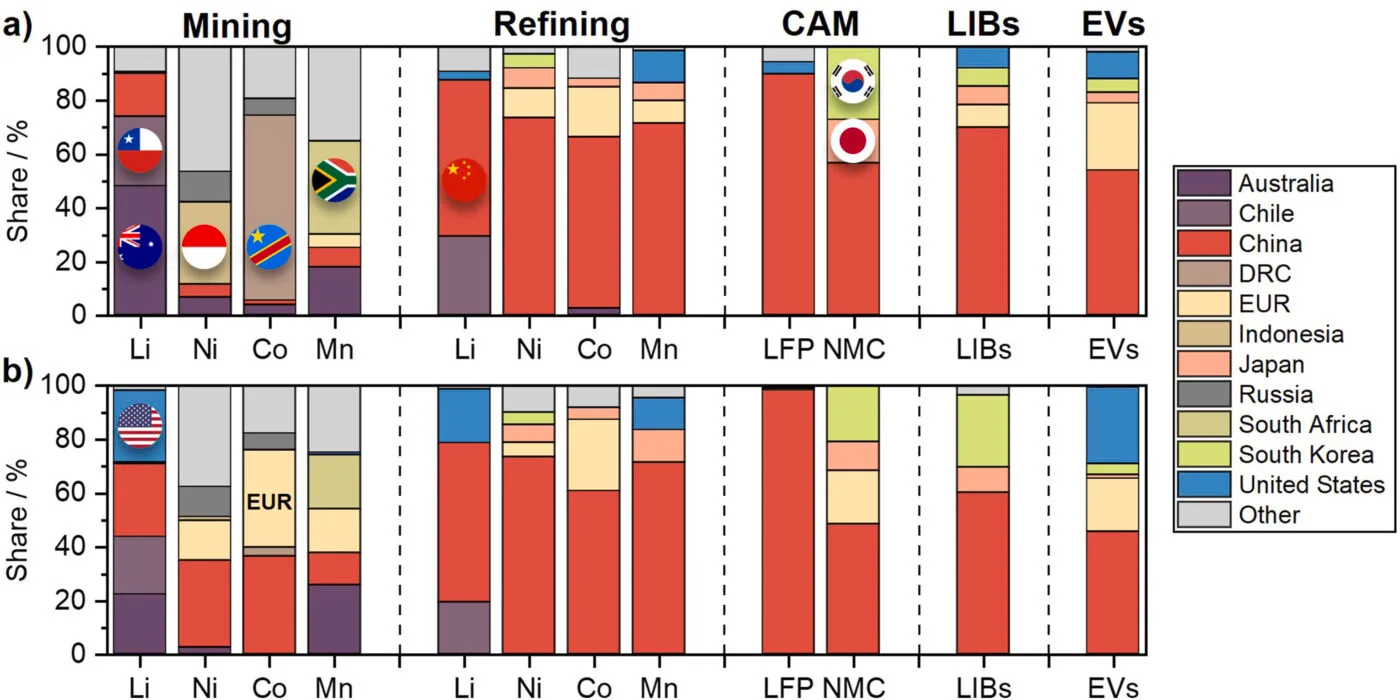

China holds a commanding position across the electric vehicle battery supply chain, controlling raw material extraction, refining, and cell production, according to a new study by Fraunhofer FFB and the University of Münster. The analysis underscores Europe and the United States’ dependence on Chinese supply lines, despite efforts to secure greater control over critical battery components.

The study examined four key raw materials essential for lithium-ion battery production—lithium, nickel, cobalt, and manganese—and found that China dominates all but one. “Mineral raw materials are at the very beginning of the supply chain for battery cell production, and Europe is almost 100 per cent dependent on imports,” said Professor Simon Lux, Director of Fraunhofer FFB.

See also: CATL Leads Global EV Battery Market with 37.9% Share in 2024, Followed by BYD at 17.2%

China’s dominance extends beyond mining operations to the refining and processing of raw materials, as well as the manufacturing of battery cells. The latest annual report by SNE Research shows that Chinese battery manufacturers CATL and BYD account for a combined 55% of the global installed battery capacity for electric vehicles.

Global Ownership Structures in Raw Materials

The study details the geographical distribution of ownership in the lithium, nickel, cobalt, and manganese supply chains:

- Lithium: While 74% of the world’s lithium is extracted from Australia and Chile, major production shares are held by Chinese and U.S. companies. Tianqi Lithium (China) and Albemarle (U.S.) control 29% and 26% of global production, respectively. European investments remain negligible, with the Barroso lithium project in Portugal accounting for just 0.4% of global production.

- Nickel: Indonesia contributes 30% of global nickel production, but domestic firms control less than 5%. Chinese companies, led by Tsingshan, manage 86% of Indonesia’s nickel output, giving China overall control of 32% of global production. Europe, the Philippines, and Russia collectively account for just over 40%.

- Cobalt: The Democratic Republic of the Congo (DR Congo) produces 68% of the world’s cobalt, but local firms manage only 5% of mining operations. Chinese companies control 47% of production, with European firms, including Glencore and Eurasian Resources Group, also holding 47%. Outside Chinese and European influence, Russia, Cuba, and the Philippines make up 12%.

- Manganese: Australia is increasing its footprint in manganese mining, now controlling 25% of global output through South 32 and Jupiter Mines. South Africa follows with 20%, while Europe holds a 16% share through investments in Australia, Gabon, and Ukraine by firms like Anglo American and Eramet.

China has also solidified its lead in lithium iron phosphate (LFP) batteries, with a more than 98% share of global production of LFP active materials. This dominance directly affects European manufacturers reliant on this cost-effective battery chemistry.

Challenges for Europe and the U.S.

“China’s growing dominance of raw materials jeopardises the future of European electric mobility. This dependency makes Europe vulnerable,” said Lux. “Geopolitical tensions or export stops could lead to massive economic damage and losses running into billions.”

See also: Hyundai’s “Dream” Solid-State EV Battery to Debut in March, Promising Faster Charging and More Range

Both Europe and the U.S. are working to secure greater control over the lithium-ion battery supply chain through mine acquisitions and refinery investments. The study notes that the U.S. has made stronger progress in lithium procurement, while Europe remains significantly behind in securing essential raw materials.

Australia, Indonesia, and DR Congo are seeing a surge in company takeovers by foreign investors, underscoring global competition for critical resources. “These developments underline the global competition for critical raw materials and the strategic realignment of value chains,” Lux added.

Possible Solutions for Europe

The study suggests several measures to reduce dependency and ensure a stable battery supply chain for Europe. These include expanding local refining capacities, establishing strategic partnerships for raw material supply, and strengthening circular economy initiatives to recycle battery components.

“A holistic strategy combining local production, international collaboration, and sustainable recycling is crucial for Europe’s energy transition,” the researchers concluded.

See also: Stellantis Reportedly Exploring BYD Batteries for Sub-€20,000 Electric Cars

The study is based on a comprehensive data analysis of global ownership structures in the lithium-ion battery supply chain, comparing geographical production shares and corporate control to present an overarching view of power dynamics in the industry.