Tesla’s Cybertruck, initially revealed in 2019 with a bold pricing strategy, has undergone several adjustments since its prototype debut. The original concept placed the base model at $39,900, while the top-tier tri-motor version was expected to cost under $70,000. However, the current pricing now starts at $79,990 for the dual-motor All-Wheel Drive version, and the tri-motor variant is priced just under $100,000.

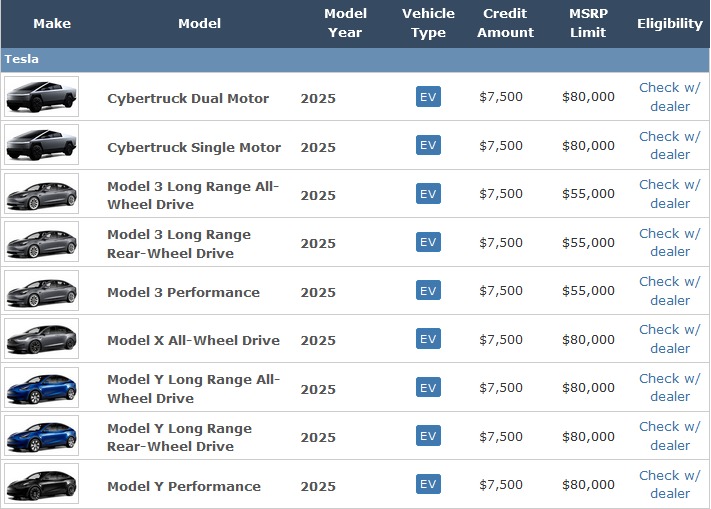

The good news for potential buyers is that the dual-motor Cybertruck now qualifies for the $7,500 federal tax credit, effectively reducing the price to approximately $72,490 before delivery and taxes. This eligibility was included in the updated list of vehicles eligible for the credit published by FuelEconomy.gov on January 1, 2025. However, the tri-motor version does not meet the criteria for the credit due to its MSRP exceeding the $80,000 cap.

Interestingly, the single-motor version of the Cybertruck, which is not yet in production, was also listed as eligible for the tax credit. While the price for this model is not confirmed yet, it was originally listed at $60,990, and if it remains at that price, the effective cost after applying the tax credit would drop to $53,490 before delivery and taxes.

In comparison, the Ford F-150 Lightning, which starts at $62,995, is also eligible for the $7,500 tax credit. Unlike the rear-wheel-drive Cybertruck, the F-150 Lightning comes with two electric motors and an EPA-estimated range of 240 miles, slightly less than the Cybertruck’s estimated 250 miles for the single-motor version.

To be eligible for the federal tax credit, consumers must meet certain income thresholds. For married couples filing jointly, the adjusted gross income (AGI) must not exceed $300,000, while heads of household must have an AGI of no more than $225,000, and individual filers are capped at $150,000.