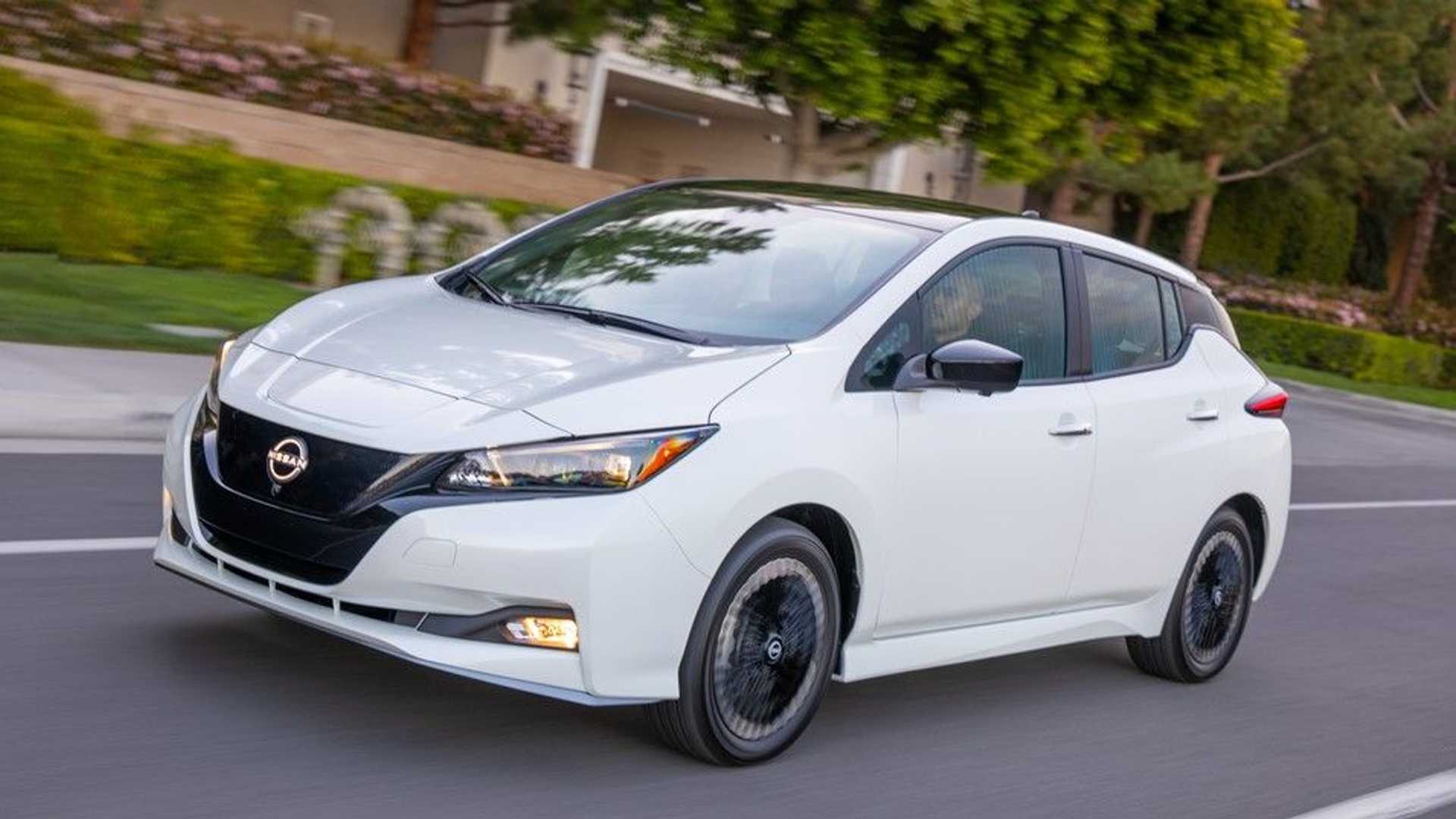

Nissan and the IRS announced today that the Leaf has once again become eligible for the federal tax credit for electric vehicles, now offering a $3,750 tax credit. This tax credit brings the starting price of the Leaf down to just $24,400, positioning it as one of the most affordable EVs in the US market.

Nissan, like many other automakers, has faced challenges in meeting the battery component requirements necessary to qualify for the up to $7,500 tax credit for electric vehicles in the US. The Leaf, which is manufactured in Tennessee, has previously gained and lost eligibility for the tax credit twice since the tax credit reform was implemented last year.

See also: Nissan Stops Production of Current Leaf at Sunderland Plant, Readies for New Models

Following the more stringent battery component sourcing requirements that took effect in January 2024, the Leaf lost access to the tax credit. However, Nissan has now announced that the 2024 Nissan Leaf vehicles manufactured in 2024 and sold on or after March 6 will be eligible for the $3,750 federal EV tax credit, provided customers meet all purchase and income qualifications outlined in the Internal Revenue Code Section 30D.

In a press release, Nissan stated that the Leaf now meets the “battery component” requirements, allowing it to qualify for half of the full $7,500 tax credit. This means that the Leaf does not meet the critical minerals requirement.

See also: Nissan’s Leaf Recognized Among Top Transport Innovations in Recent Survey

With a starting MSRP of $28,140 in the US, the Leaf’s price can be further reduced to $24,400 for eligible buyers who qualify for the tax credit based on their income. Starting in 2024, the tax credit can also be applied directly at the time of purchase, reducing the cost immediately.

When combined with state and local incentives available in some regions, the price of the Leaf can drop to approximately $20,000, offering an exceptional value for a brand-new electric vehicle.