The Chinese Ministry of Commerce has unveiled proposals for additional export restrictions targeting technologies used in the production of battery components and the processing of critical metals like lithium and gallium.

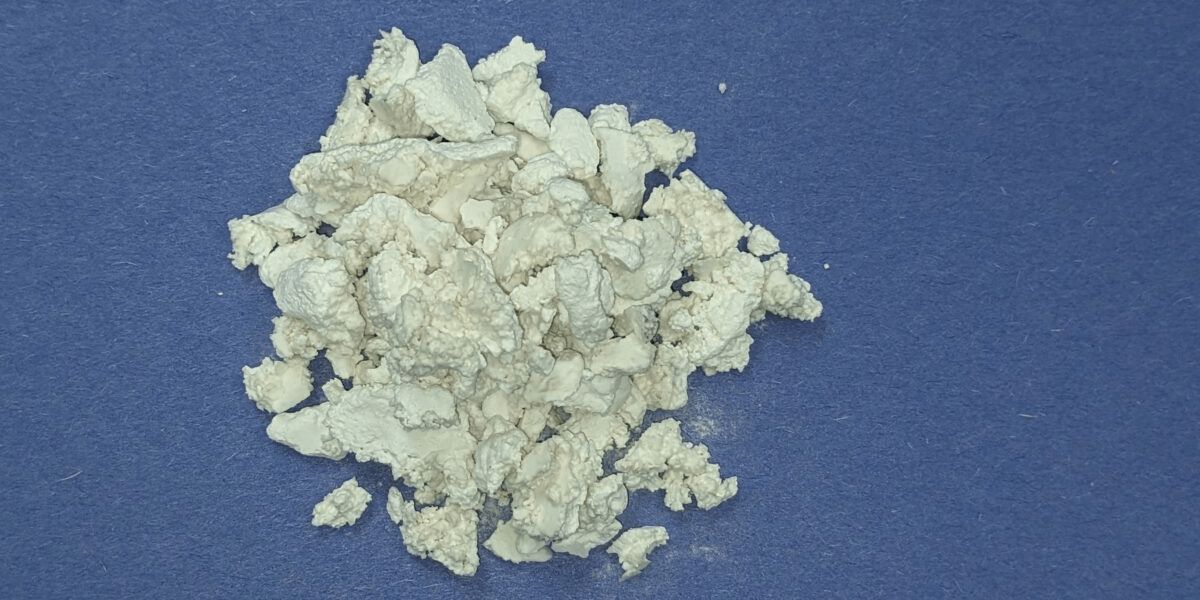

The draft regulations, released on Jan. 2, focus specifically on lithium iron phosphate (LFP) and lithium manganese iron phosphate (LMFP) batteries, as well as lithium carbonate extraction processes. These restrictions would extend beyond raw materials to include technologies critical to their processing. Public consultations on the proposals will be open until Feb. 1, but the timeline for their potential implementation remains unclear.

China currently dominates global lithium processing, with a 70% market share in converting raw lithium into battery-grade material. According to Adam Webb, head of battery raw materials at Benchmark Mineral Intelligence, the proposed measures would reinforce China’s leadership in this sector. “These restrictions could create challenges for Western lithium producers that rely on Chinese technology for processing lithium chemicals,” Webb told Reuters.

The measures are expected to impact not only Western companies but also Chinese firms with international operations. The restrictions could complicate the global expansion plans of major battery manufacturers like CATL, Gotion, and EVE Energy, potentially necessitating changes in their supply chains.

The timing of the announcement appears deliberate, coinciding with the impending inauguration of Donald Trump as U.S. president, who is expected to implement tariffs and trade restrictions aimed at China. The proposed export controls highlight Beijing’s strategic intent to protect its competitive edge in battery and metal processing technologies amid rising geopolitical and economic tensions.

The move follows China’s 2023 export restrictions on graphite, an essential anode material for batteries. By targeting both materials and the underlying technologies, the new proposals signal a broader approach to safeguarding China’s dominance in key industries critical to the global transition to clean energy.

Source: Reuters