The Centre of Automotive Management (CAM) has released its latest analysis of global market trends in electromobility, revealing a challenging market environment with increasing competition worldwide.

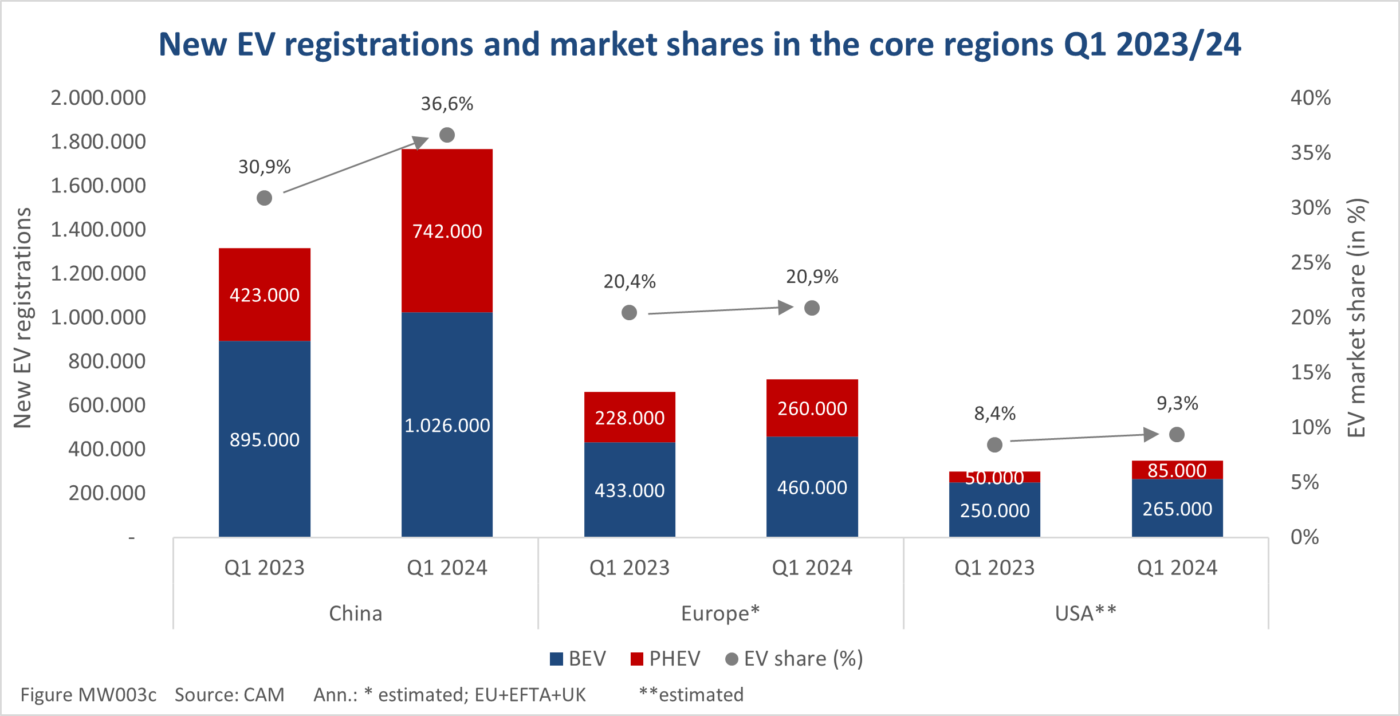

In the first quarter of 2024, a total of 1.75 million Battery Electric Vehicles (BEVs) and around 1.1 million Plug-in Hybrid Electric Vehicles (PHEVs) were newly registered in China, Europe, and the USA, marking an 11% and 52% increase respectively. China led this surge with one million BEVs and 740,000 PHEVs, accounting for more than half of all new electric car registrations. Despite a slowdown in growth, China exceeded its previous year’s BEV registrations of 895,000, while PHEVs saw a significant increase from 423,000 to 742,000 units.

