The European Union’s car market experienced substantial growth in October 2023, with new registrations soaring by 14.6% to reach 855,484 units, marking the fifteenth consecutive month of expansion.

Prominent double-digit percentage increases were observed in key markets, including France (+21.9%), Italy (+20%), and Spain (+18.1%). However, the German car market reported a more modest year-on-year increase of 4.9%.

Over the first ten months of 2023, new car registrations demonstrated a robust 16.7% increase, totaling nearly nine million units. Noteworthy growth was observed in all markets except for Hungary, with the four largest markets – Italy (+20.4%), Spain (+18.5%), France (+16.5%), and Germany (+13.5%) – contributing significantly to this positive trend.

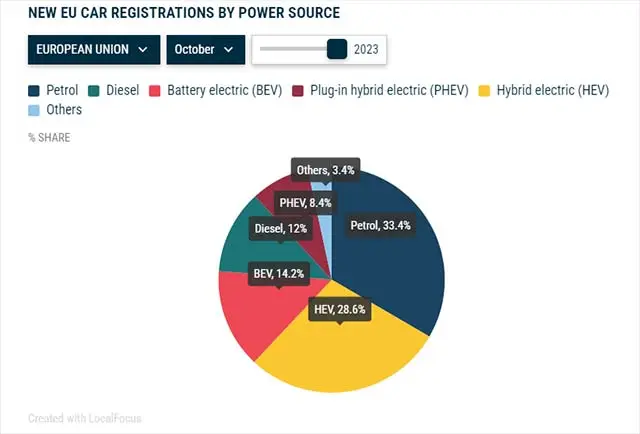

In October, the market share of battery-electric cars saw a rise to 14.2%, up from 12% in the same month last year. This surpasses diesel’s cumulative share for the first time, with hybrid-electric cars securing the second spot with nearly 29% market share. Petrol cars maintained their lead, albeit decreasing to 33.4% in October.

Battery-electric car registrations in the EU increased by 36.3% in October, reaching 121,808 units. Several markets, including Belgium (+147.3%) and Denmark (+100.7%), contributed to this surge. Germany, the largest market for battery-electric cars, experienced modest growth (+4.3%) in October.

Hybrid-electric cars also witnessed a surge with a 38.6% increase in registrations in October, driven by substantial growth in Germany (+57.9%), France (+40.1%), and Italy (+28%). This contributed to a cumulative increase of 29.8% over the first ten months.

Conversely, plug-in hybrid electric car sales saw a 5% year-on-year decline to 72,002 units in October. Despite notable increases in Belgium (+70.2%) and France (+34.2%), Germany’s decline (-49%) impacted the overall market share of plug-in hybrid cars, which decreased from 10.2% to 8.4% in October.

The EU petrol car market grew by 8.1%, although its market share contracted from 35.4% to 33.4% compared to the same period last year. Key bloc markets, including Italy (+21%), France (+17.4%), Spain (+7.7%), and Germany (+7.5%), contributed to this increase.

In contrast, the EU’s diesel car market continued its decline in October, decreasing by 13.2%. This decline was evident in most of the bloc’s markets, including France (-29.4%), Spain (-20.2%), Germany (-4.6%), and Italy (-3.7%). Diesel cars now have a market share of 12%, down from 15.9% in October last year.