Contemporary Amperex Technology Co Ltd (CATL), the world’s largest battery manufacturer, is in discussions to establish battery recycling operations in Europe, Bloomberg reported. The Chinese power battery giant is exploring potential factory sites with several European governments, including Hungary, Jason Chen, CATL’s regional operations chief, stated in an interview.

This initiative aligns with CATL’s strategy to mitigate environmental concerns associated with battery production and disposal. In addition to leveraging its subsidiary, Guangdong Brunp Recycling Technology Co., the company is considering partnerships with European firms to bolster its recycling capabilities. The move underscores CATL’s commitment to sustainability as it navigates the growing environmental demands of the EV industry.

CATL’s footprint in Europe has already expanded with a €7.34 billion investment in a battery manufacturing plant in Debrecen, Hungary. Officially launched in 2022, this facility will be CATL’s second European plant, complementing its existing German site. Expected to commence production in late 2025, the Hungarian plant aims for an initial annual capacity of 40 GWh, eventually reaching 100 GWh—enough to power over 1 million EVs.

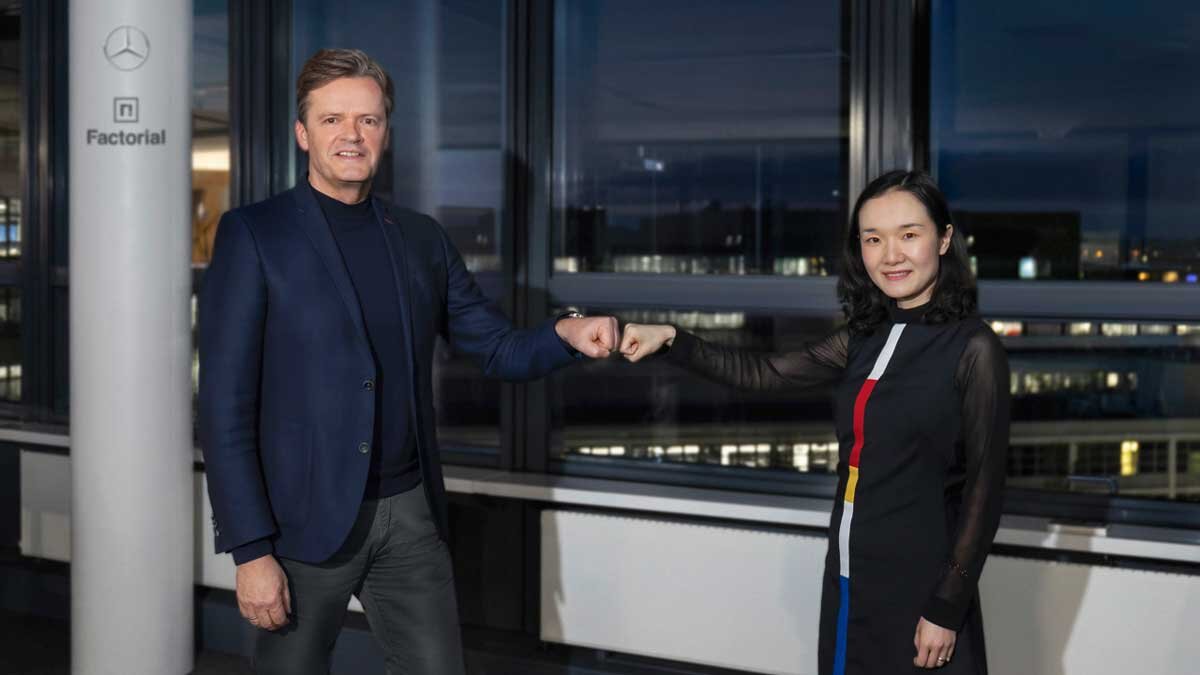

The environmental footprint of power batteries, which contain non-renewable metals and contribute significant carbon emissions during production, has spurred CATL’s recycling focus. Earlier this year, CATL and Volvo Cars signed a strategic memorandum to promote battery recycling. The partnership aims to dismantle, recycle, and repurpose used batteries, reducing lifecycle emissions for Volvo’s EVs. Over 90% of valuable metals like nickel, cobalt, and lithium will be extracted and reused in new batteries for Volvo vehicles, according to an April statement.

Separately, CATL has signaled interest in expanding into the U.S. market, contingent on favorable policy changes. Founder and chairman Robin Zeng recently mentioned a willingness to explore U.S. investments if trade barriers and tariffs, which were intensified during Donald Trump’s presidency, are eased. Zeng’s comments mark a rare indication of openness from a Chinese supplier to U.S. automakers, reflecting a broader ambition to navigate complex geopolitical and economic landscapes.