A recent report from Bank of America (BofA) suggests that Ford, GM, and Stellantis will emerge as the major players in the US electric vehicle (EV) market over the next four years, although they will face significant hurdles along the way. Titled “Car Wars,” the annual report highlights the uncertainties and volatilities surrounding product strategies in the automotive industry, particularly with the acceleration of EV launches, uncertainties surrounding internal combustion engine (ICE) vehicles, and the potential for last-minute product cancellations.

BofA states that the era of ICE dominance is coming to an end, as electric cars are expected to make up a larger proportion of new model launches between 2024 and 2027. The report projects that 46% of new models will be EVs, while ICE vehicles will represent 35%, with hybrid vehicles accounting for an additional 18%.

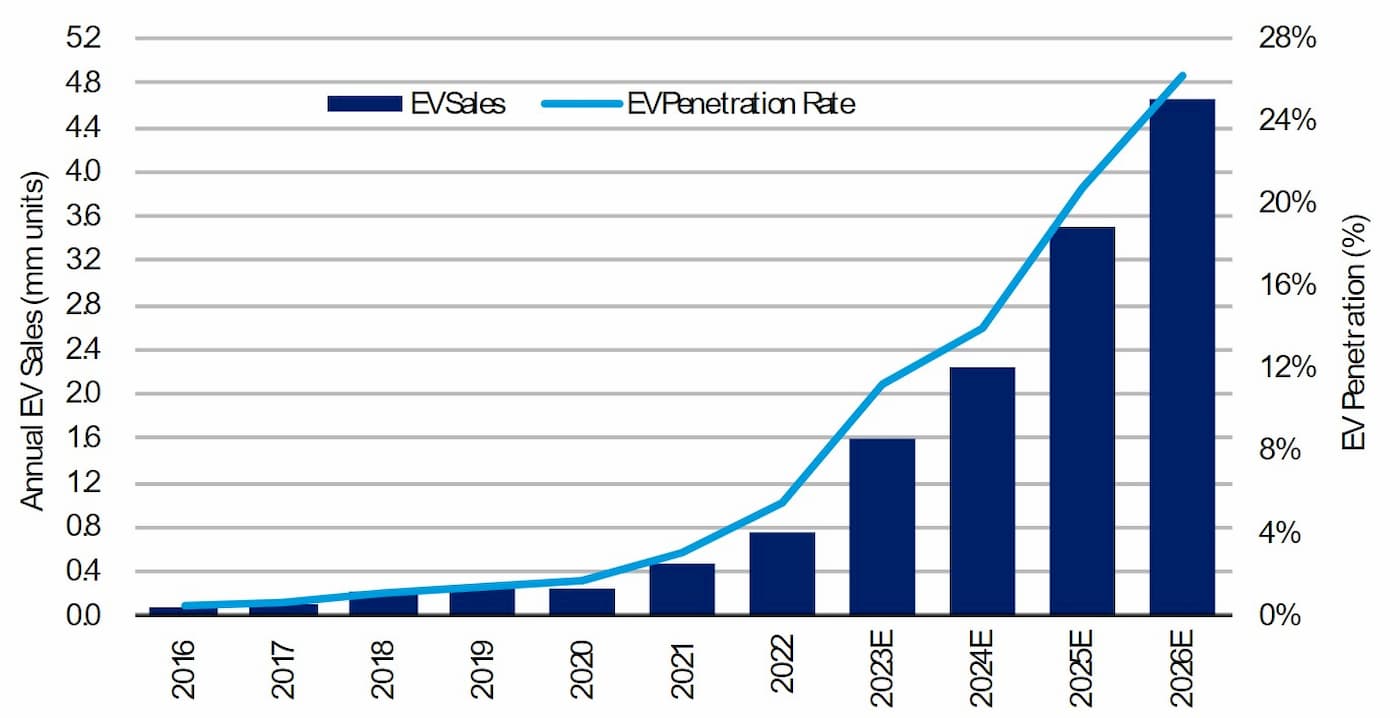

The rise of EVs is evident in the market, as electric vehicle sales broke records in the first quarter of 2023, capturing over 7% of the US auto market for the first time. This trend is predicted to gain further momentum in the coming years.

The “Car Wars” analysis indicates that EVs could account for as much as 26% of total US auto sales by 2026, driven by factors such as the Inflation Reduction Act and the growing demand for electric vehicles.

