In a surprising turn of events, Tesla has announced that all new Tesla Model 3 vehicles will now be eligible for the full $7,500 federal electric vehicle (EV) tax credit. This information was revealed through a recent update on Tesla’s website, signaling a significant change in the company’s tax credit policy.

The EV tax credits were initially introduced by Congress in August of last year as part of the Inflation Reduction Act. The aim of these credits was to reduce the United States’ reliance on China for batteries. The $7,500 tax credit is divided into two parts. The first half, amounting to $3,750, can be claimed if at least 50% of the value of battery components were produced or assembled in North America. The second half of the credit requires that 40% of the value of critical materials used in the vehicle be sourced from the U.S. or another free trade agreement country.

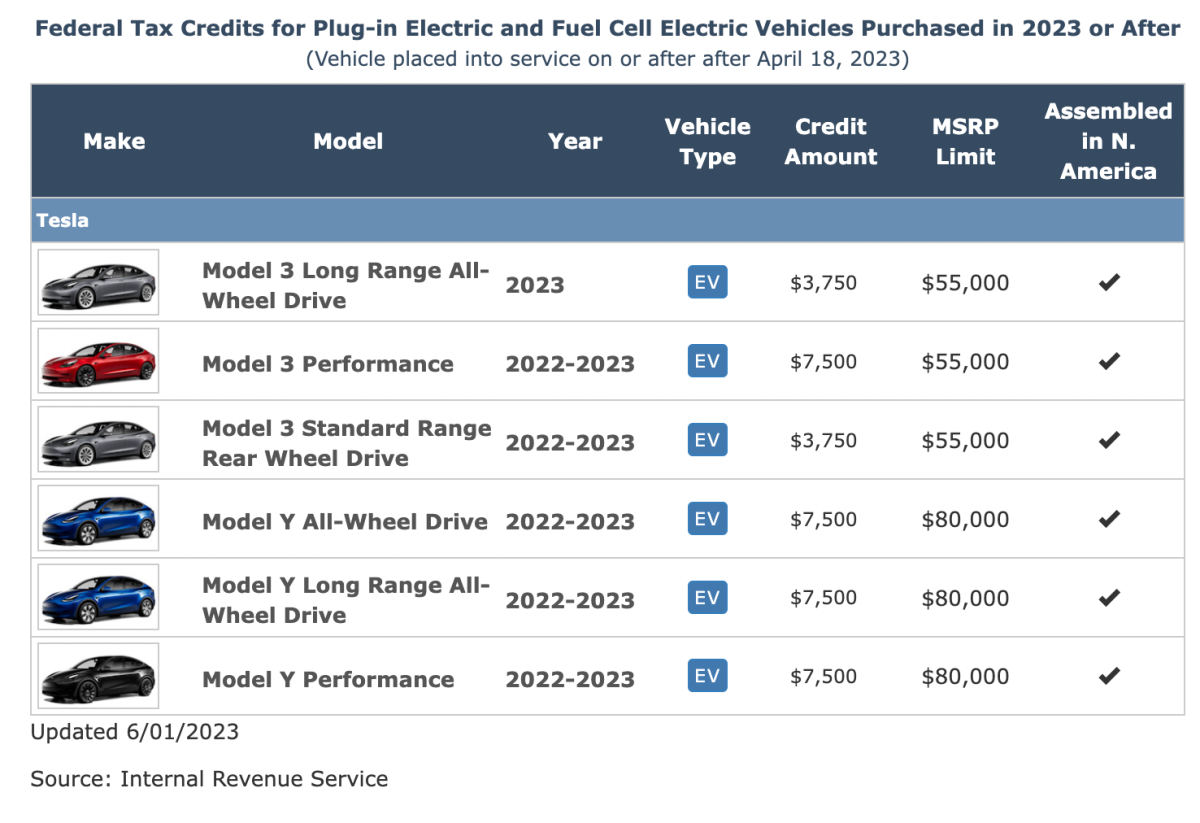

When the tax credits came into effect on January 1, the Treasury Department refrained from publishing guidance on battery sourcing in order to give electric vehicle manufacturers time to meet the requirements. However, on April 18, the department began enforcing the critical material sourcing requirement, resulting in several vehicle models losing their eligibility for the full tax credits they had initially qualified for in the first quarter of the year.

