U.S. President Donald Trump’s decision to revoke a key electric vehicle (EV) target set by his predecessor, President Joe Biden, may temporarily slow demand for lithium and other critical minerals, but industry leaders and analysts remain optimistic that the global demand for EVs will continue to drive growth in the mining sector.

Trump’s move on Tuesday to undo Biden’s 2021 executive order, which aimed for 50% of new U.S. vehicle sales to be electric by 2030, caused a brief dip in shares of automakers and lithium producers, particularly in Japan, South Korea, the U.S., and Australia. However, experts argue that the decline in U.S. demand will be offset by strong EV growth in other global markets, particularly in China, which currently leads the world in EV sales.

See also: Asian Automakers and Battery Makers Face Turbulence Amid U.S. Tariff Concerns

Glyn Lawcock, an analyst at Australian investment bank Barrenjoey, acknowledged that the removal of subsidies and incentives could dampen demand in the short term. “Every time people take away subsidies or benefits, it’s a dent to the demand scenario,” Lawcock said. However, he added, “ultimately demand will still grow even if the U.S. is a bit slower under Trump.”

Liontown Resources, an Australian lithium producer, emphasized that the global transition to electric vehicles is well underway, regardless of U.S. policy shifts. CEO Antonino Ottaviano noted that China dominates the EV market, with 65% of global sales, while North America accounts for only 20%. The rest of the world is also experiencing rapid growth, with a 27% year-on-year increase in EV sales. This global momentum is expected to more than compensate for any slowdown in the U.S. market.

See also: Trump Revokes Biden’s EV Executive Order, Seeks to End Support for Electric Vehicles

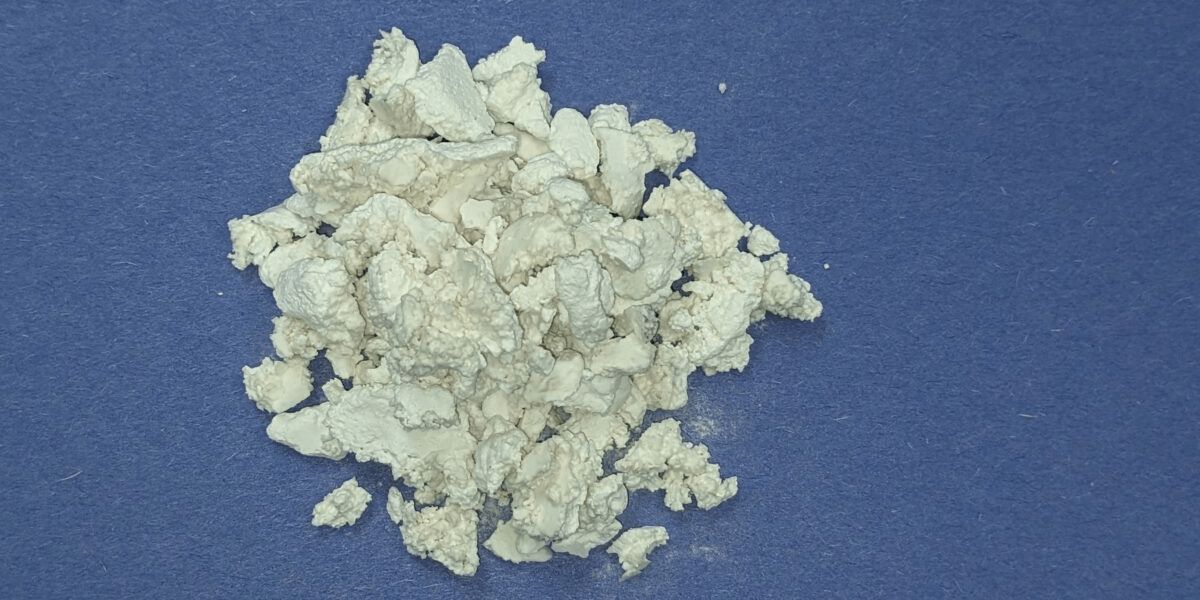

As EV adoption grows, demand for critical minerals like lithium is also rising. The global market for grid-scale batteries, consumer electronics, and the growing artificial intelligence industry further fuels this demand. Industry leaders like Rio Tinto’s CEO Jakob Stausholm remain bullish on lithium, predicting that demand could increase fivefold over the next 15 years.

Beyond EVs, the demand for critical minerals is expected to grow due to the increasing need for electronics and energy storage solutions. David Klanecky, CEO of Cirba Solutions, highlighted that U.S. demand for these materials will surge by 2030, driven by the growing use of electronics and batteries.

See also: Auto Industry Prepares for Challenges Under Incoming Trump Administration

Some industry players believe that efforts to reduce reliance on Chinese imports will provide additional support for the mining sector. Arafura’s CEO, Darryl Cuzzubbo, emphasized that measures to build supply chain independence from China may have a greater impact than the rollback of the EV target itself.

Source: Reuters