Amid the tumultuous impact of the pandemic on the automotive industry, vehicle prices saw significant fluctuations. However, with automakers now better equipped to meet consumer demand, prices are beginning to stabilize, leading to increased satisfaction among new vehicle shoppers. This shift in the market dynamics is a key driver of the overall rise in customer satisfaction, as highlighted in the 2023 U.S. Sales Satisfaction Index study by J.D. Power.

In the previous year, the average satisfaction rating across the industry stood at 786 out of 1,000. This year, the industry’s performance has improved, with the satisfaction rating climbing to 793. The most notable contributors to this boost in customer contentment are price and supply.

Chris Sutton, Vice President of Automotive Retail at J.D. Power, noted that “Buyers are more satisfied with the inventory choices they now see in dealerships across the country—more than in the past three years. Increased inventory also means fewer buyers are paying more than the manufacturer’s suggested retail price (MSRP) for their new vehicle.”

While dealers have fewer opportunities to charge above MSRP for vehicles, prices have not yet fully returned to their pre-pandemic levels. Consequently, customer satisfaction has not entirely rebounded to pre-pandemic standards either.

According to J.D. Power’s findings, consumers shopping for mass-market vehicles rated the fairness of the price they paid at 8.04 out of 10 in 2023, a slight decline from the 8.14 score recorded in 2020. In the premium segment, shoppers rated price fairness at 8.18 in 2023, down from 8.42 in 2020.

