Deutsche Bank has revised its sales forecast for Chinese electric vehicle (EV) manufacturer Nio Inc, citing increased clarity from the company’s latest earnings call. The bank now predicts a total of 450,000 units sold in 2025, in line with Nio’s guidance, driven by robust performance across its three brands—Nio, Onvo, and Firefly.

“We now expect the Nio brand to sell 223,000 units in 2025 (up 10% year-on-year), and Onvo brand to sell 219,000 units in 2025 (vs. approximately 20,000 units in 2024), along with 8,000 units from the Firefly brand,” Deutsche Bank analyst Wang Bin’s team wrote in a research note.

The updated projection reflects confidence in Nio’s growth trajectory, bolstered by a strong product pipeline and the ramp-up of sub-brands. During its earnings call, Nio provided a fourth-quarter delivery target of 72,000 to 75,000 vehicles, projecting full-year 2024 deliveries of 221,000 to 224,000 units.

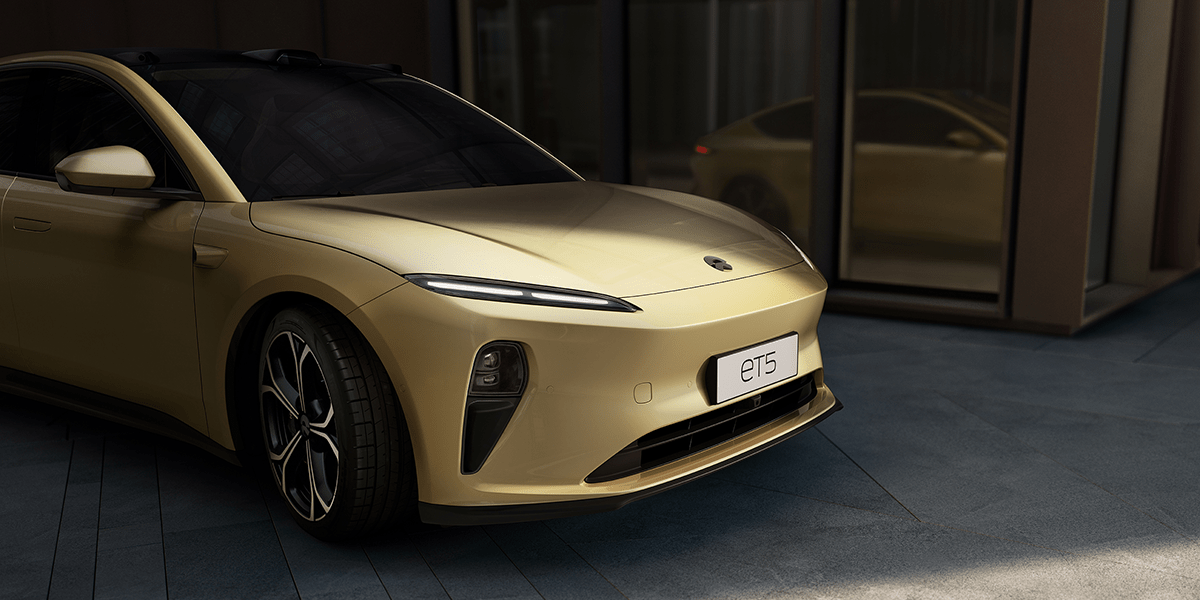

Nio has outlined ambitious plans for 2025, including the launch of its ET9 flagship sedan in March, alongside two SUVs under the Onvo sub-brand—a six/seven-seater and a large five-seater. Additionally, Nio plans to upgrade five models under its main brand, including next-generation iterations of the ES6, EC6, ES7, ET5, and ET5 Touring.

The Onvo sub-brand, launched in September with the L60 SUV, has already gained traction. Onvo President Alan Ai reported over 7,000 L60 deliveries as of mid-November and set a target of reaching 20,000 monthly deliveries by 2025. Nio’s third brand, Firefly, is also set to make its debut at Nio Day 2024 on December 21, with its first vehicle delivery expected in the first half of 2025.

Deutsche Bank’s revised forecast comes as Nio works to meet its 2025 target of doubling annual sales to 450,000 units. The updated outlook reflects improved visibility into Nio’s strategy and market positioning.

“Our confidence stems from Nio’s expanding product lineup and the continued growth of its sub-brands, which are targeting diverse customer segments,” the research note stated.

Despite the optimistic outlook, Nio faces ongoing challenges, including securing market share in an increasingly competitive EV landscape. However, the company’s plans to switch to a next-generation platform and enhance its offerings signal a focus on long-term growth.