The global shift towards renewable energy sources and decarbonization has led to an increasing demand for low-carbon hydrogen. As a versatile fuel that can be used across a wide range of industries, hydrogen is seen as indispensable in achieving the goals of the energy transition. According to data from GlobalData, green hydrogen production capacity reached over 109 kilotons per annum (ktpa) worldwide in 2022, representing a 44% growth compared to 2021.

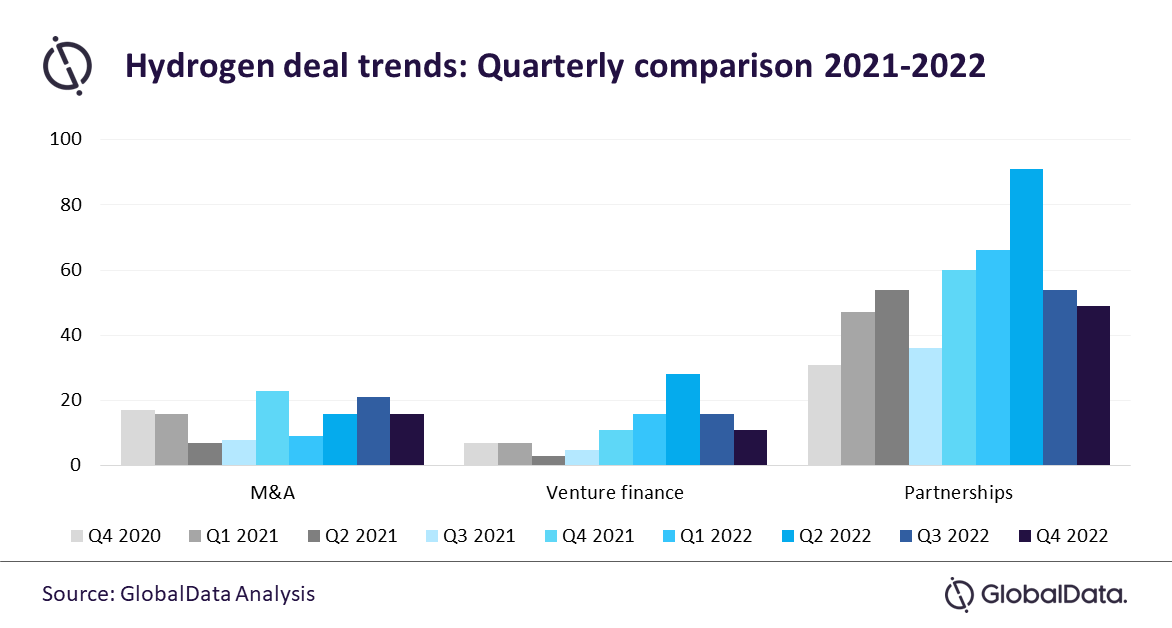

In addition, there was a significant increase in deals related to hydrogen in 2022, with over 393 deals closed compared to 277 in the previous year. This shows a clear upward trend in the development of the low-carbon hydrogen market, which could be decisive in achieving over 111 million tons per annum (mtpa) capacity worldwide by 2030.

See also: Qualcomm announced deals to supply chips to automakers Volvo Group, Honda and Renault

“During 2022, over 393 deals related to hydrogen were closed, representing a significant increase compared to 277 deals registered in 2021. This shows an upward trend in the low-carbon hydrogen market development, which could be decisive in achieving over 111 million tons per annum (mtpa) capacity worldwide by 2030. However, the partnerships represented 66% of the deals last year, and the number of deals decreased after Q2 2022 to numbers even below those seen in the same quarter in 2021. This could have been due to the companies trying to strengthen their core business and diversify the investment risk given the global economic situation.” said Andres Angulo, Energy Analyst at GlobalData

However, while partnerships accounted for the majority of deals in 2022, the number of deals decreased after Q2 2022. This could be attributed to companies trying to strengthen their core business and diversify their investment risk given the global economic situation.

Investing and raising capital were crucial to developing the hydrogen economy in 2022, with mergers and acquisitions (M&A) deals reaching $24.4 billion in monetary value, representing a 288% increase compared to 2021 levels. Venture finance deal values also grew significantly from $595.23 million to over $3,001.1 million.

See also: Nikola secures hydrogen supply from KeyState for Tree FCEV trucks

Companies such as Green Hydrogen International (GHI), Suez Canal Economic Zone, New and Renewable Energy Authority, Sovereign Fund of Egypt, and Egyptian Electricity Transmission Co are the global leaders in low-carbon hydrogen, with 56.3 mtpa active and upcoming capacity combined.

As part of developing low-carbon hydrogen, electrolysis is a key technology, and an electrolysis capacity of over 1,065 GW is now in the pipeline. This is being produced by manufacturing companies such as Hydrogenics, Nel ASA, ThyssenKrupp, ITM Power, HydrogenPro, Enapter, and Plug Power.

Engineering, procurement & construction (EPC) leaders for green projects include companies such as Globeleq Africa, Linde, John Wood Group, ThyssenKrupp, H2-Industries, Alcazar energy, and Samsung Engineering.

Despite the challenging global economic conditions, the number of investments in low-carbon hydrogen increased from 600 to over 1,700 between Q4 2021 and Q4 2022. As of January 2023, over 90% of pipeline hydrogen projects are green, reflecting the increasing manufacturers’ electrolysis capacity and the number of EPC contractors participating in bigger green projects. This, in addition to the renewable energy development, will create a momentum that will accelerate the cost reduction across the entire hydrogen value chain.