California-based electric vehicle (EV) manufacturer, Fisker Inc. (FSR), recently disclosed its second-quarter earnings, showcasing an improvement in profitability. However, the company had to revise its annual production guidance once again, citing ongoing supplier constraints.

Fisker had begun ramping up production and delivered its first Ocean electric SUV in May. However, the company fell short of its initial production targets, manufacturing only 55 Ocean SUVs in the first three months of the year, well below the goal of 300. For the second quarter, Fisker aimed to build between 1,400 and 1,700 vehicles but could only produce an impressive 1,022 Ocean EVs due to challenges faced by suppliers in meeting the required components.

See also: Fisker Commences Reservations for New EV Models: Ronin Convertible and Alaska Pickup

In light of the production difficulties caused by supplier constraints, Fisker decided to revise its annual production forecast. The company now expects to build between 20,000 to 23,000 vehicles this year, compared to the earlier projection of 32,000 to 36,000.

To address the supply chain challenges, Fisker pointed to a planned summer shutdown at its manufacturing partner, Magna Steyr. During this period, the company plans to collaborate closely with its suppliers to ensure future component availability. Following the shutdown, production is expected to resume promptly.

Despite the production setbacks, Fisker showcased a peak production rate of 140 units per day in July, representing a remarkable 75% improvement from the previous month. Of the 1,022 vehicles produced in the second quarter, 1,009 were manufactured in July.

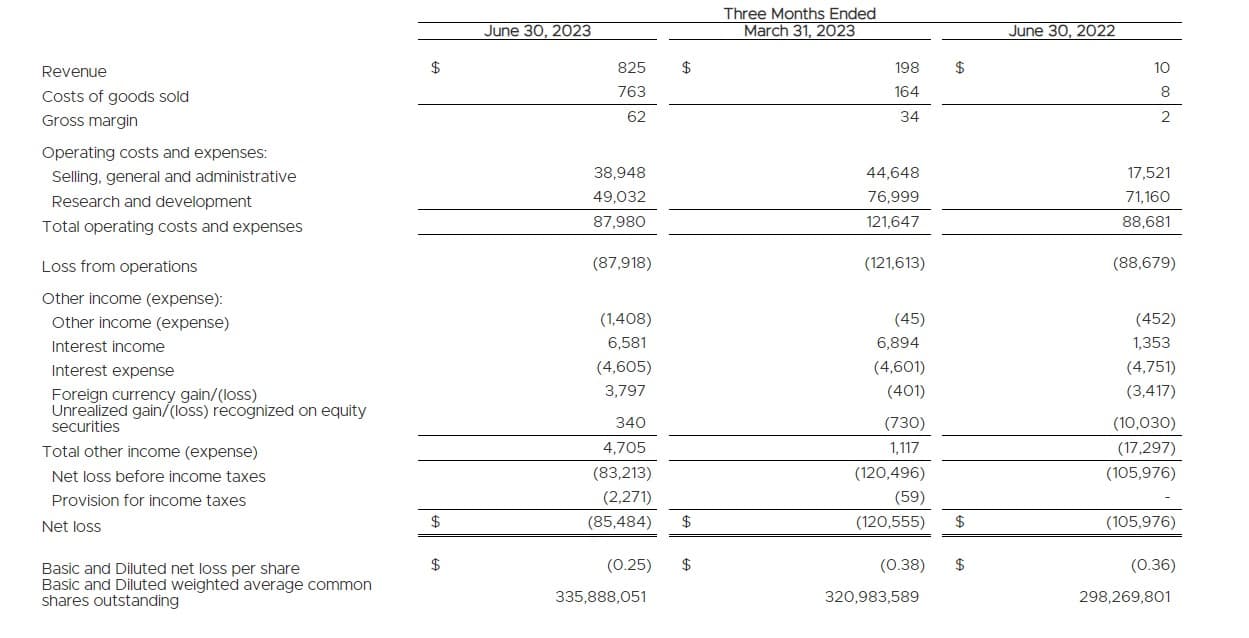

The EV maker reported a revenue of $825,000 for the second quarter, up from $198,000 in the first quarter. Notably, Fisker achieved a 7.5% gross margin with its first Ocean vehicles delivered. Excluding early-stage investor vehicles, the gross margin stood at 18.5%.

Fisker’s operating expenses also showed improvement, decreasing to $88,000 in the second quarter from over $121,000 in the first three months of the year. Additionally, the company’s net loss narrowed to $85.5K, or 25 cents per share, compared to 35 cents per share in the same period last year, surpassing Wall St. estimates of approximately 28 cents per share.

See also: Fisker Falls Short of Q2 Production Targets for Ocean Electric SUVs Due to Supplier Challenges

As of June 30, Fisker reported holding $521.8 million in cash and equivalents (excluding $300 million in gross proceeds), down from $736.5 million at the end of 2022. However, in July, the company raised an additional $300 million from convertible bonds, bringing the total cash, cash equivalents, and restricted cash to $822 million on a proforma basis (excluding $33 million in VAT receivables).

Fisker showcased its commitment to innovation and growth during its “Product Vision Day.” The event revealed several new products, including the Fisker Ronin, Alaska electric pickup, and the upcoming $30,000 Pear small SUV. The company also teased the Fisker Ocean with the Force E off-road package, highlighting its unique advantage in differentiated segments.

In addition to its product showcase, Fisker announced an agreement with Tesla to use its NACS connector during its earnings call. The company is awaiting Tesla’s signature to finalize the agreement.

Despite facing challenges, Fisker remains optimistic about its future prospects, with its focus on novel products and strategic partnerships driving the company forward in the competitive EV market.