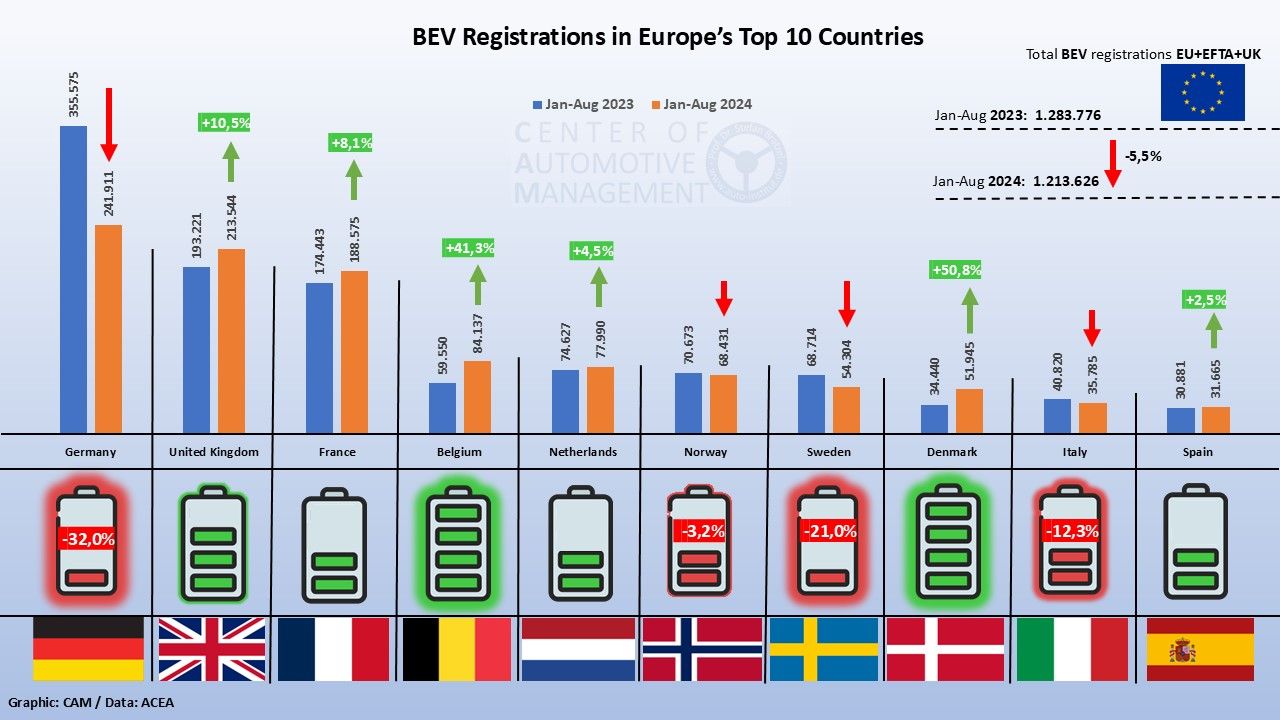

Registrations of battery-electric vehicles (BEVs) in Europe have seen a modest decline of 5.5% between January and August 2024 compared to the same period last year, according to the latest data from the Center of Automotive Management (CAM). While the overall numbers dipped, significant differences emerged between individual countries, with some markets experiencing notable growth.

A total of 1,213,262 BEVs were registered across Europe in the first eight months of 2024, down from 1,283,776 in 2023. Europe, as defined by CAM, includes EU member states, the EFTA countries (Iceland, Liechtenstein, Norway, and Switzerland), and the United Kingdom. The EFTA countries’ figures still count towards manufacturers’ CO2 fleet limits, while the UK, post-Brexit, operates under its own CO2 regulations.

According to CAM Director Stefan Bratzel, the European market is undergoing “significant shifts,” with some countries compensating for declining sales in others. Germany, Europe’s largest car market, saw a steep drop in new BEV registrations, falling by 32% to 241,911 units this year, a stark contrast to the 355,575 vehicles registered in the same period last year. The end of Germany’s environmental bonus for commercial owners and the upcoming cessation of EV subsidies in December 2024 have contributed to this decline.

In contrast, the United Kingdom posted a strong 10.5% increase in BEV registrations, reaching 213,544 units. With this momentum, the UK is closing the gap on Germany and may soon become Europe’s largest electric car market. France, in third place, recorded 188,575 BEV registrations, marking an 8.1% rise. Belgium and Denmark also saw substantial growth, with Belgium climbing to fourth place with an impressive 41.3% increase and Denmark recording the highest growth among the top ten, with a 50.8% surge.

Growth Patterns and Outlook for 2025

While Germany struggles with falling sales, other markets, particularly the UK, are showing resilience. This shift could lead to a reordering of Europe’s top EV markets, especially as manufacturers increase efforts to meet CO2 fleet targets for 2025. The UK’s growth, alongside France’s steady rise, indicates strong competition for the top spot in Europe’s electric vehicle market.

Smaller markets, like Belgium and Denmark, have also demonstrated robust growth. Belgium’s BEV registrations jumped by over 40%, placing it ahead of traditionally strong markets like Sweden. Denmark, which recorded a 50.8% rise in new registrations, is catching up quickly, reflecting the broader European trend of market diversification in the electric mobility sector.

Experts expect that automakers will continue to adjust their strategies to meet upcoming CO2 regulations while also managing sales volume. According to Peter Mock, Director at ICCT Europe, the share of BEVs is expected to grow steadily in the coming years, with a 25% market share likely by 2025.

Source: Linkedin