Polestar, the Swedish electric vehicle (EV) manufacturer, has announced its expectation to meet the lower end of its 2023 delivery target. Despite the adjusted expectations, the company remains optimistic about the surge in demand with the upcoming launch of new EV models. In a significant move, Polestar’s first electric SUV coupe, the Polestar 4, is set to begin production next week.

During the third quarter, Polestar reported the delivery of 13,976 vehicles, marking a 51% year-over-year increase. However, this number is slightly down from the 15,800 vehicles delivered in the second quarter.

This year-over-year growth coincides with the rollout of the Polestar 2, which includes the recently launched upgraded 2024 model. The company expects that the higher-priced model will help bolster deliveries as the year draws to a close.

In the third quarter, higher deliveries pushed the company’s revenue to $367.7 million, reflecting a 25% increase. However, increased costs caused gross profits to decline by 63%, settling at $36.3 million.

The higher expenses incurred during the quarter resulted in an operating loss of $261 million, marking a 33% increase compared to the previous year. Meanwhile, gross profits fell from 4.1% to 3.6% year-over-year.

Polestar anticipates achieving the lower end of its 2023 delivery target, which is estimated to be around 60,000 vehicles. Notably, the EV manufacturer had already revised its target downward in May, reducing it from 80,000 to a range of 60,000 to 70,000.

Due to these adjusted delivery expectations, Polestar expects its gross margins for the year to be approximately 2%, down from the previous 4%. To mitigate these challenges, the company is implementing cost-cutting measures aimed at improving efficiency. As of the end of September, Polestar had $951.1 million in cash reserves. Additionally, the company has secured an additional $450 million in loans from its top two investors, Volvo and Geely.

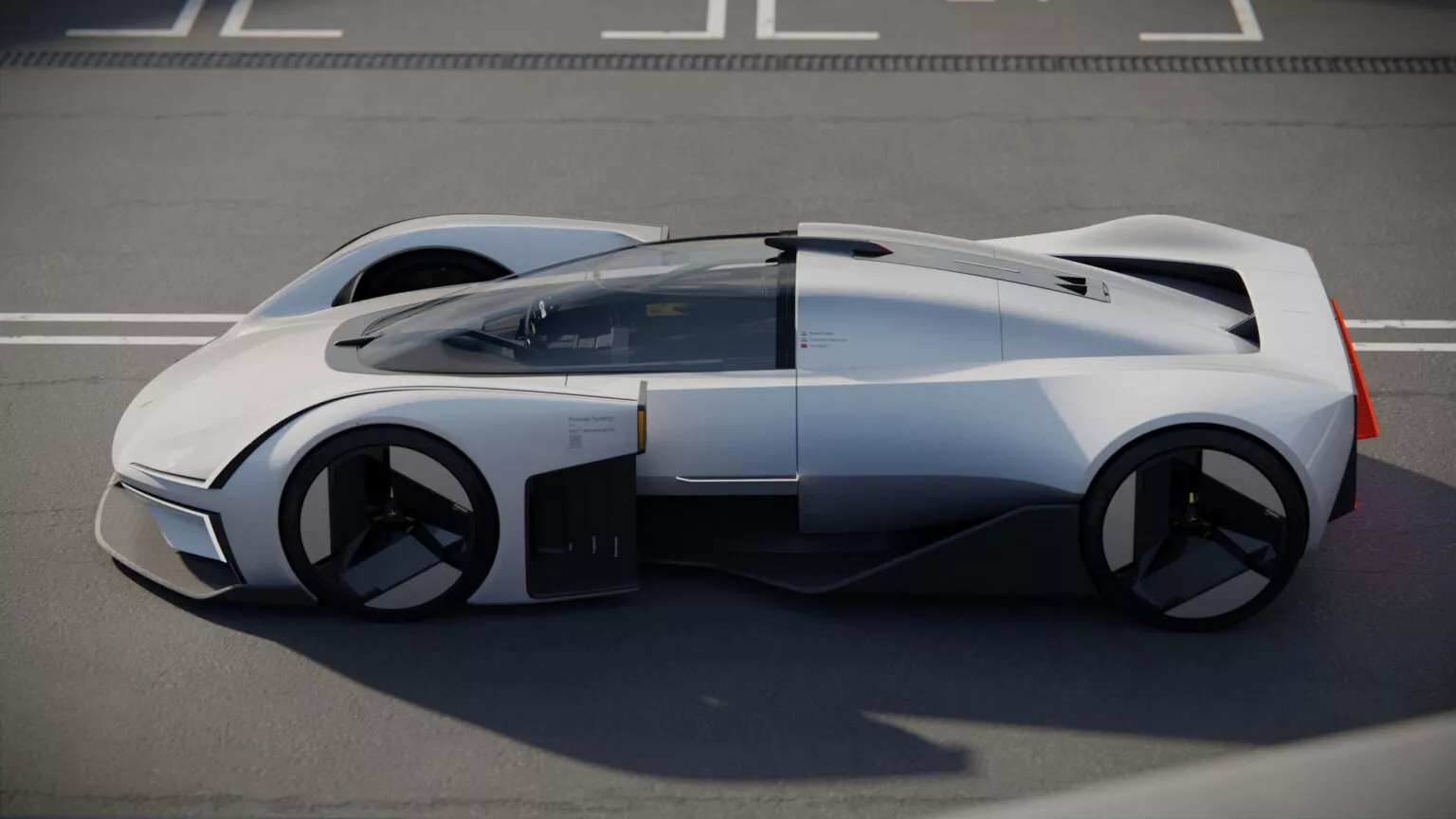

Despite the near-term challenges, Polestar remains hopeful that the launch of new electric models will drive up demand. The company’s first electric SUV coupe, the Polestar 4, is scheduled to begin production next week, with customer deliveries set to commence next month.

Furthermore, the Polestar 3 electric SUV is “on track” to enter production in China early in 2024 and over the summer in the United States. The company reported that its electric SUV recently completed hot weather testing in the UAE.

Polestar’s CEO, Thomas Ingenlath, believes the Polestar 3 is well-suited for the U.S. market. The launch edition of the electric SUV will have a starting price of $83,900 in the U.S. and offer up to 300 miles of range. Powered by the same platform as the new Volvo EX90, the Polestar 3 will be available in two trims: a long-range dual motor version and a performance pack version, both equipped with a 400V battery boasting an 111 kWh capacity.

Polestar is committed to expanding the brand, with a focus on increasing volume and profitability. With plans for four models, including the Polestar 5, the EV manufacturer aims to deliver between 155,000 and 165,000 vehicles.

By the middle of the decade, Polestar envisions achieving gross profit margins in the high teens. The company believes that an enhanced vehicle lineup and additional measures will contribute to improved profitability.

During its earnings call, Polestar also hinted at the possibility of a new plant, though it did not specify its location, indicating further developments in the company’s future.