The electric vehicle (EV) market is encountering a notable slowdown, with consumer reluctance attributed to the steep entry costs into this transformative technology, according to recent research by S&P Global.

While the North American market predominantly features larger, luxurious EVs with elevated Manufacturer’s Suggested Retail Prices (MSRPs), the study indicates that even in regions where more affordable EV options exist, such as China, the cost implications tied to batteries and electric motors deter potential buyers.

S&P Global’s survey reveals that nearly half of respondents worldwide perceive EV prices as prohibitively high. While acknowledging the inherent premium associated with advanced technology, consumers express reservations about the overall affordability of transitioning to electric vehicles, especially amidst record-high average monthly payments for new cars in the U.S.

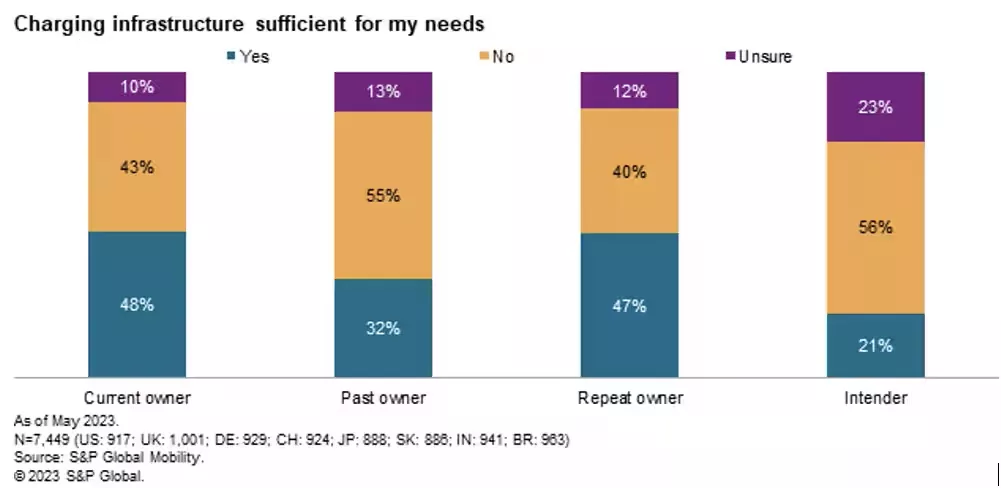

Despite being the primary barrier to EV adoption, price is not the sole concern. The practical challenges of battery-powered driving also weigh on consumer minds. Of those surveyed, 46 percent express worries about charging durations, while 44 percent highlight concerns about station availability.

Though a majority are willing to endure a 30 to 60-minute charging time, the reliability of America’s infrastructure and the scarcity of charging stations in comparison to traditional gas stations continue to influence consumer perceptions. Collaborative efforts between established automakers and Tesla may play a role in addressing these infrastructure concerns in the U.S.

Surprisingly, home charging does not emerge as the anticipated solution. Only 51 percent of EV owners report having a home charger, with many unwilling to incur additional costs for installing a Level 2 fast-charger in their garages. Instead, a significant number express a preference for charging at work or public stations, potentially raising the overall ownership cost.

Encouragingly for automakers, range anxiety appears to be subsiding. Only 29 percent of respondents expect an EV to cover over 300 miles per charge, suggesting that the market offers a variety of vehicles aligning with consumer expectations.

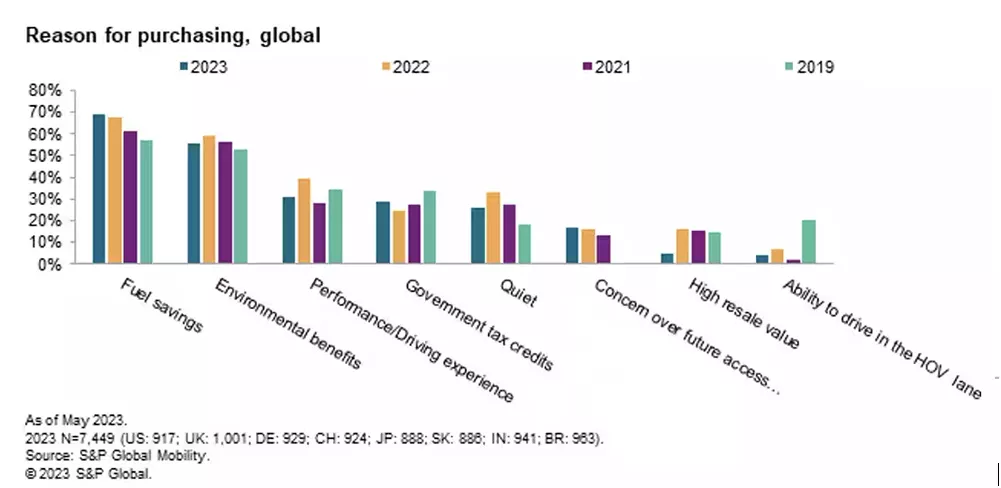

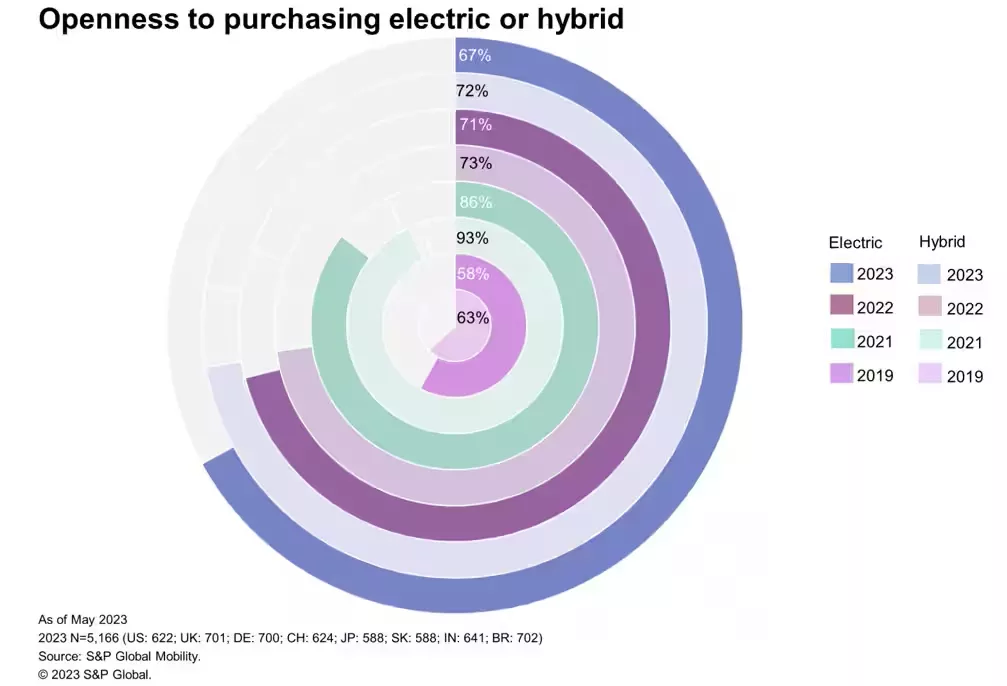

While the fuel savings (69 percent), environmental benefits (56 percent), and driving experience (31 percent) remain key appeals for potential EV buyers, the research indicates a shift in consumer openness. In 2021, 86 percent expressed willingness to consider an EV for their next vehicle, a figure that has now dropped to 67 percent, driven by concerns related to pricing and charging infrastructure. However, the expanding variety of EV choices is attracting more attention from consumers compared to 2019, reflecting a growing interest in the evolving landscape.