BYD, a major Chinese electric vehicle manufacturer, has reported an 11-fold increase in net profit for the fourth quarter of 2022, reaching 7.3 billion yuan ($1.06 billion) compared to 602 million yuan a year earlier. This significant growth in profit is largely attributed to BYD’s successful expansion in the domestic market, as well as the release of a wide range of products.

For the entirety of 2022, the company’s net profit increased by 446%, totaling 16.6 billion yuan. The gross profit margin for automobiles and related products, which accounted for 77% of BYD’s total revenue in 2022, also saw a significant increase, reaching 20.4%, largely improved from 3.7% in 2021.

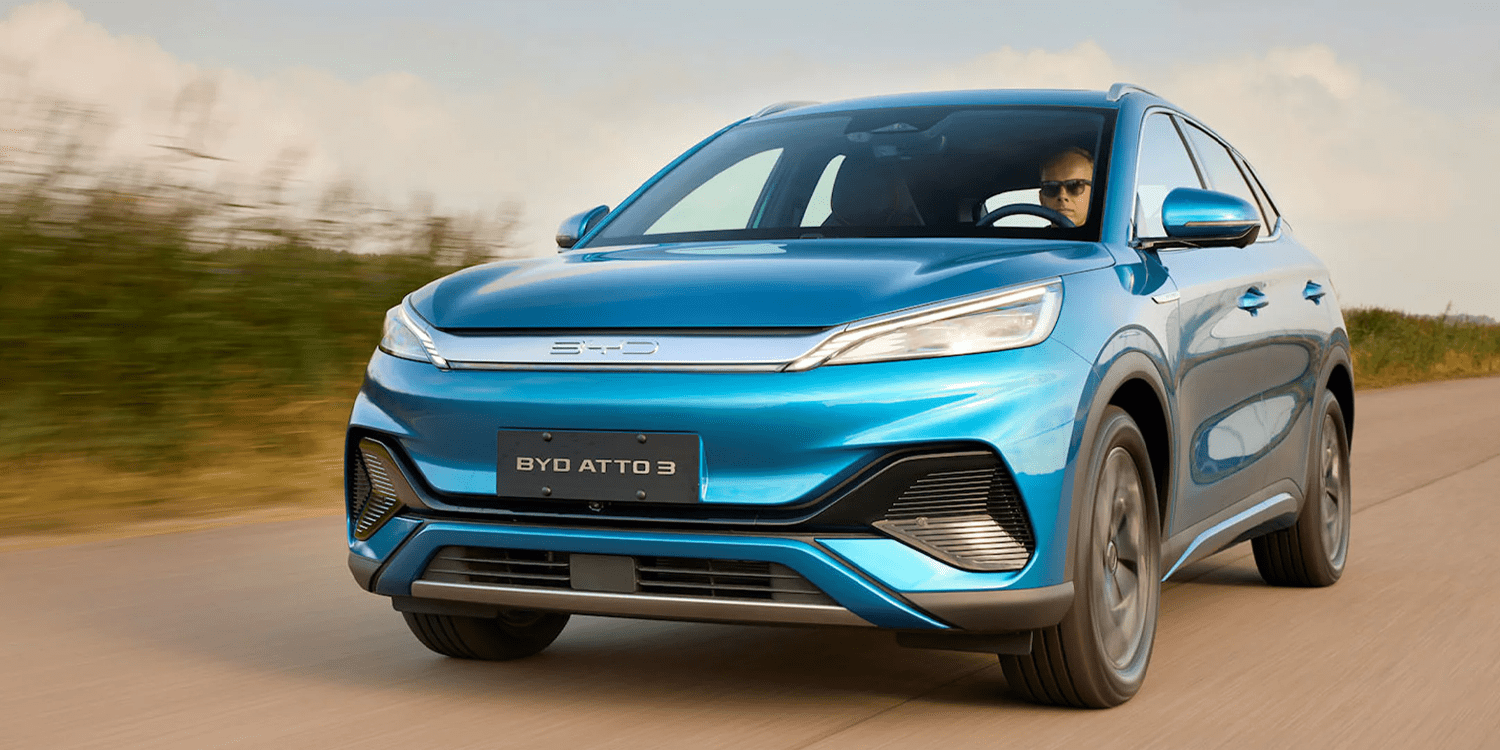

BYD’s Dynasty and Ocean series of plug-in hybrids and pure electric cars have helped the company overtake Volkswagen as the best-selling passenger car brand in China. In February, BYD claimed the top spot for the second time in four months. Moreover, BYD has surpassed Tesla in China’s electric vehicle market, accounting for 41% of new energy car sales in the first two months of 2023, while Tesla accounted for 8%.

Despite a recent slowdown in industry-wide sales and the end of China’s national subsidy programme for EVs and plug-in electric vehicles, BYD expressed confidence in its future growth. The company expects new energy vehicle sales to continue their strong growth momentum and penetration rate to largely increase. BYD plans to introduce more competitive products and improve delivery capabilities to meet market demand.

BYD’s EVs are powered by its self-developed and manufactured lithium batteries, called Blade Battery, which use less expensive but more stable iron phosphate than nickel and cobalt-based batteries. In January, BYD’s battery installation volume ranked second globally with 17.6% market share, exceeding LG Energy Solutions, according to SNE Research.

However, BYD has had to slow down production since the start of 2023 due to weakening demand, reducing shifts at two auto assembly plants in Shenzhen and Xian in China, which make its top-selling models such as the Song and Qin EVs. In March, BYD also joined other domestic Chinese automakers in a price war by offering discounts for its Song Plus and Seal EVs, which Tesla started.