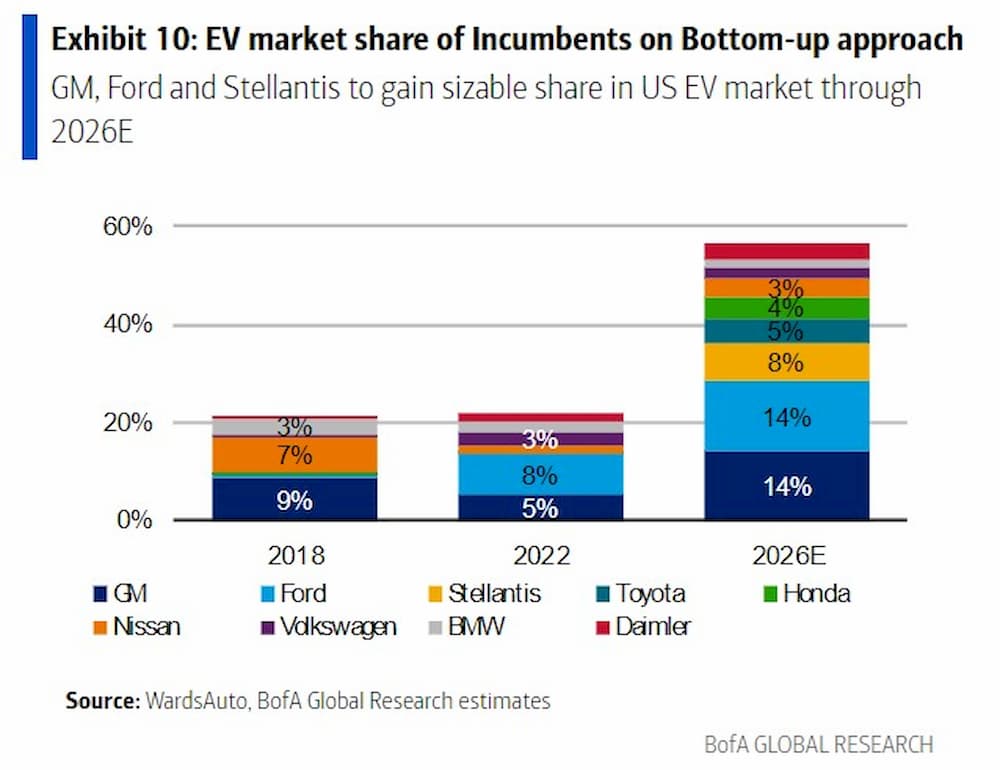

Although BofA suggests that Tesla’s dominance in the nascent EV market segment might be waning, the report recognizes that the company will continue to be a significant factor. Tesla’s market share is expected to decrease from its peak of 78% in 2018 to approximately 18% by the end of 2026.

While Tesla is projected to maintain its position as the most significant player in the US EV market, Ford, GM, and Stellantis are expected to experience the most substantial gains in market share. Both Ford and GM are forecasted to reach a 14% share of the US EV market, with Stellantis, a company that has been slower in entering the EV market, projected to achieve an 8% share.

See also: Tesla to Invest $10 Billion in Monterrey to Build Its Largest Factory Yet, Giga Mexico

According to the report, GM, Stellantis, Volkswagen (VW), and Hyundai/Kia are making the most aggressive moves into the EV market based on product pipeline forecasts and powertrain offerings. These companies are set to introduce several new EV models in the coming years.

GM, in particular, has set ambitious goals after selling over 20,000 electric cars in the first quarter of this year. The company expects a breakout in the EV market with high-volume launches from the Chevrolet brand, including the Blazer EV, Equinox EV, and Silverado EV. By 2025, GM aims to produce one million EVs annually across ten segments.

GM’s Cadillac brand plans to unveil several new EV models, including the electric Escalade IQ, while GMC and Buick will introduce their own EV variants. Stellantis, on the other hand, has lagged behind its competitors in the US EV market but intends to catch up by launching almost as many electric models as GM. The company aims to release 75 EV models and achieve five million in sales by 2030. Stellantis-owned RAM is entering the electric pickup truck segment with the 2025 RAM 1500 REV, which will compete directly with Ford’s F-150 Lightning. Additionally, Jeep is planning to release its first EVs in the US, namely the Recon and Wagoneer S, later this year.

Ford has taken a different approach by focusing on a select number of high-volume models, such as the F-150 Lightning, Mustang Mach-E, and electric Explorer (currently available in Europe). To support its EV strategy, the American automaker has divided itself into three divisions, enabling cash flow from its ICE vehicle business to fund its electric initiatives.

See also: Ford Boosts Mustang Mach-E Inventory in Landmark Tesla Deal, Expanding Access to Charging Stations

The report also highlights the similar approach taken by Hyundai and Kia, mirroring Volkswagen’s strategy. On the other hand, Japanese automakers like Toyota, Honda, and Nissan have a lower emphasis on EVs, with a greater focus on hybrids. The “Car Wars” report predicts that other EV original equipment manufacturers (OEMs), including Rivian, Lucid, and Fisker, will achieve moderate success in commercializing their products.

As the US EV market continues to evolve rapidly, Ford, GM, and Stellantis are poised to secure significant shares. However, challenges lie ahead, and the competition is intensifying as more automakers ramp up their EV efforts in response to changing consumer preferences and government regulations.