The global electric vehicle (EV) industry has been growing rapidly in recent years, with China leading the way as the largest market for EVs. However, according to Li Xiang, founder, chairman, and CEO of Li Auto, the demand for lithium carbonate, a key raw material for EV batteries, is far less than expected. As a result, the price of lithium carbonate has been falling, dropping more than 30 percent from its high last November.

The weak demand for lithium carbonate is mainly due to the underperformance of the Chinese auto market in the first two months of this year. Total insurance registrations for passenger cars in China were down more than 25 percent from the same period last year, with new energy passenger cars contributing more than 30 percent of sales. Although the combined January and February sales of new energy passenger cars in China are expected to be up 17.06 percent from the same period last year, the growth rate has slowed down significantly compared to last year’s 145.08 percent year-on-year growth.

See also: Lithium Prices Expected to Continue Decline in 2023, Impacting China’s EV Industry

Despite the decline in lithium carbonate prices, Li Auto’s CEO has stated that the company’s models will not be reduced in price. This may be due to the fact that Li Auto, as a leading Chinese EV manufacturer, has already secured its supply chain for raw materials.

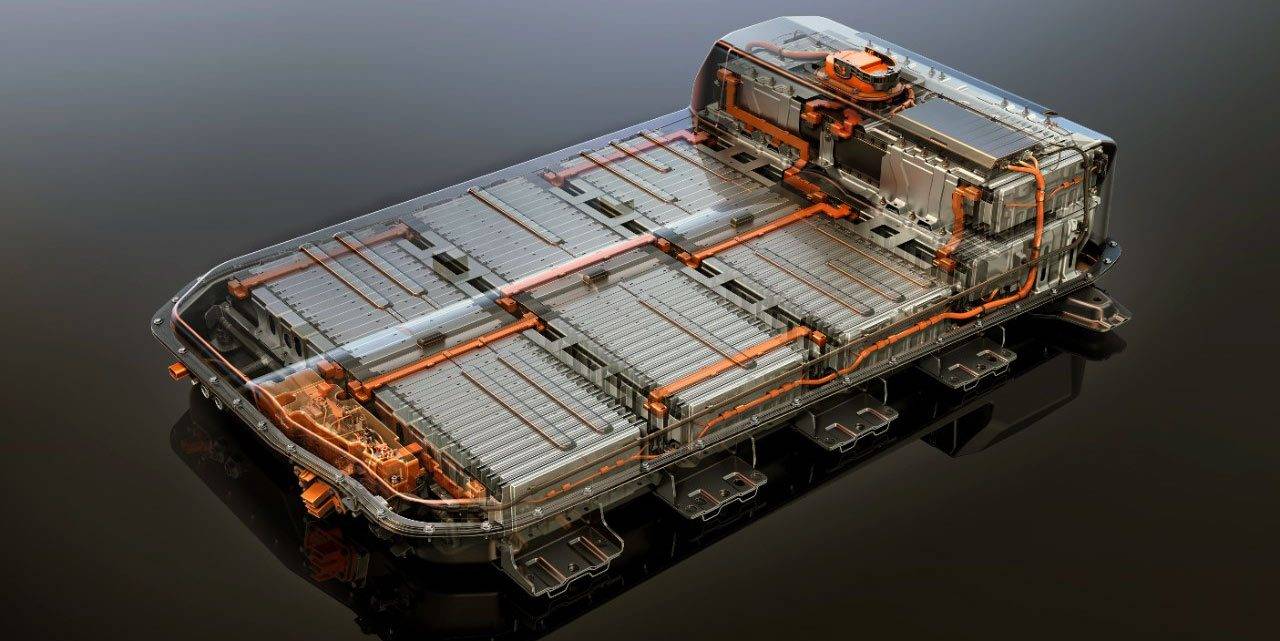

The decline in lithium carbonate prices is good news for EV manufacturers, especially for those who have been struggling with high battery costs. Chinese EV battery giant CATL has reportedly been pursuing a program to several strategic customers, including Li Auto and NIO, to settle a portion of its power battery supply at a fixed price of RMB 200,000 per ton of lithium carbonate for the next three years.

The declining prices of lithium carbonate could also have a significant impact on the global lithium industry. Yichun, a city in China, is known as the “lithium capital of Asia” and is a major lithium-producing region. However, lithium miners in Yichun are shutting down production to rectify, which could affect 13 percent of the global lithium supply if the shutdown lasts for a month.

See also: CATL Offers Discounts on Battery Costs to Select EV Makers

The decline in lithium carbonate prices is a sign that the EV industry is maturing and becoming more sustainable. Lower prices mean that EVs will become more affordable and accessible to the mass market, which could drive further growth in the industry.

In conclusion, the decline in lithium carbonate prices is a significant development in the global EV industry. While it may be a cause for concern for lithium producers, it is good news for EV manufacturers and consumers. As the industry matures, we can expect to see more sustainable growth and greater accessibility to EVs for the mass market.