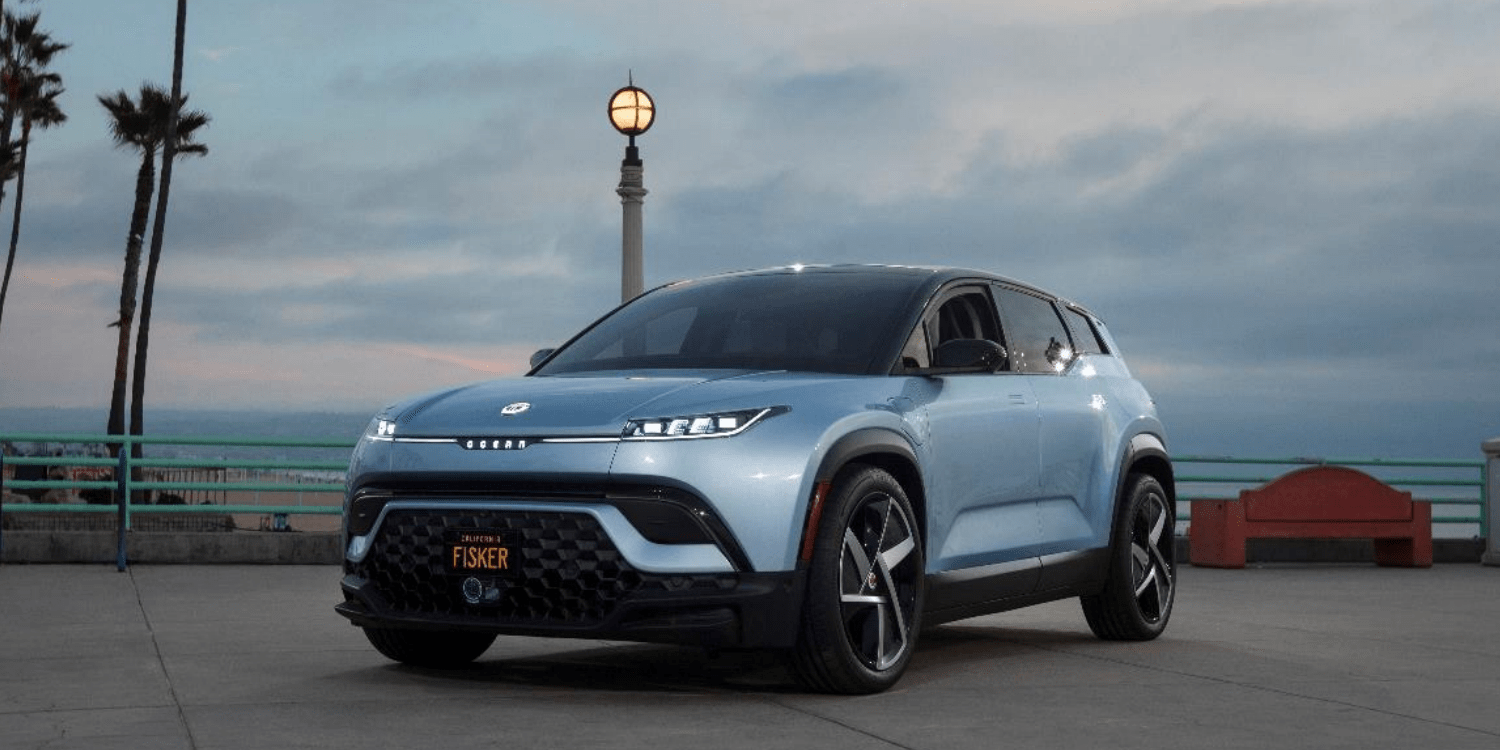

Electric vehicle startup Fisker has received court approval for its bankruptcy liquidation plan, following intense negotiations that preserved the company’s $46 million sale of its remaining inventory, which includes approximately 3,000 Ocean SUVs. U.S. Bankruptcy Judge Thomas Horan approved the plan during a court hearing held in Wilmington, Delaware, enabling Fisker to repay creditors using the proceeds from the asset liquidation.

Fisker filed for bankruptcy in June after unsuccessful attempts to secure a partnership with Nissan for the production of its electric vehicles. During negotiations, the company faced cash flow challenges, leading to a pause in vehicle production and subsequent staff layoffs. Ultimately, Fisker opted to liquidate its operations, selling its remaining vehicle fleet to American Lease and transferring its intellectual property to creditors.

However, the sale encountered a last-minute issue when American Lease discovered that Fisker would be unable to transfer essential data and support services to its new servers. This data is crucial for functions such as updating vehicle software, reviewing diagnostic information, and enabling drivers to remotely access their vehicles.

To resolve the dispute, American Lease agreed to pay an additional $2.5 million over five years for ongoing tech support services. This arrangement will also benefit existing Fisker Ocean owners, who had raised concerns about the future of their vehicles following the shutdown of Fisker’s servers, attorneys noted during the court proceedings.

The highly competitive electric vehicle market has witnessed multiple companies, including Proterra, Lordstown Motors, and Electric Last Mile Solutions, filing for bankruptcy in the past two years as they struggled with declining demand, fundraising challenges, and operational hurdles stemming from global supply chain issues.

Source: Reuters