The year 2022 proved to be a significant setback for electric mobility in Italy, Europe’s fourth largest auto market. While electric vehicles (EVs) continued to gain market share across the continent, Italian sales of plug-in vehicles suffered an unexpected setback.

In 2021, over 67,000 battery electric vehicles (BEVs) were sold in Italy, doubling the numbers from the previous year. It was expected that the country would surpass the psychological threshold of 100,000 annual units sold. However, EV incentives abruptly ended before 2022 even started, leaving the Italian car market in limbo for several months.

Although a new set of leaner incentives was launched in May 2022, it was likely too little, too late. A mix of political ineptitude and consumer uncertainty led to a surprising inversion of the electrification trend in car mobility, the only such occurrence in any significant world auto market.

Official statistics from Unrae reveal a complex picture. The overall car market declined 9.5% year-on-year (YoY) from 2021, from almost 1.5 million units to just over 1.3 million. While traditional petrol and diesel powertrains also declined in absolute numbers, they remained virtually unchanged in terms of market share, at 25.5% and 20.5% respectively (from 26.1% and 20.5% in 2021).

This trend diverged from the rest of Europe, where internal combustion engines (ICEs) continued to plummet to new lows. Plugless, full, and mild hybrids (HEVs) increased their sales by 6.4%, meaning that over a third of all new cars sold in Italy last year, 34.6% to be exact, were mildly electrified.

Fully electric cars proved to be the truly negative surprise for Italy’s market in this year of uncertainty. BEVs declined by a whopping 26.6% YoY, from over 67,000 units in 2021 to slightly less than 50,000 in 2022, an unpredictable retreat. While the top three European markets reached new highs, with Germany at 17.7% BEV market share, France at 13.3%, and the UK at 16.6%, Italy’s BEV share dropped from 4.6% in 2021 to an unflattering 3.7% for the whole of 2022.

The reasons for this phenomenon have been discussed at length in past monthly updates. Political indecisiveness, ongoing economic uncertainty, and the broader consumers’ unwillingness to embrace a technology that has been frequently blamed by the Italian government for upending the future of Italy’s automotive industry are just some of the factors.

To unlock BEV growth in Italy, the price equation needs to be aligned with the country’s market, which has a clear focus on small vehicles at reasonable prices. This is one of the last steps in the BEV roadmap to mainstream adoption. The many facets of last year’s missed BEV growth opportunity will ultimately be resolved, but for now, Italy’s electric mobility market remains in a state of uncertainty.

Plug-in hybrids (PHEVs) managed to hold steady in 2022, despite a challenging year for the auto industry. With around 68,000 units sold, PHEVs only saw a negligible 2.7% YoY reduction in absolute sales. However, given the wider contraction of the overall car market, PHEVs managed to gain market share and reached 5.1%, up from 4.7% the year before. This trend first emerged in 2021 when PHEVs overtook battery electric vehicles (BEVs) in the Italian auto market, and it was reinforced in 2022, which was an outlier amongst major European markets that saw BEVs outsell PHEVs. Overall, plug-ins market share was 8.8%, down from 9.3% in 2021.

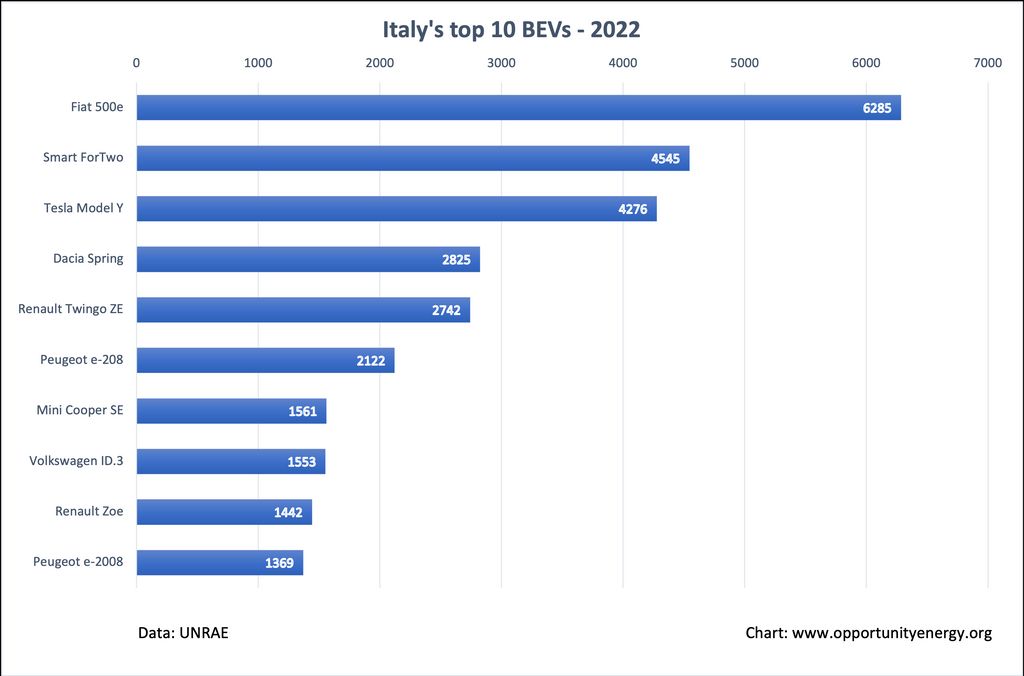

The top 10 BEV models for the year were a mix of the usual best sellers, except for one notable exception. The Fiat 500e won the annual crown of best-selling BEV for the second year in a row, with 6,285 registrations. This figure is around 40% less than in 2021, when it broke the 10,000 unit barrier. This is a worrying sign for the supermini’s home country. The Smart ForTwo followed in second place, with a similarly underwhelming performance of 4,545 units. The Tesla Model Y gained its first annual podium, trailing the Smart with 4,276 registrations. This was a great result for an un-incentivized, €50k+ upmarket model in the realm of A- and B-segment cars.

Further down the chart, the Dacia Spring was a disappointment with less than 3,000 units sold, which was clearly due to scarce supply. A similar fate was followed by the Renault Twingo ZE. Both models saw their sales halve YoY, and in fact, followed the same downward trajectory as virtually every model in the top 10. The Volkswagen ID.3 was even more unimpressive, losing 55% YoY, compounding the lukewarm reception it received the year prior.

The only exceptions were the Mini Cooper SE, which saw slightly increased sales YoY, and of course, the Tesla Model Y, which literally exploded to third place. Even the Tesla Model 3 could not escape the 2022 curse and faded away from the chart altogether. This was an issue of Tesla’s own doing as the D-segment car was burdened by €13k+ cost hikes in the year, making it an unpalatable option for most buyers.

Looking ahead to 2023, the economic and political picture remains unchanged, and good news for the EV market will not be easy to come by. However, one external factor could make an unlikely contribution. Tesla’s January cost cuts saw Model 3 prices drop below where they had started, and the already successful Model Y also received price cuts. With both Tesla models now in a cheaper tier than ever (Model 3 RWD is now even eligible for incentives), a major boost in Tesla sales can be expected in the coming months, which will inevitably bump up monthly stats in this ailing EV market.

As other automakers take note of Tesla’s move towards market domination, some may be tempted or forced to lower BEV prices instead of increasing them, in the hope of maintaining market share and relevance. With the new average price of new cars sold in Italy now at €26,000 (mostly ICEs), a low value but also an unprecedented increase from previous years (it was around €21,000 four years before), the cost difference between old and new powertrains is narrowing down fast.