British electric vehicle startup Arrival has appointed EY as administrator for two of its units, the consulting firm announced on Monday, signaling ongoing struggles for the company in securing adequate funding and establishing its business operations.

Simon Edel, Alan Hudson, and Sam Woodward from EY-Parthenon’s Turnaround and Restructuring Strategy team have been appointed joint administrators of Arrival UK and Arrival Automotive UK, according to EY.

The decision follows reports last month indicating that Arrival was in discussions with EY regarding potential administration if rescue funding efforts were unsuccessful.

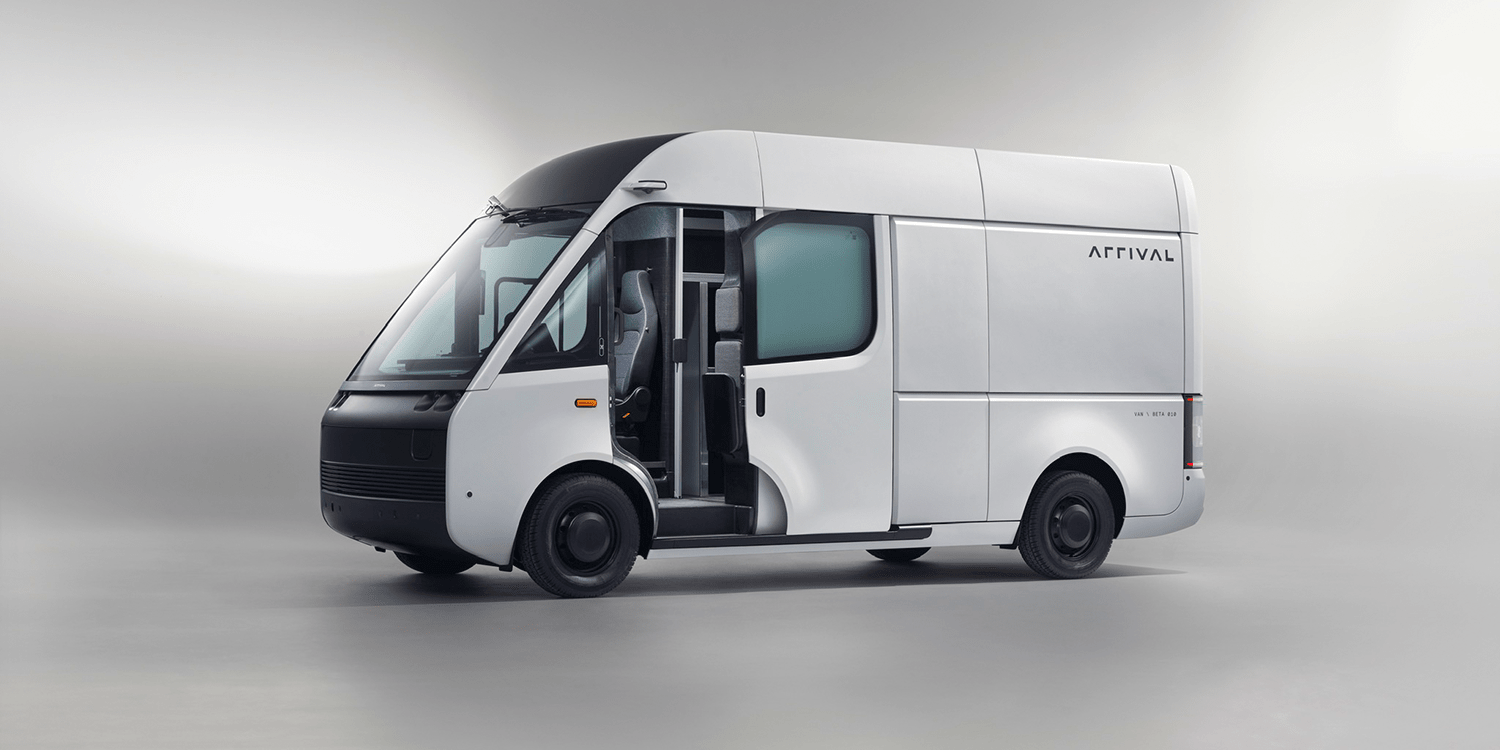

EY has stated that it is exploring options to sell assets of the startup, including its EV platform, software, intellectual property, and research and development assets, in collaboration with Arrival.

Having faced challenges in generating revenue, Arrival raised concerns about its ability to continue as a going concern in November 2022 and has since reduced its workforce significantly.

Previously backed by Hyundai, Kia, and United Parcel Service, Arrival announced plans in late 2022 to shift its focus to the U.S. market, aiming to leverage incentives provided under the Inflation Reduction Act and target a broader customer base.

Arrival had pursued fundraising efforts through a proposed double SPAC merger with blank-check firm Kensington Capital Acquisition Corp V, which ultimately fell through despite the potential injection of hundreds of millions of dollars into the company.

Following its delisting from the Nasdaq on January 30, prompted by a notification from the stock exchange, Arrival joins a string of casualties in the EV industry grappling with challenges such as rising interest rates, persistent inflation, and high production costs.

The collapse of Arrival’s stock exchange listing adds to a series of setbacks faced by startups in the EV sector, including Lordstown Motors, Proterra, and Sweden’s Volta Trucks, which have all filed for bankruptcy in recent times.