Fisker, the electric vehicle startup, is moving towards liquidation, according to statements made by attorneys in U.S. bankruptcy court on Friday. This development comes as two creditor factions prepare for a battle over the priority of repayment.

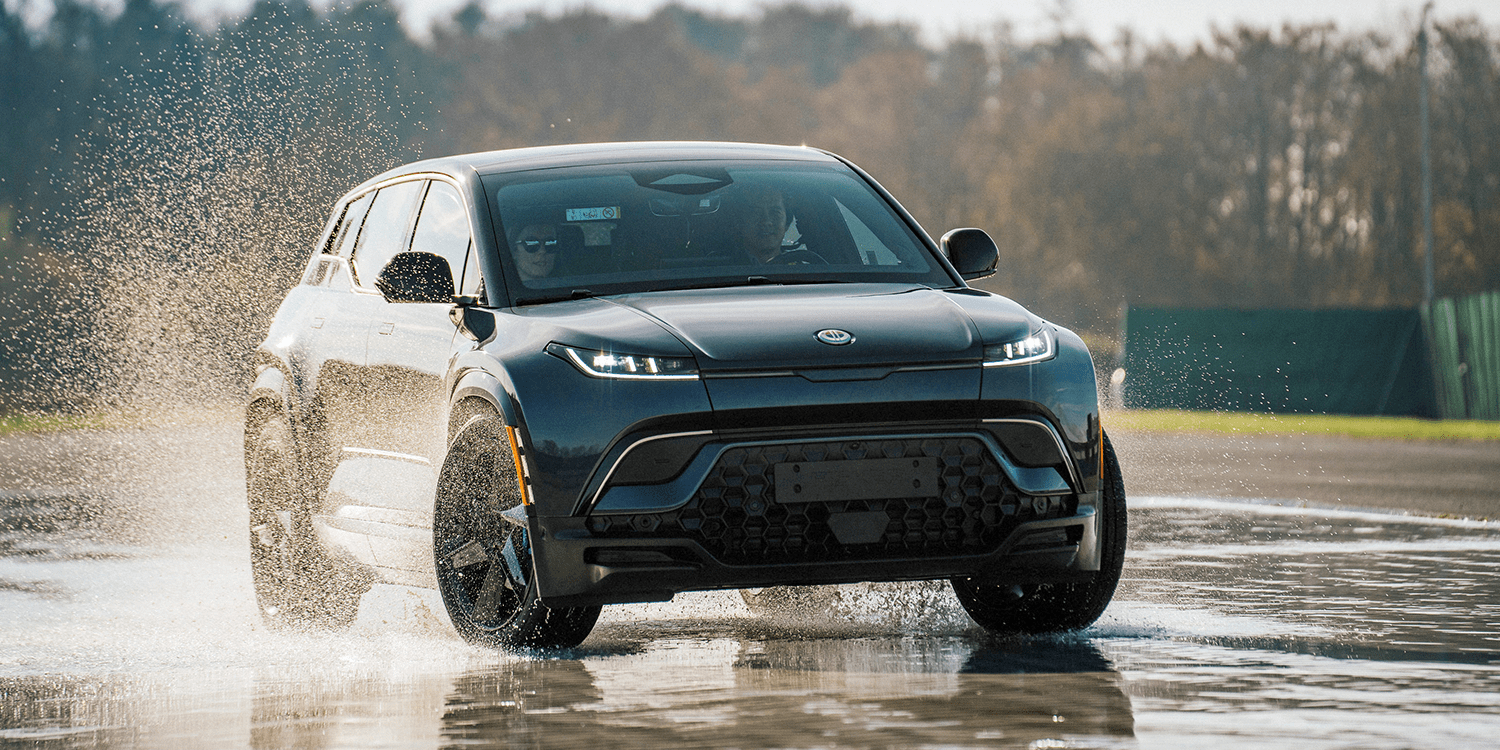

Following a cash drain in its efforts to boost production of its Ocean SUVs, Fisker filed for bankruptcy protection in Delaware on Monday. Despite initial intentions to secure additional financing and maintain “reduced operations,” Fisker’s attorney, Brian Resnick, indicated during the Wilmington hearing that obtaining financing is currently unlikely.

See also: Fisker Files for Bankruptcy as Deal Talks Collapse, Citing Cash Burn and EV Market Challenges

Resnick informed U.S. Bankruptcy Judge Thomas Horan of the company’s plan to liquidate its assets, revealing a tentative agreement with a single buyer for all 4,300 of its vehicles.

Founded by automotive designer Henrik Fisker, the California-based company has never been profitable, reporting around $273 million in revenue in 2023 and a net loss of $940 million.

Fisker is indebted to two groups of bondholders for over $850 million. Attorneys representing the larger bondholder group accused a minority faction led by Heights Capital Management of gaining control over Fisker’s debt in November through a contentious transaction.

See also: Fisker Faces Ocean SUV Power Loss Recall in North America and Europe

At that time, Fisker had delayed providing audited financial statements as required under its debt agreements. Heights Capital Management exploited this “minor, technical default” to assert its claim over all of Fisker’s assets as collateral on its bonds, according to Alex Lees, an attorney representing other bondholders.

“They essentially handed the entire business over to Heights,” Lees stated to Horan. “Fisker has been liquidating outside of this court’s supervision, essentially for the benefit of one creditor.”

Lees’ group intends to challenge the November agreement that elevated Heights to the forefront of creditors in Fisker’s bankruptcy proceedings.

See also: Fisker Faces Dire Straits: Offers Employees Steep Discounts on Remaining Ocean SUVs

Heights’ attorney, Scott Greissman, refuted Lees’ claim, labeling it “outrageous” and emphasizing that Heights had attempted to aid Fisker in surviving its financial woes.

Greissman predicted that the anticipated sale of Fisker’s vehicle fleet would only cover a “fraction” of Heights’ $185 million debt, leaving little hope of repayment for other creditors.

Linda Richenderfer, an attorney representing the U.S. Department of Justice’s bankruptcy watchdog, noted that Heights seemed to hold significant leverage, suggesting that Fisker’s bankruptcy could ultimately transition into a standard Chapter 7 liquidation once the vehicle fleet is sold.

See also: Fisker EV Startup Faces Layoffs Amid Funding Struggles

“Heights is obtaining everything it desires,” Richenderfer remarked. “There is no incentive for them to agree to anything further next week.”

The financial challenges faced by the company have raised concerns about its ability to provide customer service. Owners of the Fisker Ocean, the company’s first EV, are experiencing difficulties contacting the company for assistance with issues such as cars becoming inoperable, or “bricked.”

One frustrated owner expressed concern, stating, “It’s my aunt’s car and she’s distressed beyond measure. What the hell is she supposed to do? She waited on call for more than an hour and there’s nobody who seems to help! Who’s gonna do something about the bricked car? It won’t even turn on, the doors won’t open.”

Recently, ChargePoint notified Fisker owners via email about the removal of their EV charging credits. This action follows Fisker’s alleged abandonment of its contract with ChargePoint, leading to a dispute over unpaid promotional charging costs.