As part of US President Joe Biden’s effort to shift half of the country’s new car sales to electric cars or plug-in hybrid electric vehicles (PHEVs) by 2030, the US Treasury Department has updated the list of eligible electric car models. The new rules, published a fortnight ago under the Inflation Reduction Act, require electric cars in the US to meet specific requirements to qualify for tax incentives of up to $7,500.

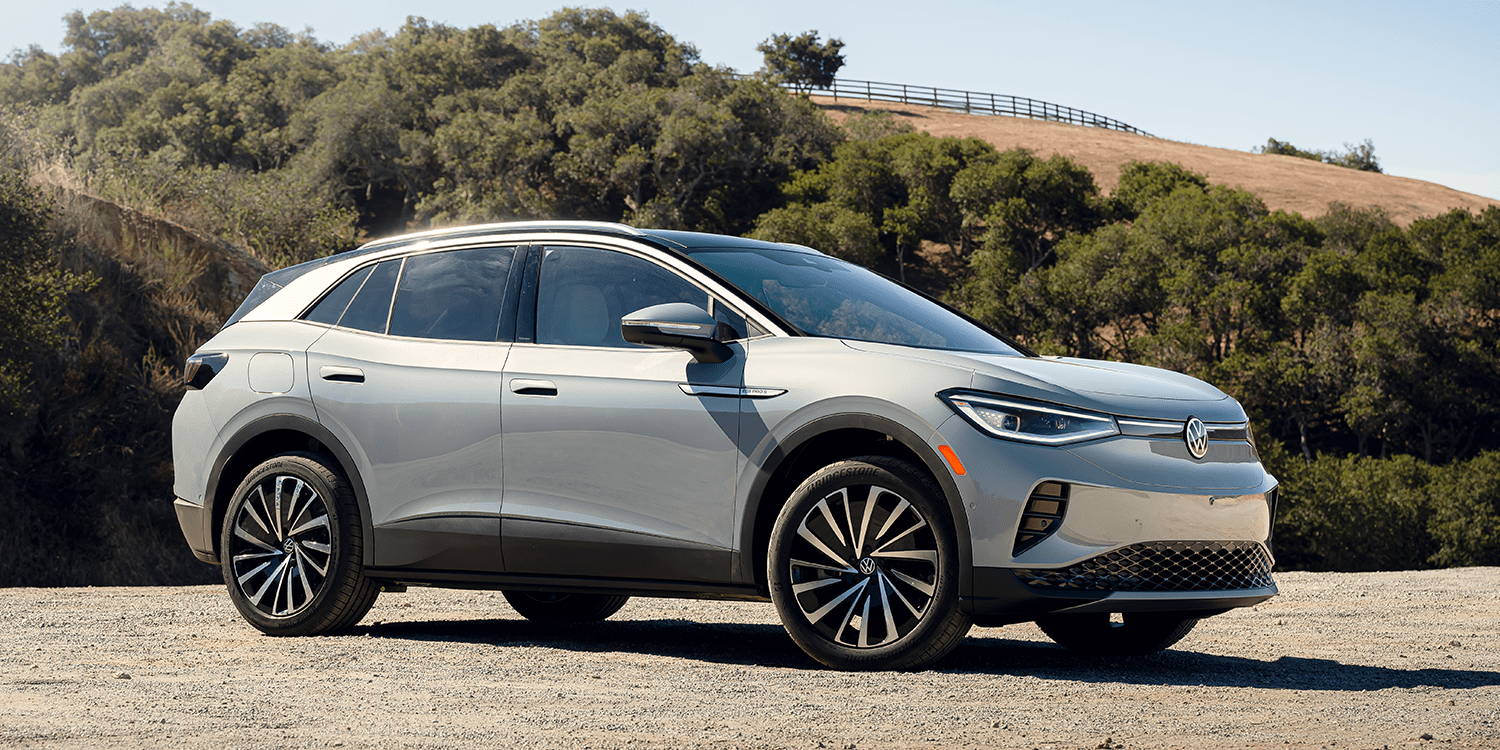

The updated rules apply to registrations on or after April 18, and electric and plug-in hybrid models from Volkswagen, BMW, Nissan, Rivian, Hyundai, and Volvo Cars will be excluded from the incentives immediately. As it stands, only BEV and PHEV models from Cadillac, Chevrolet, Chrysler, Ford, Jeep, Lincoln, and Tesla are eligible for the tax credits.

See also: Tesla Superchargers Must Meet CCS Standard to Qualify for Biden’s $7.5B Subsidy

The new regulations make battery material sourcing a crucial criterion for eligibility to make the United States less reliant on China for electric car supply chains. Currently, to qualify for half of the tax credit ($3,750), 40% of the battery’s critical minerals must be extracted, processed, or recovered in the US or in a country with which the US has a free trade agreement. This percentage will gradually increase to 80% by 2027, with a ten percentage point increase each year.

In the Notice of Proposed Rulemaking (NPRM) published two weeks ago, the US Treasury Department outlined the regulations for determining this percentage value, including a three-step process to identify supply chains, qualifying critical minerals, and calculating the content of these minerals. The NPRM also suggested which countries could be accepted as source countries, such as Australia, Canada, Mexico, Chile, or Bolivia.

For the other part of the tax credit, at least 50% of the vehicle’s battery components must be manufactured or assembled in North America by 2023, with the percentage rising gradually to 100% by 2029. Electric vehicles are only eligible for tax credits up to a sales price of $55,000 for passenger cars or $80,000 for SUVs, pickup trucks, and vans.

The news of the updated rules is welcomed by international automotive manufacturers. Hyundai Motor said that it remains committed to its long-term EV plans and will use key provisions of the Inflation Reduction Act to accelerate the transition to electrification. Volkswagen expressed optimism that the ID.4 SUV would qualify for the tax credit and is awaiting proper documentation from a supplier. Nissan Motor is working closely with its suppliers and hopes that the Leaf will qualify for at least a portion of the tax credit in the future.

While the reform of the US tax credit for electric cars went into effect at the turn of the year, the final regulations were expected to be published in 2022. However, it was announced before Christmas that the criteria around the origin of the battery would not be published until March. The updated rules will help the US achieve its goal of reducing emissions and increasing the use of electric vehicles.