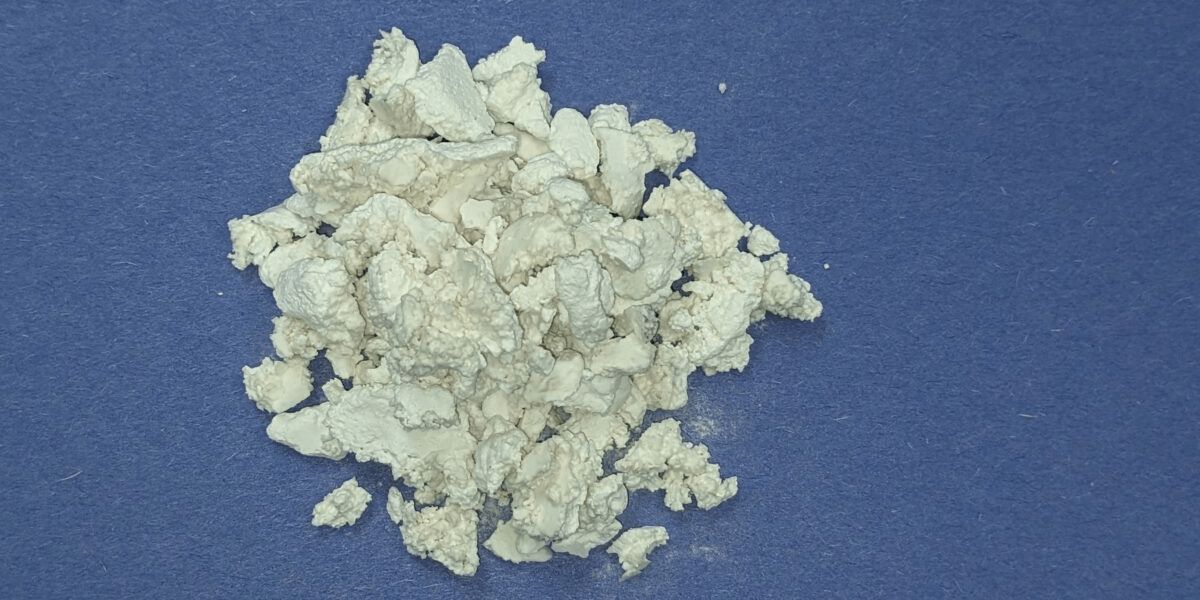

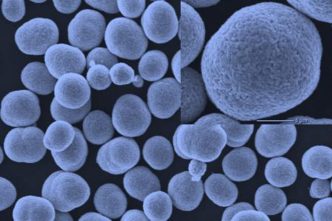

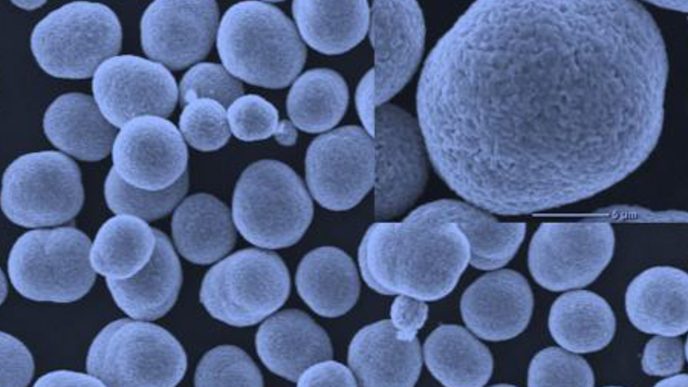

South Korean battery material manufacturer L&F is set to commence mass production of NCM (nickel-cobalt-manganese) cathode material with a nickel content of 95 percent in December, marking the highest nickel concentration achieved to date for this type of battery.

The new cathode material is intended for supply to both Korean battery cell manufacturers and U.S. electric vehicle producers starting next month.

L&F’s significant customers include Tesla and the three leading South Korean battery manufacturers: LG Energy Solution, SK On, and Samsung SDI.

While the specific recipients of battery cells utilizing the new cathode material remain unspecified, it has been confirmed that cathode materials with over 90% nickel content have already been supplied to General Motors through a partnership with LGES.

Currently, many electric vehicles utilize NMC811 batteries, which comprise nickel, manganese, and cobalt in a ratio of 8:1:1 in the cathode. The increase to 90% or even 95% nickel represents a substantial enhancement. Industry representatives have indicated that raising the nickel content by one percentage point can increase an electric vehicle’s range by approximately ten kilometers. Consequently, shifting from about 80% in an NMC811 battery to 95% could potentially extend the range by 150 kilometers.

However, nickel is one of the more expensive materials used in battery production, and higher nickel content can drive up costs. Despite this, high-nickel battery cells are particularly sought after in premium electric vehicles that demand longer ranges, allowing manufacturers to command higher prices.

L&F is strategically targeting this market segment, differentiating itself from Chinese cathode material manufacturers that are increasingly focusing on lithium iron phosphate (LFP) cathodes for the more cost-sensitive volume market.

In addition to L&F, competitor EcoPro BM is reportedly on the verge of mass-producing cathode materials with a nickel content of 94%. LG Chem, the parent company of LGES and a producer of cathode materials, focuses on batteries with nickel content ranging from 40 to 60%, which, while less energy-dense, are more affordable.

Analysts view L&F and EcoPro BM’s emphasis on high-nickel batteries as both an opportunity and a risk. If the adoption of electric vehicles slows down and advancements in autonomous driving face delays, L&F and EcoPro BM may encounter substantial challenges in their business strategies.

Nickel-containing cathode materials could prove particularly advantageous for autonomous electric vehicles, which are expected to require significant energy for their numerous sensors and computers. However, for reasons of cost and durability, some experts advocate for LFP batteries in applications such as robotaxis.

Source: kedglobal