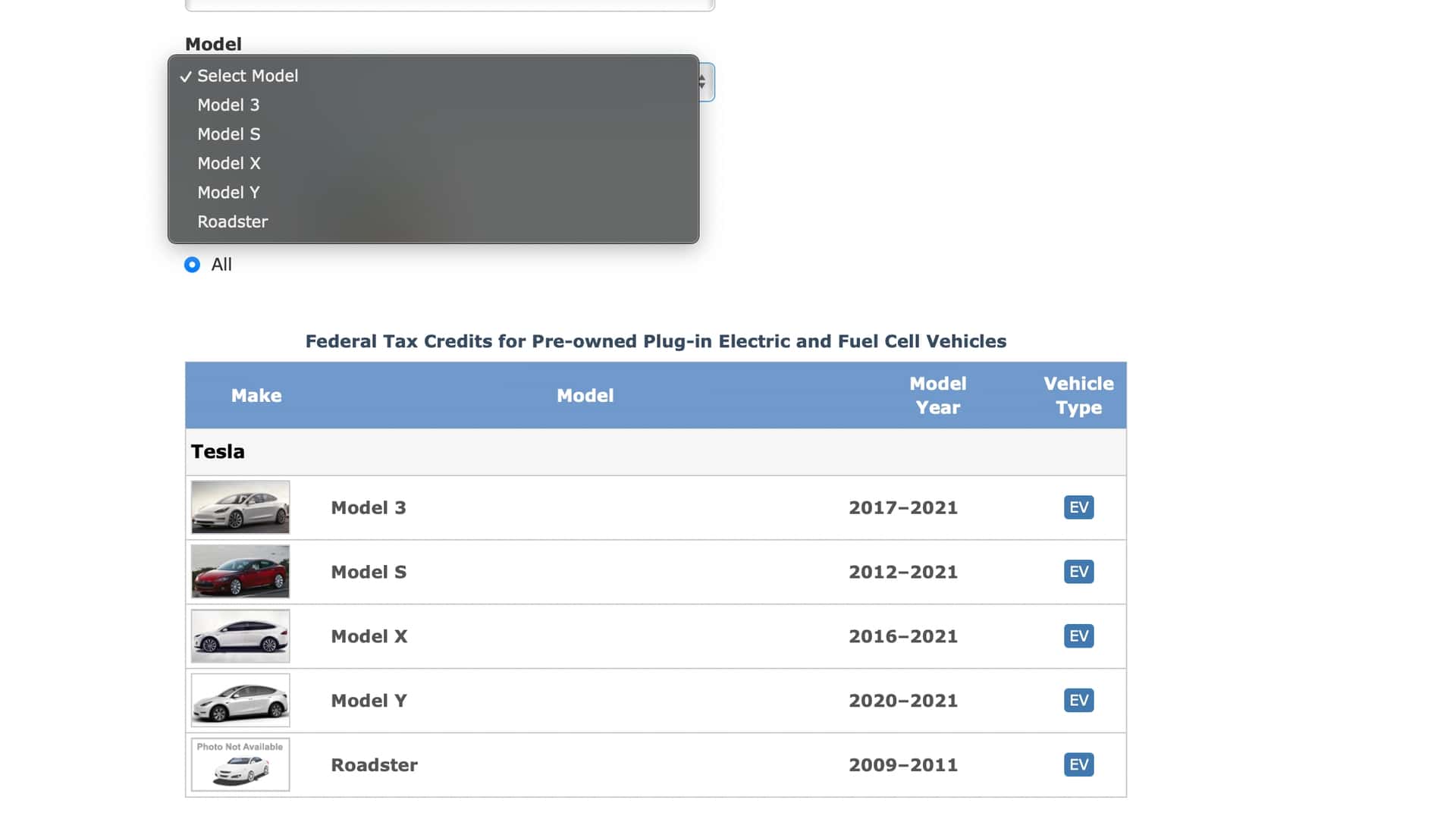

The updated IRS website, now linking directly to the EPA’s platform, features Tesla vehicles prominently as eligible candidates for the used EV tax credit. As a noteworthy contrast, the tool does not present the Honda Accord PHEV as qualifying, reflecting the vehicle’s battery size falling short of the required 7-kilowatt-hour minimum. The inclusion of the entire Tesla lineup on the EPA’s platform is especially intriguing since the manufacturer’s vehicles were conspicuously absent from the original list, last updated on July 13th.

While the updated information points towards a potential shift in the IRS’s position, it remains to be seen whether used Teslas will indeed qualify for the tax credit. Subsequent releases from both the IRS and Tesla are anticipated to provide a more comprehensive understanding of the situation. Notably, this development could make a substantial impact on the market, opening up opportunities for several early Model S sedans to become eligible. However, the availability of sub-$25,000 Tesla Model 3s, which have been in high demand, may pose limitations on eligibility.

For those interested in gauging their qualification status, certain criteria must be met. Individual filers with an annual income under $75,000, head of household filers with up to $112,500, and joint filers with a combined income of $150,000 are eligible to claim the credit. The vehicle must be purchased from a dealership and be valued below $25,000. Moreover, the car should be at least two years old, and if it is a plug-in hybrid, the battery capacity should be at least 7 kilowatt-hours. Vehicles priced at $13,333 or less will be eligible for a 30 percent credit. Furthermore, the tax credit cannot be claimed if the vehicle’s previous owner has already availed of the used EV tax credit.

As the electric vehicle landscape continues to evolve, these recent changes in the IRS’s website underscore the fluidity of regulations surrounding the used EV market. While the full implications are yet to be fully comprehended, it is clear that a fresh chapter in the realm of used EVs might be underway, with potential benefits for both buyers and the industry as a whole.