Lucid Motors, the prominent American electric vehicle (EV) manufacturer, has unveiled its financial report for the second quarter of 2023. The announcement comes in anticipation of an investor call scheduled for later today. The newly revealed financial figures follow a previous production report released last month, which indicated a consecutive decline in deliveries over the past two quarters. Despite these delivery challenges, Lucid’s revenue remains steady, and its robust liquidity position offers hope that the company can achieve its annual production targets, albeit at the lower end.

The last three months have been notably active for Lucid Motors since the disclosure of its Q1 2023 results, leaving a trail marked by both excitement and market caution. Notably, shortly after the public disclosure of its Q1 results, the automaker successfully raised $3 billion through a public stock sale, accompanied by an investment infusion from Saudi Arabia’s Public Investment Fund (PIF).

See also: South Korean HL Group to Supply Autonomous Driving Components for Lucid Motors’ Gravity SUV

As the full Q2 2023 report is unveiled, Lucid Group has shared its production and delivery statistics, which have yet again fallen short of expectations. This trend has prompted a decline in the company’s stock value. While today’s results may not elicit overwhelming market enthusiasm, they do underscore Lucid’s ability to sustain its revenue stream.

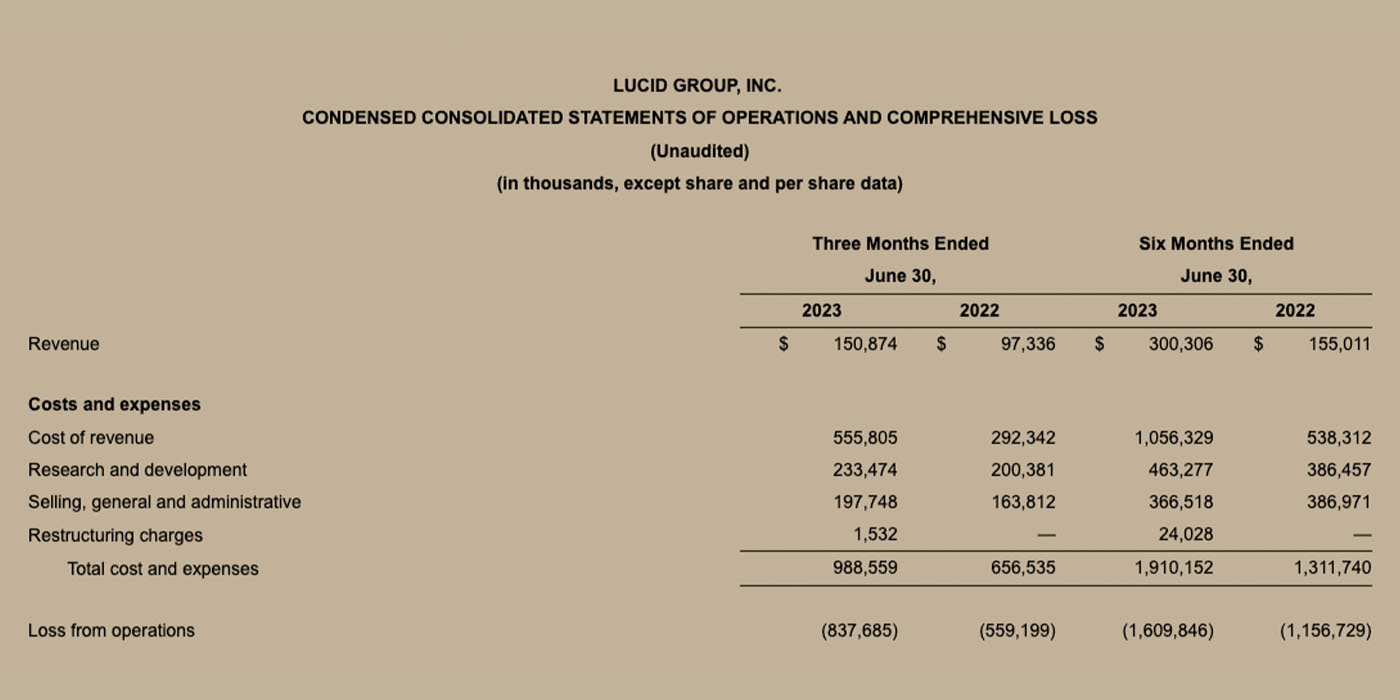

In line with the data reported last month, Lucid Motors produced a total of 2,173 electric vehicles between April 1 and June 30 of this year. Of these, 1,404 units were successfully delivered to customers. This performance translated to a Q2 revenue of $150.9 million, demonstrating a slight uptick from the $149.4 million achieved in the preceding quarter.

See also: Lucid CEO Proposes Future Electric Cars with 250-Mile Range and Lower Costs

Comparing these figures to Q4 2022, the production of Lucid’s Air models exhibited a 33% decline to 2,314 units in Q1 2023. Unfortunately, this downward trajectory persisted into Q2 with an additional 6% decrease. Nonetheless, the automaker remains confident in its ability to meet its production goal of manufacturing a minimum of 10,000 vehicles annually. According to Peter Rawlinson, Lucid Group’s CEO and CTO:

“We are on track to achieve our 2023 production target of more than 10,000 vehicles, but we recognize we still have work to do to grow our customer base. During our second quarter, we achieved several major milestones, including signing agreements to enter into a long-term strategic partnership with Aston Martin.”

Rawlinson’s outlined milestones carry substantial significance. However, he acknowledges that Lucid’s priority should be to expand its customer base. The production of 10,000 EVs in a year might lose some of its luster if consumer demand falls short. This scenario could result in an accumulation of costly inventory.

Addressing this concern, Lucid recently announced a reduction in the prices of its Air models to align with the initially promised Manufacturer’s Suggested Retail Prices (MSRPs). These price cuts, some amounting to as much as $12,000, are expected to sway prospective buyers who were previously undecided about purchasing the Air sedan. Despite the adjustment, even the most affordable Pure trim is still priced at $82,400.

See also: Lucid Sets Its Sights on Expanding Technology Supply Business Following Aston Martin Deal

The eagerly awaited rear-wheel-drive Pure and the tri-motor Sapphire Air models are slated to commence production in September. These models are anticipated to significantly impact Lucid’s revenue by the end of the fiscal year. Notwithstanding the challenges in delivery, Lucid’s achievements during Q2 are commendable. The company remains well-financed through to 2025, which aligns with the scheduled launch and start of production for the long-anticipated Gravity SUV. This release could serve as another catalyst for increased sales and deliveries. According to Lucid CFO Sherry House:

“During the second quarter, we raised $3.0 billion in capital, including $1.8 billion from the PIF, and I’m pleased to say that our current liquidity of $6.25 billion is expected to take us through the start of production for the Lucid Gravity, and into 2025. In addition, the targeted actions underway to invigorate our marketing programs in the luxury and premium segment have resulted in greater brand awareness.”

With a series of strategic partnerships, pricing adjustments, and impending product launches, Lucid Motors navigates a challenging period of delivery setbacks with the hope of realizing its growth ambitions in the electric vehicle market.