Svolt Energy, the battery manufacturer spun off from Great Wall Motor (HKG: 2333), has halted its construction of two battery factories in Germany, with no set timeline for resuming operations, according to a report by local media outlet Caixin citing multiple sources familiar with the situation.

The company had aimed to establish a battery module and pack plant in Saarland and a cell plant in Brandenburg. The pack facility was announced in November 2020, with plans for completion by mid-2024 and a design capacity of 24 GWh, supported by a total investment of €2 billion. The cell plant, which was expected to become operational in 2025, was announced in September 2022, featuring an annual capacity of 16 GWh. However, construction was suspended earlier this year.

Current reports indicate that both projects are at a standstill, attributed to Svolt’s operational challenges within its domestic market in China. One insider noted, “Svolt simply cannot afford to manage overseas factories at this time.”

The construction of the two European plants was projected to require an investment of approximately RMB 30 billion, which is deemed excessive for a company of Svolt’s size. Another source indicated that the suspension was influenced by Svolt’s financial situation rather than technical or policy-related issues, emphasizing the need for the company to first address its financial challenges.

Since becoming independent from Great Wall Motor in February 2018, Svolt has concentrated on battery materials, cells, modules, packs, battery management systems (BMS), and energy storage technology. The company ranks as one of the largest battery producers in China, with 1.29 GWh of batteries loaded in September and a 2.36 percent market share in the domestic power battery sector, according to the China Automotive Battery Innovation Alliance (CABIA). Industry leaders Contemporary Amperex Technology Co Ltd (CATL, SHE: 300750) and BYD (HKG: 1211, OTCMKTS: BYDDY) hold significant shares of 44.02 percent and 24.20 percent, respectively.

Exports currently constitute around 20 percent of Svolt’s total capacity, mainly driven by orders from Great Wall Motor. However, considering that some of these batteries are produced in China before being exported, Svolt’s actual export capacity may be less than 20 percent.

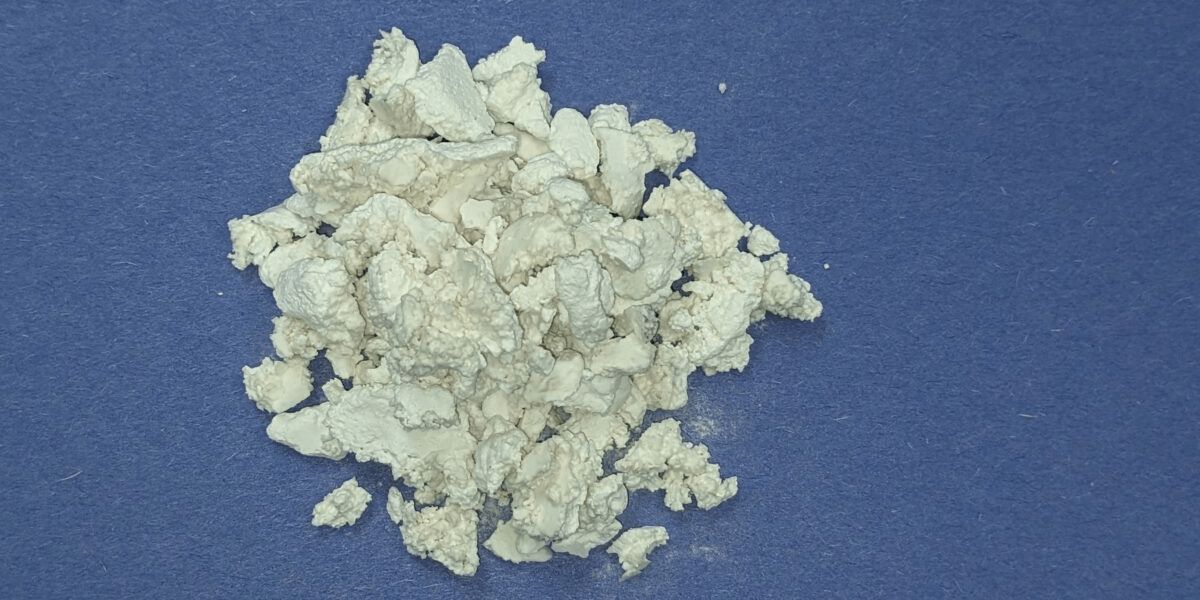

The battery market has faced declining prices over the past two years due to a slowdown in the new energy vehicle (NEV) sector and a decrease in raw material costs, such as lithium carbonate. Smaller manufacturers initially leveraged low prices to attract customers, but major players like CATL have become less aggressive amid intensifying competition.

In February, Svolt’s chairman and CEO Yang Hongxin announced on Weibo that the company had begun significant internal changes in response to overcapacity and pricing pressures in the industry, which included the reduction of poorly performing staff.

Meanwhile, Great Wall Motor is also reducing its footprint in Europe, having closed its Munich headquarters in late August and laying off approximately 100 employees, as reported by German media outlet Manager Magazin. Caixin’s report indicated that in June, Great Wall Motor adjusted its European strategy by shutting its German office and reclaiming control over its European dealerships and customer relationships.