Tesla’s Model 3, among others, experienced a reduction in the tax credit by 50%. Other automakers such as BMW, Rivian, Volvo, and Hyundai lost their tax credits entirely.

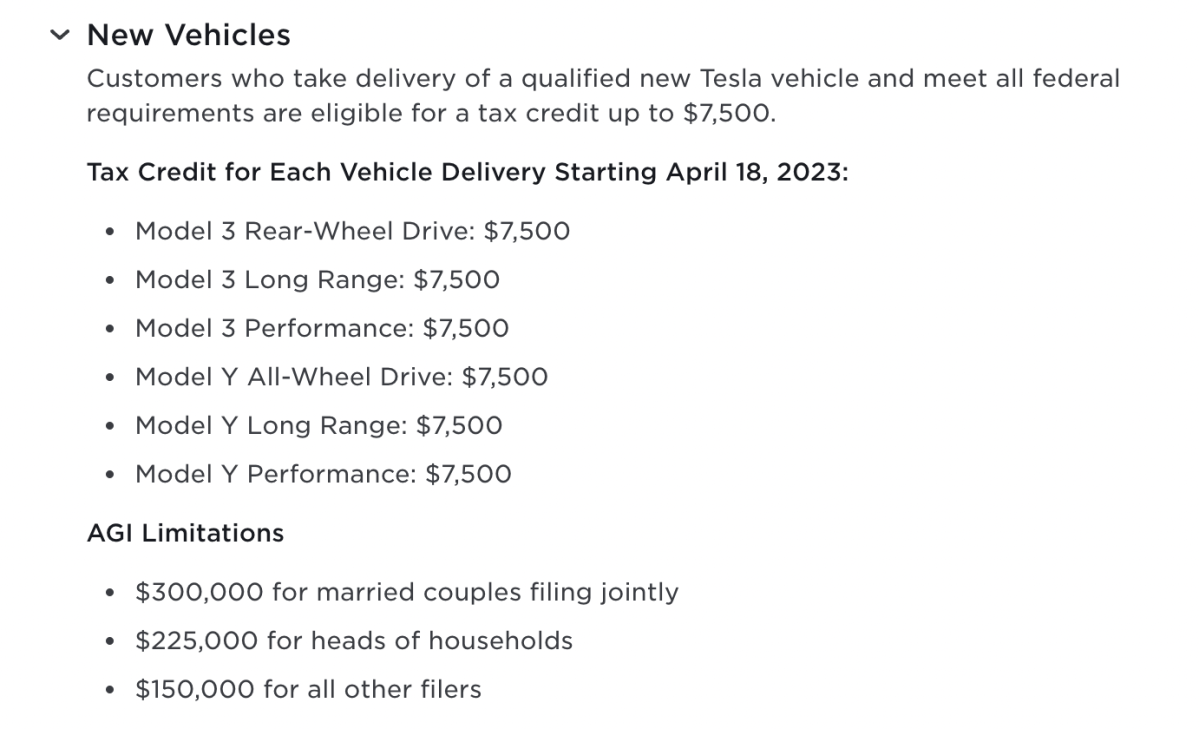

Now, Tesla has made a surprising update on its website, indicating that all Tesla vehicles, including the Model 3, will be eligible for the full $7,500 tax credit. Previously, only the Model 3 Performance variant qualified for the full credit. However, both the Model 3 long-range all-wheel drive and rear-wheel drive versions will now be eligible as well. With the tax credit, the starting price of

the Model 3 rear-wheel drive will be $32,740.

Tesla has not provided specific details on what prompted this change, but CEO Elon Musk retweeted a screenshot of the website displaying the tax credits available for each vehicle. It is worth noting that the Treasury Department’s official website has yet to be updated to reflect Tesla’s newfound eligibility for the tax credits, adding an element of uncertainty to the situation.

This development is expected to have a significant impact on Tesla’s sales and the electric vehicle market as a whole. With the full tax credit now applicable to a wider range of Tesla Model 3 vehicles, it is anticipated that more consumers will be incentivized to make the switch to electric vehicles, further driving the transition towards sustainable transportation.