In a recent development, electric vehicle parts supplier Proterra has filed for Chapter 11 bankruptcy protection, underscoring the growing difficulties faced by companies in the electric vehicle industry. This move follows a series of challenges including supply chain disruptions, weakening demand, and a lack of funding opportunities.

Proterra’s decision to seek bankruptcy protection closely follows Lordstown Motors similar action, further accentuating the tumultuous landscape within the electric vehicle sector. Lordstown Motors had initiated bankruptcy proceedings and initiated plans for its sale after a failed attempt to resolve disagreements regarding an expected investment from Foxconn.

The ramifications of Proterra’s bankruptcy declaration are notable, with the company’s stock value plummeting by nearly 50% following the announcement. The corporation revealed its assets and liabilities to be within the range of $500 million to $1 billion. For context, Proterra’s market value was documented at $362 million during the most recent market closure.

See also: Chinese EV Startup Byton Files for Bankruptcy, Crushing Hopes for Production of Flagship M-Byte SUV

Comparatively, Proterra’s financial standing appears starkly different from its position in January 2021. Back then, the company had commanded a valuation of $1.6 billion, encompassing its debt, in a merger deal that involved a special purpose acquisition company (SPAC).

Addressing the situation, CEO Gareth Joyce conveyed, “We have encountered a range of market and broader economic challenges that have adversely impacted our efforts to efficiently expand.” Joyce’s statement reflects the multifaceted obstacles impeding Proterra’s growth trajectory.

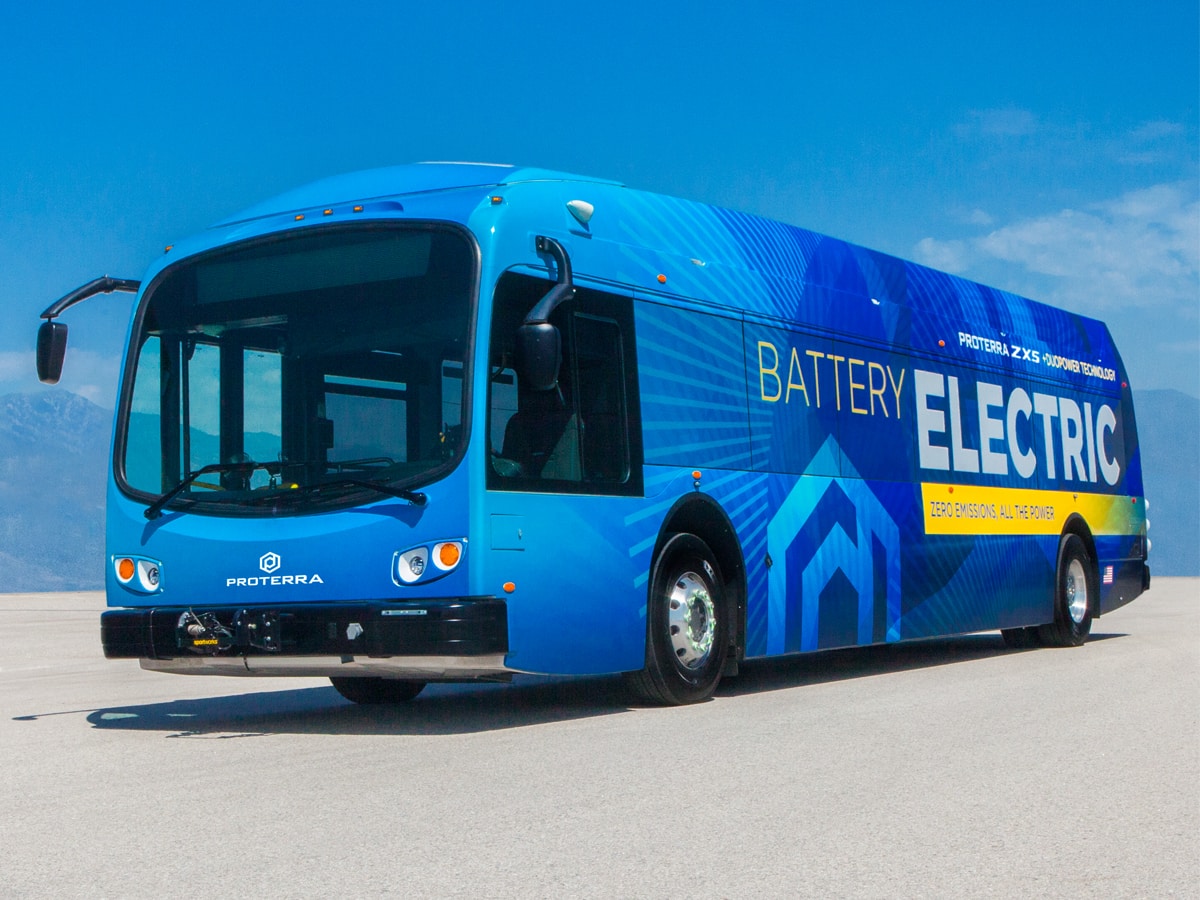

As a producer of electric buses and battery packs, Proterra aims to continue its operations as usual despite the bankruptcy filing. The company is poised to initiate standard motions within the bankruptcy court in order to utilize its existing capital for ongoing operations. This strategy is in line with the corporation’s commitment to sustain its business activities.

Notably, Proterra had earlier announced plans to enact workforce reductions and streamline operations in response to the market conditions. In an effort to enhance cost efficiency, the company revealed its intention to consolidate electric bus and battery production operations within South Carolina.

See also: Lightyear Announces Fresh Start After Restructuring and Approval from Bankruptcy Administrator

The electric vehicle sector, while promising, is currently navigating a complex landscape characterized by disruptions in supply chains, uneven demand, and challenges in securing financial support. Proterra’s recent bankruptcy filing stands as a poignant reminder of these obstacles, underscoring the industry’s need to adapt and innovate in the face of adversity.