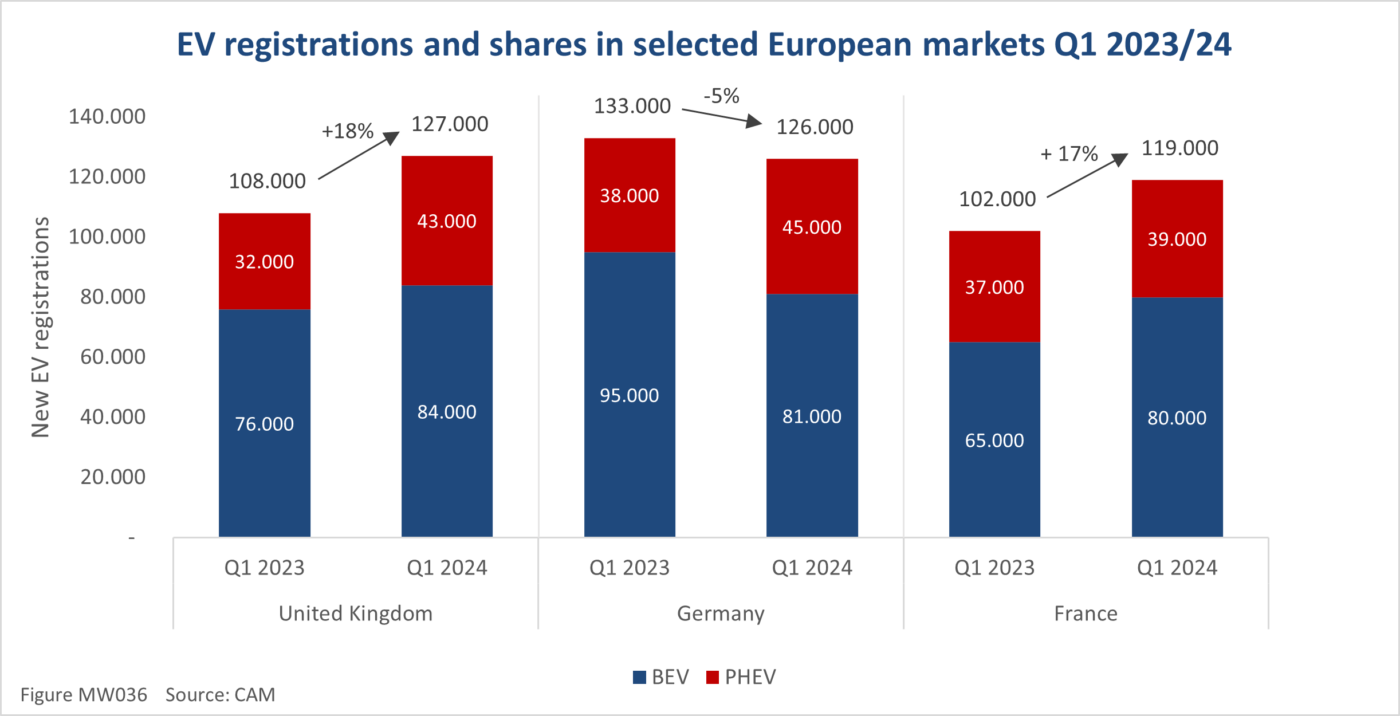

In Europe, the growth rate was even lower, with BEV registrations rising from 433,000 to 460,000 vehicles and PHEVs from 228,000 to 260,000 vehicles over the year. This slowdown was partly attributed to Germany, where demand decreased following the premature end of the purchase premium.

As a result, Germany lost its top position as Europe’s leading electric market in terms of new registrations to the United Kingdom, which saw 81,000 BEVs (-14%) and 84,000 new electric cars registered in the first quarter, an 11% growth. France closely followed with 80,000 BEVs (+24%), posing a challenge for Germany to maintain its growth momentum.

In North America, BEV and PHEV registrations also saw a slight increase, with fully electric passenger cars totaling 265,000 units and part-time electric vehicles rising from 50,000 to 85,000 registrations. However, the estimated EV quota in the USA is 9.3%, compared to Europe’s 20.9% and China’s significant leap from 30.9% to 36.6%.

