Next.e.GO Mobile, a leading German electric car manufacturer, has secured $75 million in fixed-rate debt financing, equivalent to approximately €68 million. The funding was provided by Western Asset, a prominent asset management company.

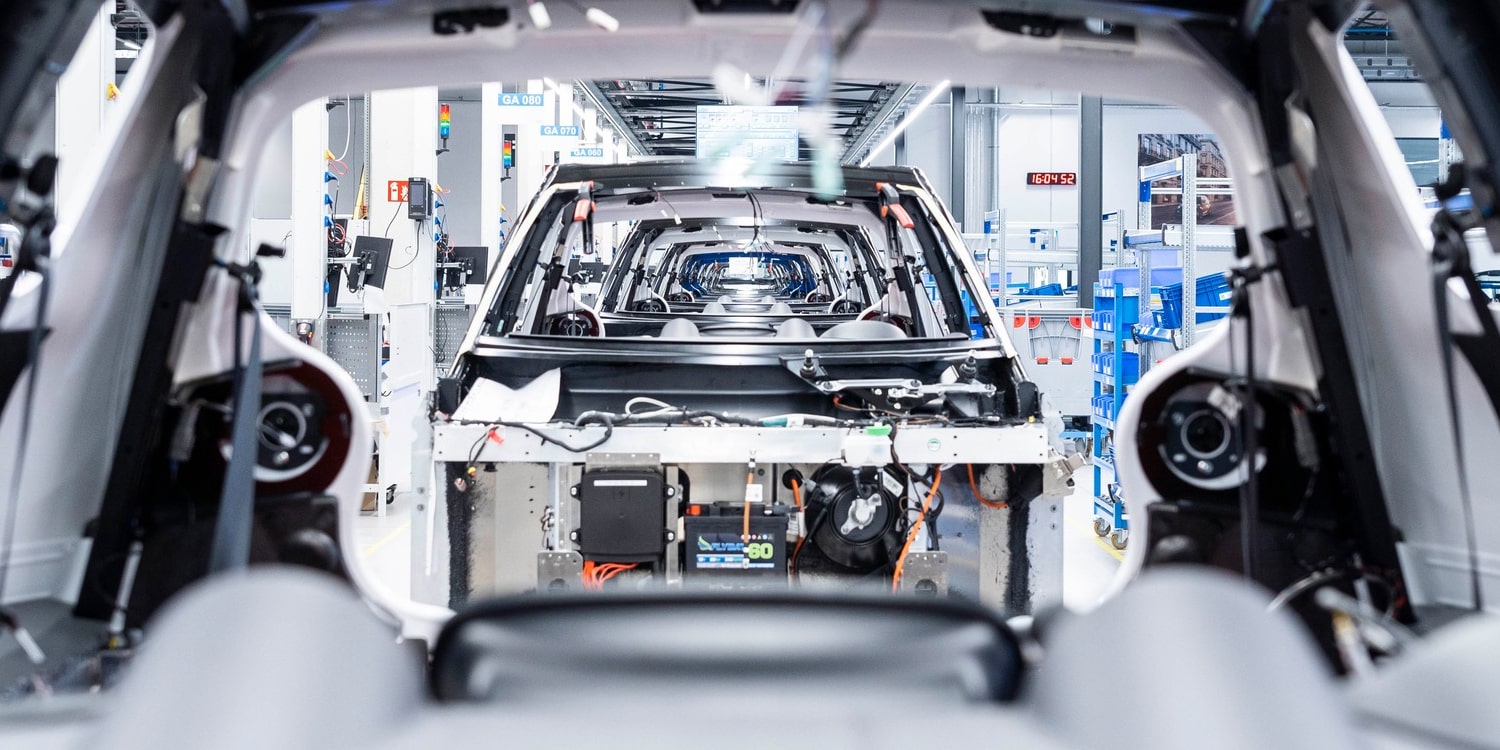

The infusion of capital will enable e.GO, based in Aachen, to accelerate its corporate strategy, focusing primarily on the production of the e.wave X and expanding its global presence. A key aspect of Next.e.GO Mobile’s strategy is the establishment of microfactories in various locations to rapidly scale up manufacturing. The company currently plans to operate three such factories. Alongside the microfactory already operational in Aachen and the one under construction in Bulgaria, there are plans to establish a third factory in Northern Macedonia.

Each of the latter two plants is expected to manufacture up to 30,000 vehicles annually starting in 2024. However, Next.e.GO Mobile still has a long way to go in terms of sales. According to the manufacturer, only a little over 1,300 e.GO vehicles are currently in use. The company intends to introduce a cargo version called the e.Xpress, which will complement the e.wave X compact car unveiled in May 2022. Both models are largely based on e.GO’s debut vehicle, the Life.

Next.e.GO Mobile emerged from the bankruptcy of e.GO Mobile, a company founded by Günther Schuh, a professor at RWTH Aachen University. The newly formed company aims to go public in the United States through a merger with a Special Purpose Acquisition Company (SPAC). By merging with Athena Consumer Acquisition, a publicly traded shell company, Next.e.GO Mobile’s shares will be listed under the ticker symbol “EGOX.” The transaction is expected to be completed in the second half of 2023.

The recently announced financing plays a crucial role in bridging the gap until the SPAC merger is finalized. “We are delighted to partner with Western Asset, a renowned fixed-income manager with a history of providing tailored financial solutions for their clients for over five decades,” stated Ali Vezvaei, Chairman of e.GO’s board of directors. “As we strive to make everyday urban mobility more convenient, practical, and affordable, this financing opportunity allows us to continue our planned production and expand our MicroFactory footprint.”

Isabelle Freidheim, Chair of Athena SPAC, expressed enthusiasm about the successful debt financing, highlighting e.GO’s strong technological foundation as an innovative electric vehicle producer. “We are truly excited about our partnership with e.GO and eagerly anticipate their continued growth following the completion of the de-SPAC transaction,” Freidheim added.