Rivian released its earnings report for Q4 and full-year 2022 on February 28th, after the market close. Although the company missed its revenue target, it significantly reduced its operating expenses as it aims to cut costs and increase production volume.

According to CEO RJ Scaringe, 2022 was a “challenging year” for Rivian as it faced supply chain issues and product recalls while ramping up production. Despite these challenges, the company’s production is growing at an impressive rate. Rivian produced 24,337 EVs and delivered 20,332 in 2022, just shy of its goal of 25,000. However, this is a significant improvement from the 1,015 vehicles it produced in 2021.

See also: Rivian R1T Electric Pickup Rescues 38,000-Pound Semi That Slid Off the Road

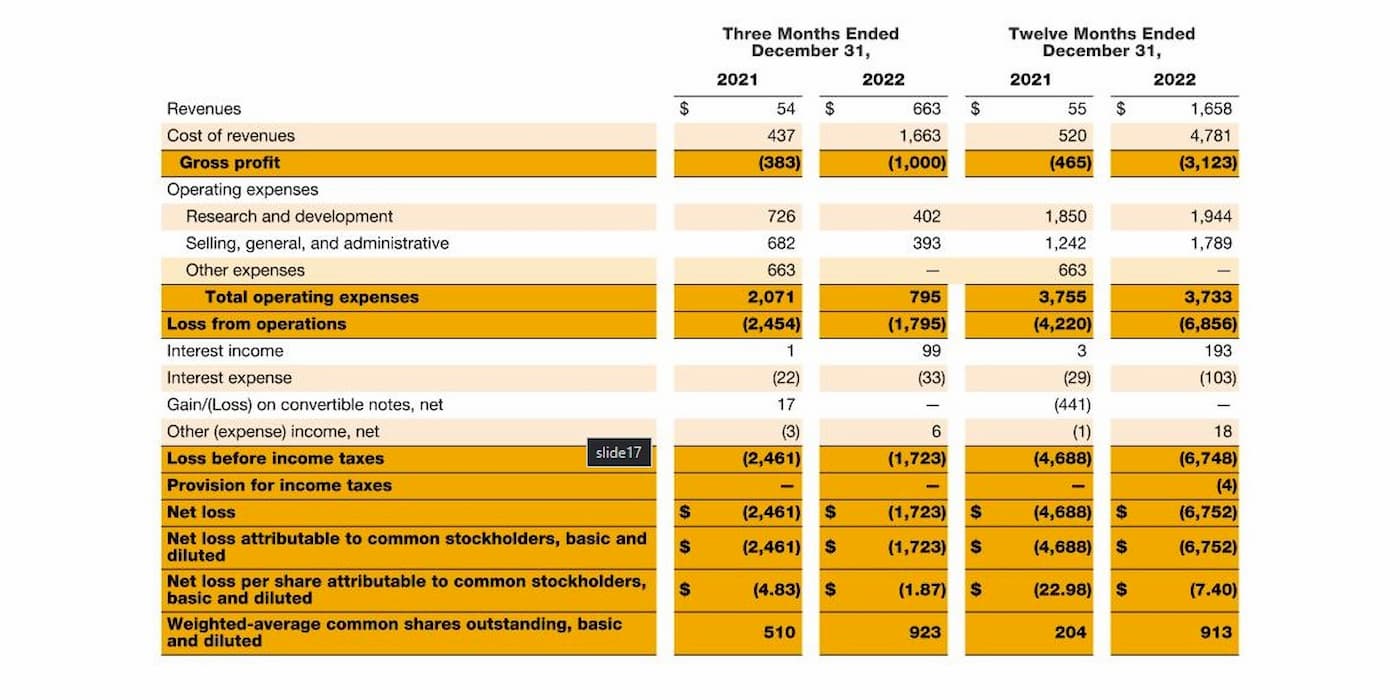

In Q4 2022, Rivian produced 10,020 EVs and delivered 8,054. The company’s revenue target for the quarter was $742 million, up from $536 million in Q3, but it fell short of Wall Street’s expectations. Analysts expected EPS of ($1.94) for the quarter.

Despite the revenue miss, Rivian lowered its operating expenses, signaling its commitment to cutting costs and improving efficiency. This move will likely be well-received by investors, who are closely watching the company’s financial performance.

Looking ahead, Wall Street expects Rivian to produce and deliver between 60,000 to 65,000 models in 2023. This guidance demonstrates the company’s ambition to continue its growth trajectory and establish itself as a major player in the EV market.

While the company’s revenue increased by 23% to $663 million compared to the previous quarter, its gross profit was negative due to a lower cost or net realizable value (LCNRV) and short-term premiums on materials and expedited freight charges. Rivian generated a gross loss of $1 billion, leading to a net loss of $1.7 billion for the quarter.

See also: Rivian to Launch R1S Dual-Motor Max This Fall, Boasting Impressive 390 Mile Range

Despite the loss, Rivian’s revenue growth shows promise, even though it fell short of analysts’ expectations. The company’s operating costs also fell significantly from over $2 billion in the previous year to $795 million in Q4, indicating that it has implemented cost-cutting procedures.

Rivian ended the quarter with over $12 billion in cash and equivalents, although it burned through $1.4 billion in the fourth quarter. The company’s financial position suggests that it has the financial flexibility to weather any short-term setbacks and focus on longer-term growth and expansion.

Rivian’s Q4 results highlight the challenges that start-ups face in the highly competitive EV market. Nevertheless, the company’s strong revenue growth, cost-cutting measures, and robust cash reserves bode well for its future.