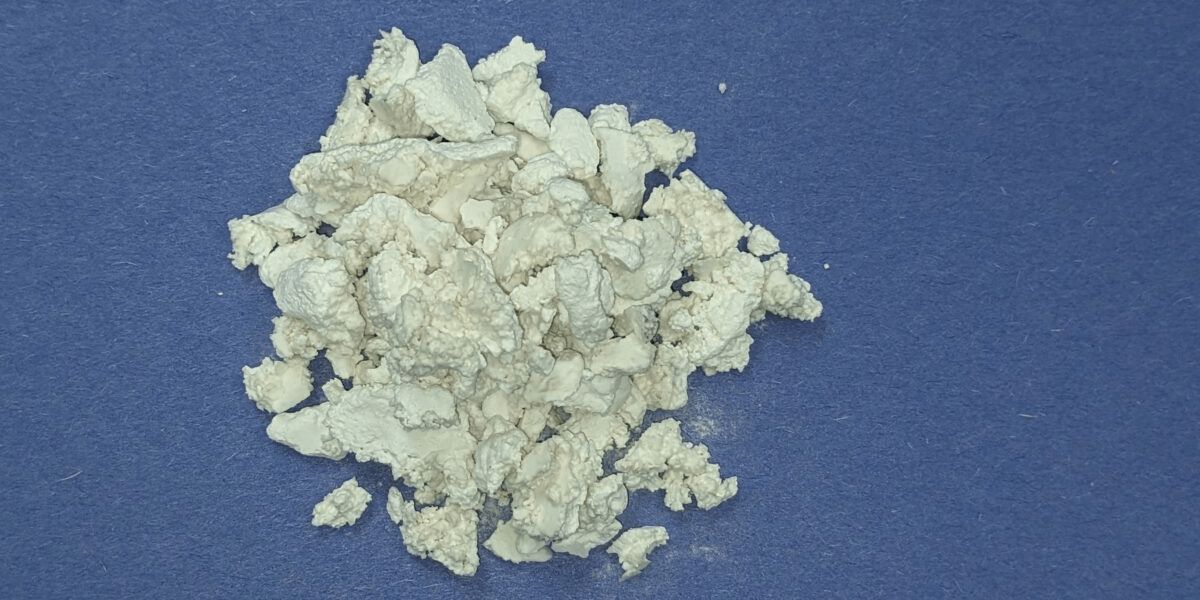

Ghana is set to open its inaugural lithium mine, as Barari DV Ghana Limited, a subsidiary of Atlantic Lithium, secures a 15-year mining lease agreement with special provisions for state revenue. The deal marks a policy shift in the country’s resource management, increasing both the state’s stake and royalty fees in the mining project.

Scheduled to commence operations in Q2 2025, the mine aims to reach a full production capacity of 365,000 tonnes of lithium per year by 2026. The Ghanaian government has renegotiated the royalty rate from a standard 5% to an elevated 10%, while the state’s “free carried interest” in the mining operation will also rise from 10% to 13%.

Additionally, the Minerals Income Investment Fund (MIIF) of Ghana will acquire an extra 6% stake in the mining operation and a 3.06% share in Atlantic Lithium, which is listed on the Australian and London Stock Exchanges. Barari DV Ghana will also be required to register on the Ghana Stock Exchange.

“The Lease we are signing today differs from our standard Mining Lease. It incorporates the agreed terms based on the Policy approved by Cabinet for the exploitation and management of green minerals,” said Samuel Jinapor, Ghana’s Minister for Lands and Natural Resources.

Beyond royalties and shareholding, Barari DV Ghana has committed to contributing 1% of its revenue to a Community Development Fund. This fund will focus on the welfare and development of communities affected by the mining operations. The company has also pledged to establish a chemical plant to process lithium. Should that fail to materialize, the mined lithium will be supplied to any third-party chemical plants established within Ghana.

The amended terms and special provisions aim to maximize Ghana’s gains from the mining operation and align with broader objectives to foster community development and elevate the country’s standing in the green minerals market.