The fate of Britishvolt, a pioneering battery startup and its ambitious plans to establish one of the UK’s two cell factories, is now shrouded in uncertainty. According to reports from administrators, the anticipated final payment from the buyer, Australia’s Recharge Industries, has not been made within the expected timeframe, raising questions about the completion of the deal.

Despite previous indications suggesting the completion of the acquisition, new information has cast doubts on the sale. Documents from EY, the accountancy firm overseeing the proceedings, reveal that Recharge Industries has fallen short of making the conclusive instalment of the total payment amounting to £8.57 million, which was originally due on 5 April 2023.

Recharge Industries, however, contests any claims of default. A spokesperson, in conversation with the BBC, explained that the timing of the final instalment hinges on the availability of a “funding facility”, which is intended to cover not only the remaining payment but also the expenses associated with land acquisition. This facility is also expected to infuse additional capital into the project. The spokesperson added that the deal is anticipated to be finalised in the month of August.

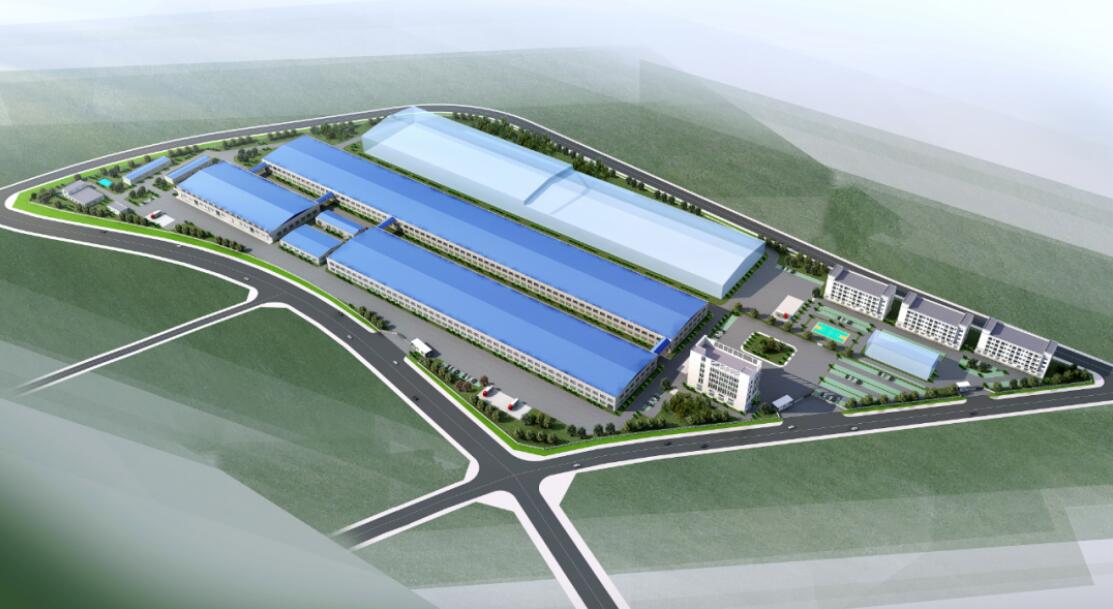

Britishvolt had initially formulated plans to construct a substantial £4 billion car battery factory in the north-eastern region of England. Unfortunately, the company faced financial difficulties and entered administration in January after exhausting its funds.

The venture had been highly promising, representing a potential lifeline for the UK’s industrial sector, which has been grappling with the imperative need for robust supply chain connections. Presently, the Chinese enterprise Envision AESC is the sole contender with plans to establish cell manufacturing capacity within Britain. Their strategy involves the establishment of a significant battery factory adjacent to the Nissan plant in Sunderland, geared towards supplying batteries to automakers including Nissan and JLR. JLR’s parent entity, the Indian conglomerate Tata Group, recently disclosed its contemplation of a European battery factory, a strategic move especially relevant due to JLR’s substantial presence in England.

Conversely, regarding Britishvolt and its agreement with Recharge Industries, uncertainties prevail even beyond the pending final instalment. The BBC’s report also highlights that the Australian offices of Scale Facilitation, a US investor group and the owner of Recharge Industries, were subjected to a raid in June on allegations of tax fraud. Sources connected to David Collard, the owner, asserted that this action resulted from a misunderstanding involving tax returns between the US and Australia, and that all parties cooperated fully.

Despite this, the raid has generated further apprehension regarding the eventual payment for the Northumberland site. The deadline for this payment had been considerably extended beyond the initial cutoff of 31 March.

According to the report furnished by EY to creditors and examined by the BBC, “The sale to the buyer had not completed as the final amount of deferred consideration was due to be paid on 5 April 2023.” The report further elucidated, “As noted in the proposals, the buyer purchased the company’s business and assets for £8.57m. This amount was payable in several instalments. The final instalment remains unpaid and overdue. As a result, the buyer is in default of the business sale agreement.”

In an additional parallel, similar to Britishvolt, Recharge Industries too is a fledgling startup with limited experience in battery manufacturing. Their preliminary blueprint for the British site revolves around the initial production of energy storage technology, rather than electric vehicle batteries.