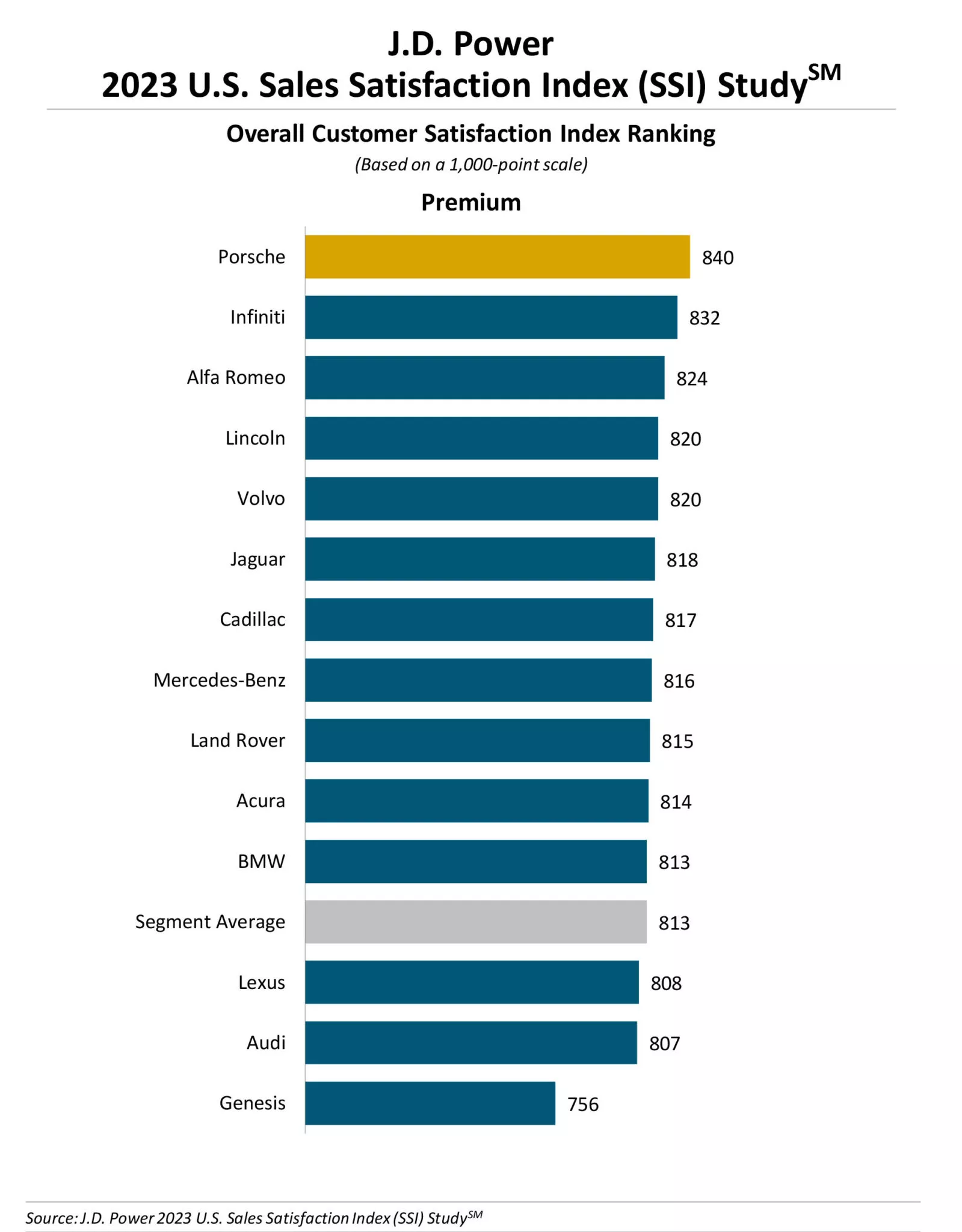

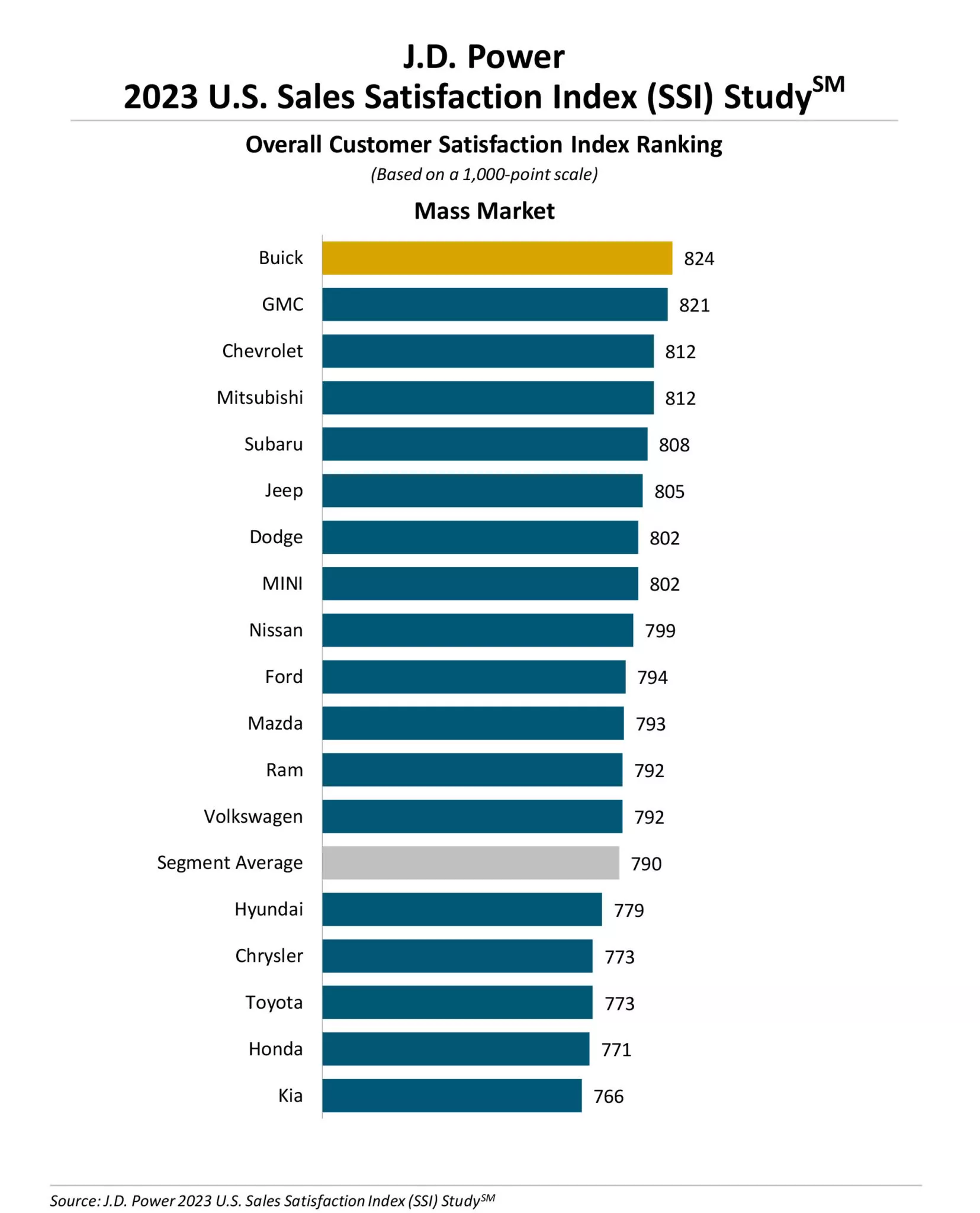

Notably, Porsche customers emerged as the most satisfied among all automakers, earning the highest satisfaction rating of 840. In the premium segment, Infiniti secured the second position with a rating of 832, closely followed by Alfa Romeo with 824. For the second consecutive year, Buick claimed the top spot in the mass market segment, with a satisfaction score of 824. GMC and Chevrolet, also under the General Motors umbrella, achieved impressive ratings of 821 and 812, respectively.

Conversely, Genesis customers in the premium segment expressed the lowest satisfaction levels by a considerable margin, with a rating of 756. In the mainstream segment, Kia earned the least satisfied customers with a score of 766, followed closely by Honda (771), Toyota (773), and Chrysler (773).

Addressing the Electric Knowledge Gap

The study further unveiled a noticeable disparity in satisfaction between buyers of internal combustion engine (ICE) vehicles and electric vehicles (EVs). Mass market segment ICE buyers rated their experience significantly higher, at 848 out of 1,000, compared to EV buyers, who rated their experience at 790. The premium segment displayed a similar trend, albeit with a smaller difference (ICE 866, EV 831).

Aside from the higher cost of EVs, the buying experience for EV owners was identified as a less satisfying aspect. The novelty of electric vehicle technology implies that dealership employees are still in the process of acquiring knowledge about EVs, leaving customers desiring more assistance with charger installation, charging procedures, and maintenance schedules.

Sutton highlighted this aspect, noting, “Buyers of ICE vehicles don’t need to be taught how to put fuel in the gas tank. But salespeople need to show EV buyers how to charge their vehicles at home and what’s involved in using a public charging station.” This reflects the ongoing educational efforts required to enhance the EV ownership experience and bridge the knowledge gap for both customers and dealership staff.