In a recent statement at the Morgan Stanley Sustainable Finance Summit, Ford Motor Co’s CEO, Jim Farley, emphasized that Chinese electric vehicle (EV) manufacturers are the primary rivals in the sector, surpassing renowned companies such as GM and Toyota. Farley expressed his conviction that the Chinese automakers would emerge as the powerhouse in the industry.

Farley commended China, the world’s largest auto market, for its exceptional battery technology and dominance in EV production. Notably, he acknowledged BYD, Geely, Great Wall, Changan, and SAIC as the “winners” among Chinese automakers. Recognizing these accomplishments, Farley identified the need for Ford to establish distinctive branding, which he believes the company possesses, or to tackle the challenge of lowering costs. However, he raised a pertinent question: How can Ford compete on cost when its scale is merely a fraction of its Chinese counterparts?

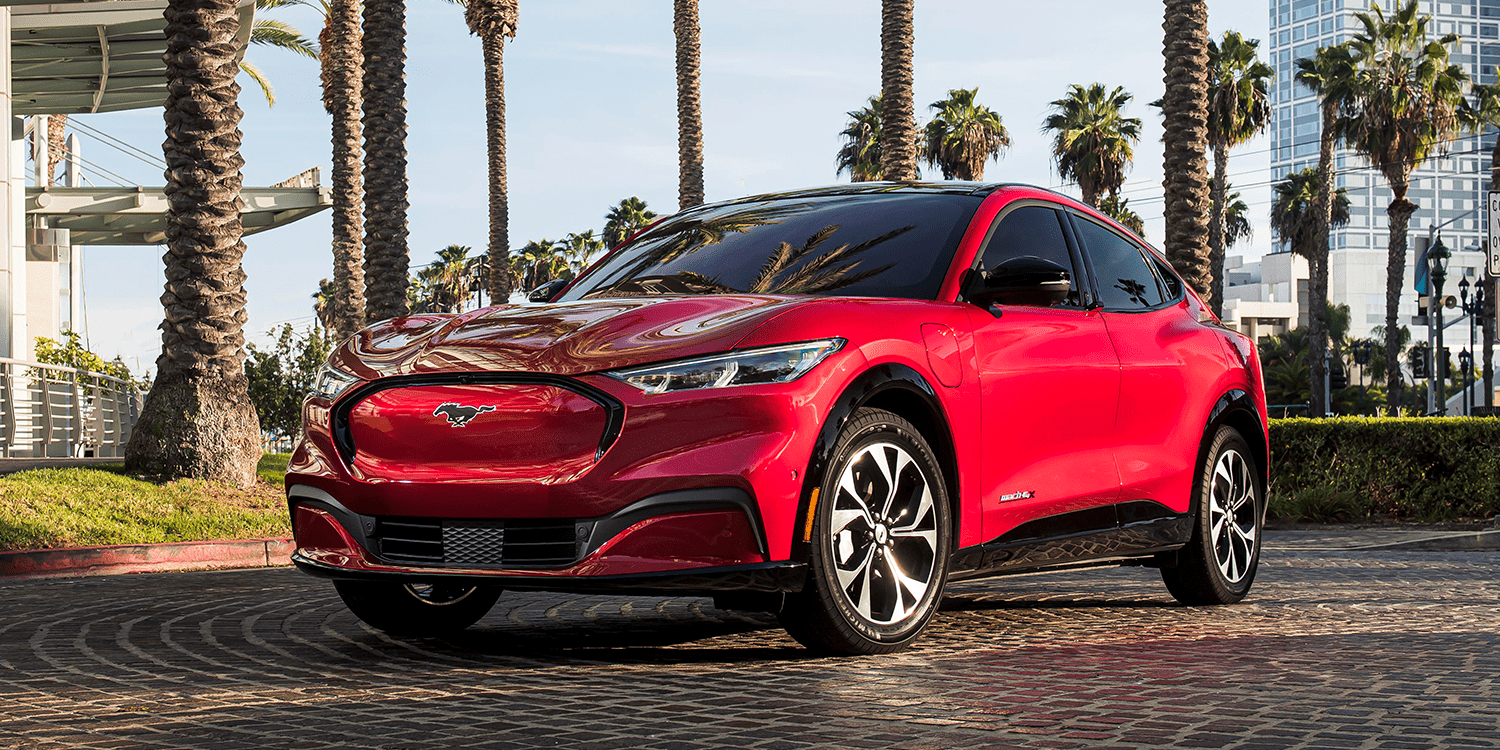

Highlighting the European market, Farley noted that European automakers had allowed Chinese manufacturers to enter their market, resulting in high-volume sales. To counter the competition from Chinese automakers, Ford disclosed its plans in February to invest $3.5 billion in a Michigan-based electric vehicle battery plant. This partnership with Chinese company CATL aims to leverage their technology and produce lower-cost batteries.

However, Ford’s collaboration with CATL awaits the U.S. Treasury’s issuance of rules later this year. These rules will determine if the arrangement violates the prohibition on “Foreign Entities of Concern,” a condition associated with a $7,500 EV tax credit. Criticism of Ford’s plan has come from Senator Marco Rubio, raising concerns about potential complications.

Farley underscored the importance of deciding on battery localization in the United States, expressing apprehension about political entanglements and the potential negative impact on customers. While Ford grapples with these challenges, General Motors CEO Mary Barra made her first visit to China since the pandemic began. GM is currently facing difficulties in the Chinese market, with sales experiencing a slump.

Meanwhile, Ford has been implementing cost-cutting measures in China, where sales have been declining since 2016. The company plans to restructure its operations in the country, converting one of its joint ventures into an export hub for low-cost commercial electric and combustion vehicles.

The significance of Chinese automakers cannot be understated, as even Tesla CEO Elon Musk acknowledged their hard work and ingenuity. Musk expressed the likelihood of a Chinese company emerging as the second most formidable competitor to Tesla.

In a landscape defined by fierce competition, Ford recognizes the need to overcome hurdles in cost and scale to effectively compete with Chinese EV manufacturers. The future of the industry hinges on innovative strategies, distinctive branding, and the ability to navigate political and economic complexities.