Toyota Motor, Japan’s largest automaker, is facing challenges in China’s rapidly expanding electric vehicle (EV) market. According to a recent report from Reuters, the company’s joint venture with China’s Guangzhou Automobile Group (GAC) has been forced to lay off workers and provide them with compensation.

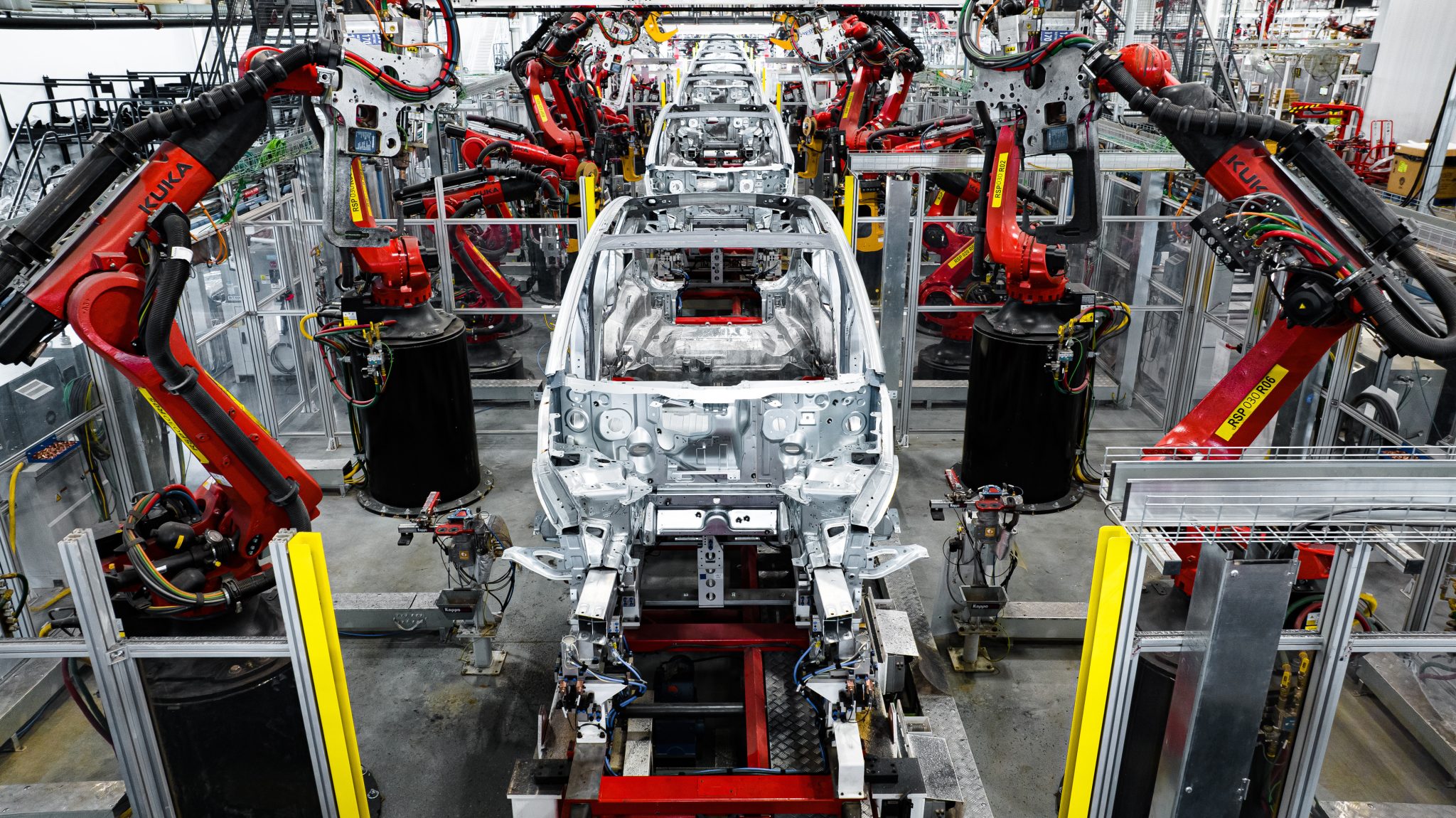

The move comes as Toyota struggles to keep up with the intense competition in China’s auto market, which is undergoing a significant shift towards EVs. The joint venture’s factory, which employs approximately 19,000 workers, produces various models, including Toyota’s first EV, the bZ4X, as well as the Camry and Levin models.

Unfortunately, Toyota’s entry into the Chinese EV market has been met with challenges. Despite launching the bZ4X in October 2022 with an initial price of 199,800 yuan (about $19,000), the company failed to gain traction as other market leaders, such as BYD and Tesla, reduced their prices. As a result, Toyota’s bZ4X accounted for only 0.26% of China’s EV market, with 3,844 units sold through January.

In an attempt to boost sales and remain competitive, Toyota decided to slash prices by 15% in February, reducing the starting price to approximately 169,800 yuan ($24,800). However, this strategy did not yield the desired results, as EV sales declined by 9% in the first half of the year.

Toyota’s struggles in China’s EV market have also been exacerbated by quality issues. The company is currently recalling over 12,000 bZ3 electric sedans, which are powered by BYD, due to defective rear door handles.

Koji Sato, who took over as CEO in April, acknowledged the urgency of the situation and the need for swift action to meet customer expectations in China’s EV market.

Toyota is not the only Japanese automaker facing difficulties in China’s EV landscape. The market share of Japanese automakers in the region has dropped from 20% in the previous year to 14.9% in the first half of 2023, according to the China Association of Automobile Manufacturers.

Chinese brands, on the other hand, have seen significant growth in the EV market, accounting for 53% of sales in the first half of the year. Domestic EV makers like BYD, NIO, Li Auto, and XPeng have been successful in gaining market share with their unique models in various segments.

In response to the challenging market conditions, Mitsubishi Motors recently announced the indefinite suspension of its operations in China. The company’s sales had declined significantly, with only 34.5K vehicles sold in 2022, compared to over 134K in 2019, largely due to the rising popularity of EVs in the country.

Overall, Japanese automakers are struggling to compete with domestic rivals in China’s booming EV market, and they are facing the consequences of not having enough electric vehicle models to meet consumer demand. As EV adoption continues to rise, the pressure on Japanese automakers to adapt and innovate in this competitive landscape remains high.