Human Horizons, the Chinese premium electric vehicle (EV) manufacturer, renowned for its HiPhi brand, is reportedly in negotiations with Saudi Arabia’s sovereign wealth fund, the Public Investment Fund (PIF), for a potential investment of at least $250 million. This strategic move aligns with Saudi Arabia’s ambitions to strengthen its domestic auto industry by supporting local carmakers.

Citing individuals familiar with the matter, a report by Bloomberg on November 7 revealed that discussions are underway, with the PIF considering a stake in the Shanghai-based company valuing it at approximately $3 billion. An agreement could materialize as early as this year.

Human Horizons is contemplating a fundraising initiative that could reach up to $1 billion from private investors to drive its growth and expansion, as per the report.

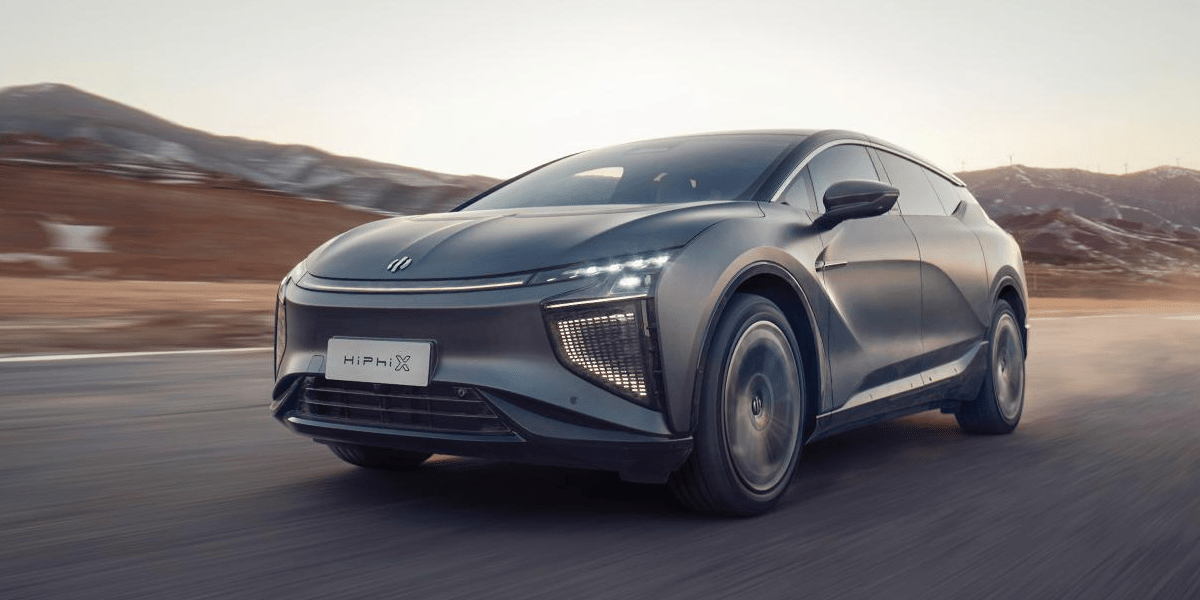

The electric vehicle manufacturer introduced the HiPhi X, its inaugural model under the HiPhi brand, in October 2020, with deliveries commencing in May 2021 in China. The HiPhi X is offered at an entry price of RMB 570,000 ($78,330) for the six-seat version, with the four-seat variant reaching up to RMB 800,000.

In August 2022, Human Horizons released its second model, the HiPhi Z, initially priced from RMB 610,000. More recently, a new version of the HiPhi Z was unveiled with a price reduction of RMB 100,000. In July, the HiPhi Y, positioned as the brand’s more affordable model, was launched, featuring a starting price of RMB 339,000.

In a notable development, the Saudi Arabian Ministry of Investment inked a substantial agreement with Human Horizons in June, valued at $5.6 billion. This collaborative deal encompasses the development, production, and sales of automobiles, comprising more than half of the $10 billion in investment agreements signed during the first day of the Arab-China business conference in Riyadh.

Saudi Arabia’s pursuit of increased investments in the non-oil sector forms a crucial part of its diversification strategy, with a particular focus on bolstering domestic electric vehicle manufacturing.

The rapidly growing Chinese EV sector has attracted substantial interest from international investors, with prominent automakers like Volkswagen entering agreements with Chinese EV manufacturers. On July 26, Volkswagen announced a $700 million investment in Xpeng, securing a 4.99 percent equity stake. The collaboration will involve co-developing two B-segment all-electric vehicles under the Volkswagen brand for the Chinese market, built on the Xpeng G9 platform.

Likewise, Stellantis unveiled its investment of 1.5 billion euros ($1.58 billion) in Leapmotor on October 26, acquiring a roughly 20 percent stake. This investment is expected to lead to the formation of a joint venture named Leapmotor International, with the aim of enhancing the global sales of Leapmotor’s products by leveraging Stellantis’ global resources.