The joint plan by automakers Volkswagen and Stellantis to acquire two Brazilian mines for battery raw materials, in collaboration with mining group Glencore, has reached an impasse. The deal has been terminated following unsuccessful attempts to revise the acquisition agreement, as reported by ACG, the financial company involved in the transaction.

Sources cited by Reuters indicate that during ACG’s proposed $300 million capital increase, a crucial part of the deal, minority investors lost interest. Although Stellantis and Glencore had committed as anchor investors, the deal faltered primarily due to pricing concerns. An insider noted, “The deal failed because of the price.”

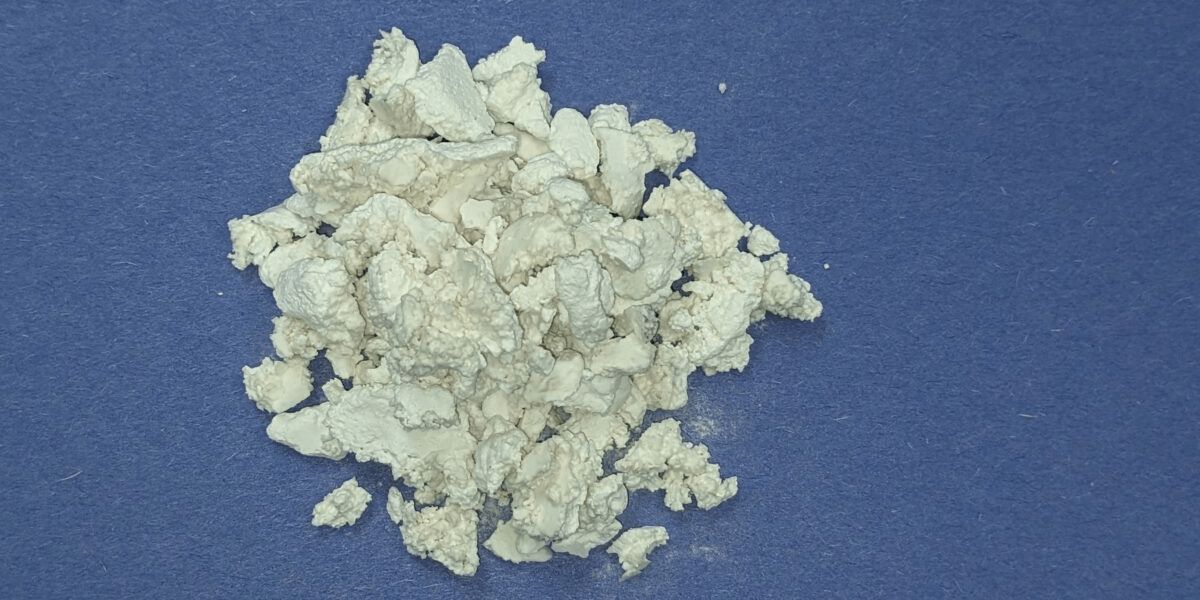

The price proposed by ACG was deemed unrealistic by potential buyers, especially considering the 37% decline in nickel prices since the start of the year. Efforts to renegotiate the terms of the deal following waning interest also proved unsuccessful.

The official announcement of the plan to purchase the mines was made in June of this year. However, the timing proved less than favorable, as ACG sought to acquire both mines from Appian Capital during a period of decreasing demand for nickel and copper materials essential for electric vehicle production and the energy transition.

Notably, this is not the first instance where a potential buyer withdrew from the mine acquisition. South African company Sibanye-Stillwater backed out last year due to a “geotechnical event,” leading to a subsequent $1.2 billion legal claim. A trial for this claim is expected to commence in 2024. It remains uncertain whether ACG will face similar legal repercussions in the aftermath of the failed deal.