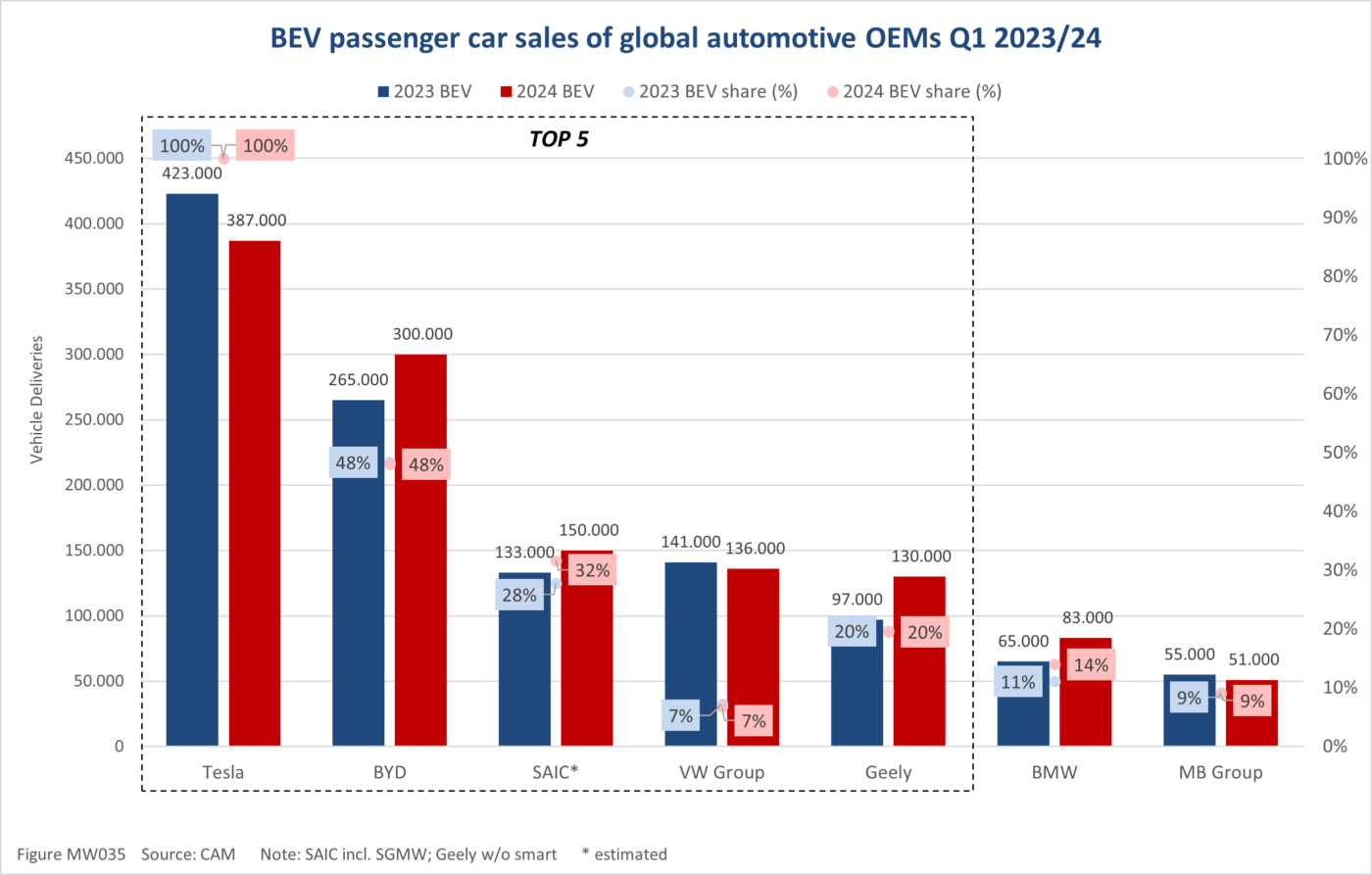

Regarding manufacturers, Tesla remains the BEV market leader with reduced sales volume of 387,000 cars (-9%). BYD reported a 13% increase to 300,000 BEVs despite significant price reductions, while BMW saw the strongest growth among German manufacturers at 28%. The VW Group (-1%) and Mercedes-Benz (-7%) experienced a drop in volume.

Looking ahead, CAM expects around 10 million BEVs in 2024, including almost 6 million in China, 2.3 million in Europe, and around 1.3 million in the USA. Despite the top two spots remaining unchanged with Tesla and BYD, SAIC has moved up in the ranking due to strong sales of new energy vehicles.

Stefan Bratzel, head of the study, highlighted the need for a revitalization of the markets with mature and attractively priced models to convince buyers without an early-adopter mindset. He emphasized the increasing competition from Chinese factories, urging the local industry to take note.