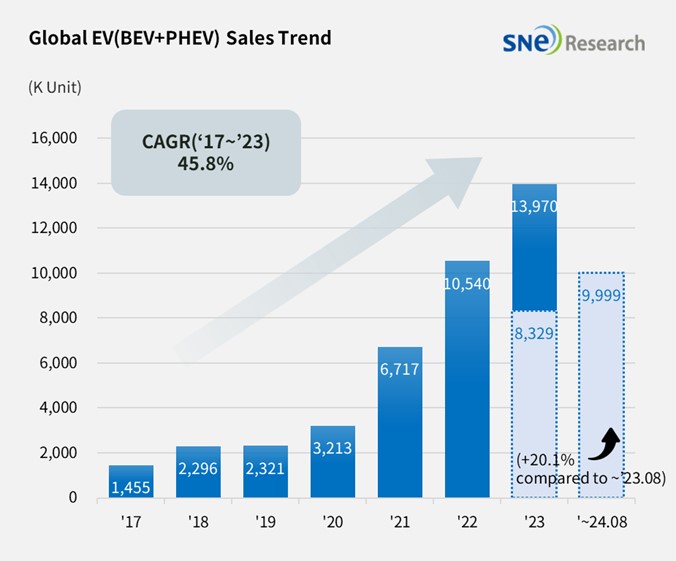

As of August this year, the number of electric vehicles (EVs) registered worldwide has increased by approximately 20% compared to the same period last year, nearing the 10 million mark. Analysts indicate that while demand for EVs is slowing in regions such as Europe and the United States, China’s remarkable growth rate is significantly driving global expansion.

According to a report by energy market research firm SNE Research on October 8, the cumulative number of EV registrations in China reached 6.258 million units by August, marking a 31.5% increase from the previous year when registrations stood at 4.76 million. Notably, China accounted for 62.6% of the global EV market share this year.

Chinese automaker BYD has emerged as the leader in global EV sales, with 2.205 million units sold, reflecting a growth rate of 27.9%. Excluding plug-in hybrids (PHEVs), sales of pure electric vehicles (BEVs) approached 980,000 units, nearing Tesla’s sales of 1.104 million units, which consists entirely of BEVs.

Tesla, the second-largest player in global EV sales, experienced a year-on-year decline of 5.8%, attributed to decreased sales of its Model 3 and Model Y vehicles. In Europe, Tesla’s sales fell by 16.2%, while in North America, they dropped by 8.4%.

In third place is China’s Geely Group, whose premium brand Zeekr is gaining traction and expanding its market share beyond China, particularly with Volvo and Polestar.

Hyundai Motor Group sold approximately 366,000 units, reflecting a year-on-year decline of 3.1%. Despite sluggish sales of the Ioniq 5 and EV6, the company is focusing on a turnaround with upcoming models such as the EV9 and EV3.

While global EV registrations have increased, overall demand continues to wane, especially in regions outside China, which recorded a year-on-year growth of 31.5%. The situation is particularly challenging in Europe, where the market has seen a decline of 2.7%. Analysts attribute the slowdown in demand and profitability concerns among traditional automakers to a more cautious approach to electrification. Contributing factors include reduced subsidies, high prices, and insufficient charging infrastructure.

The current landscape of the global EV market showcases a complex interplay of regional growth disparities, market dynamics, and shifting consumer preferences. As the industry confronts these challenges, future developments will likely depend on technological advancements, policy changes, and strategic responses from key players in the market.