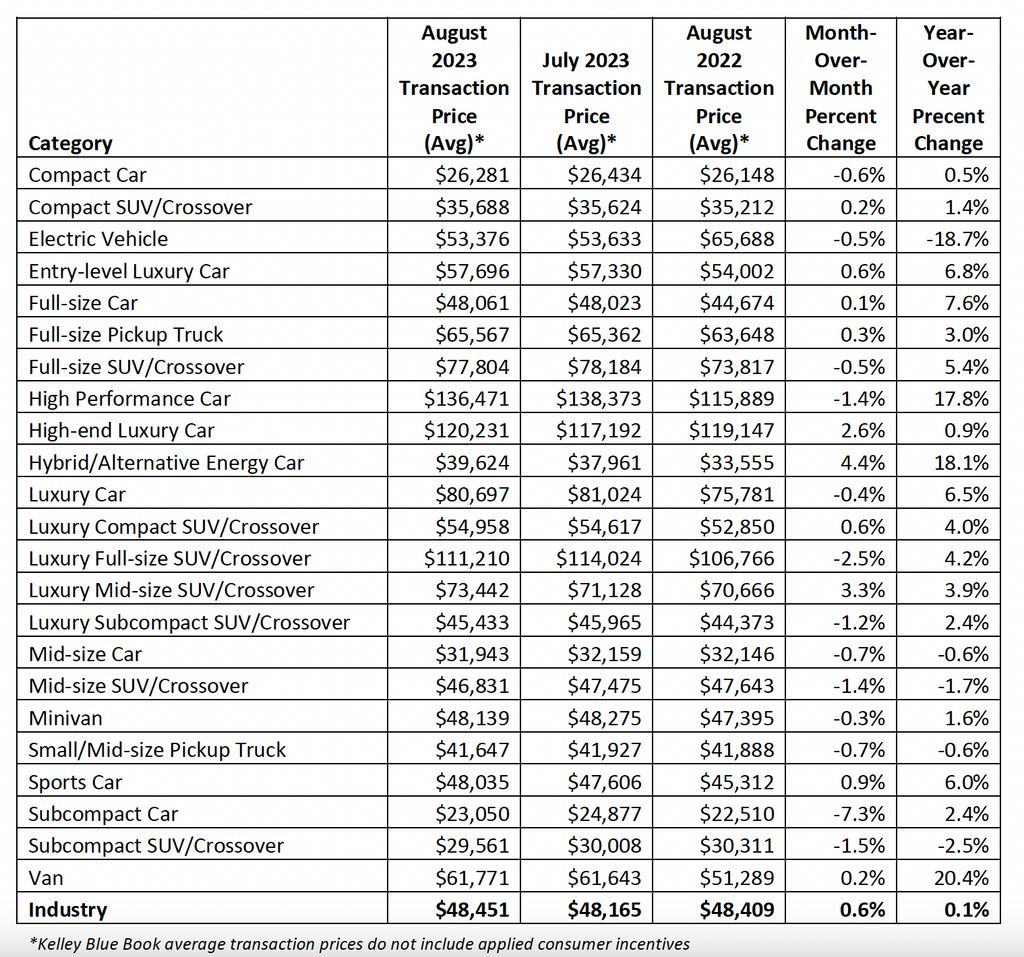

The prices of electric vehicles (EVs) in North America have been on a consistent downward trajectory, largely influenced by substantial price reductions by Tesla. According to a report by Cox Automotive, in August 2022, the average cost of an EV in the United States stood at €61,211. Fast forward to August 2023, and the same report reveals a notable decrease, with the average price now at €49,738. This marks an 18.7% reduction in just one year, with the potential for further dips when factoring in enticing federal and state incentives.

While prospective EV buyers eagerly anticipate more affordable options, franchised auto dealers appear to be less enthused about the future of EV sales. Jonathan Smoke, Chief Economist at Cox Automotive, suggests that it’s not a decline in demand that concerns dealers, but rather a looming oversupply.

Smoke characterizes this oversupply as a “natural speed bump” in the growth journey of the EV market. He goes on to explain that the surplus inventory, combined with intensified competition, could drive EV prices even lower in the near future. For those contemplating the switch to EVs, the financial scales seem to be increasingly tilting in their favor.

In the first seven months of 2023, Tesla exhibited remarkable strength with a staggering 390,377 new registrations in the United States alone. This dominance has translated into Tesla holding nearly 60% of the EV market share, leaving Chevrolet trailing behind at 6% and Ford at 5.2%.

In August 2023, Tesla went further by slashing its prices, offering discounts of up to €5,100 on the Model 3 Long Range. This move comes as Tesla prepares to introduce a facelifted version that is not yet available in the U.S. The result? Tesla’s average transaction price plummeted by 19.5% over the course of a year, dropping from €63,583 to €51,199.

While pure EVs benefit from the ongoing price reductions, hybrid vehicles are experiencing a different trend. Their average prices have risen by 18.1% over the past year. Despite Tesla’s dominant market share and aggressive pricing strategy, hybrids have proven resilient and remain the preferred choice for those seeking an eco-friendly yet affordable drive.

As the new generation of improved electric cars enters the market, older models are increasingly appearing in used car dealerships. However, potential buyers are cautious, recognizing that a 5-year-old EV is not equivalent to a 5-year-old legacy internal combustion engine-powered vehicle. This situation may necessitate further price reductions to facilitate the movement of these older EVs.