Chinese electrical automotive start-up Xpeng plans to turn into a worldwide automaker, with half of car deliveries going to nations exterior China, vp and chairman Brian Gu mentioned Wednesday.

“As an organization that focuses on world alternatives, we need to be balanced with our contribution of supply — half from China, half from exterior China — in the long term,” Gu mentioned in an unique interview with CNBC’s Arjun Kharpal on “Squawk Field Asia.”

Gu didn’t present a particular time-frame for reaching that purpose.

For comparability, U.S.-based Tesla mentioned within the third quarter that its residence market accounted for 46.6% of whole gross sales.

China accounted for 22.6% of Tesla’s general gross sales, up from just below 20% a 12 months in the past. Elon Musk’s automaker opened a manufacturing facility in Shanghai and started delivering domestically made automobiles simply earlier than the onset of the pandemic in January 2020.

Gu mentioned Guangzhou-based Xpeng would make investments extra in worldwide markets this 12 months and subsequent, and expects to enter Sweden, Denmark and the Netherlands subsequent 12 months.

Xpeng started delivery automobiles to Norway in December 2020. Different Chinese language automakers have centered their preliminary abroad growth on the nation, the place authorities incentives have supported native demand for electrical automobiles.

U.S.-listed Chinese language start-up Nio opened a flagship retailer in Oslo and started native automotive deliveries in September.

BYD, backed by U.S. billionaire Warren Buffett, started delivery electrical automobiles to Norway this summer time, and goals to ship 1,500 automobiles there by the top of the 12 months. Final week, BYD mentioned it launched deliveries to the Dominican Republic, following an analogous growth to Brazil, Mexico, Colombia, Uruguay, Costa Rica, and the Bahamas in October.

U.S.-listed Xpeng’s shares rose greater than 8% in a single day after the corporate reported a beat on income within the third quarter, coming in at 5.72 billion yuan ($887.7 million). That topped expectations of 5.03 billion yuan, in response to StreetAccount.

Nonetheless, the start-up reported a greater-than-expected lack of 1.77 yuan (27 cents) per share, versus expectations of an 1.17 yuan loss, in response to StreetAccount.

Gu mentioned Wednesday he expects the automaker can attain breakeven in two years.

In late 2019, earlier than the coronavirus pandemic and the following chip scarcity, Gu informed CNBC he anticipated to achieve breakeven in about two or three years — if the corporate is ready to produce 150,000 automobiles a 12 months.

Xpeng mentioned final month it has produced a complete of simply over 100,000 automobiles since its founding six years in the past.

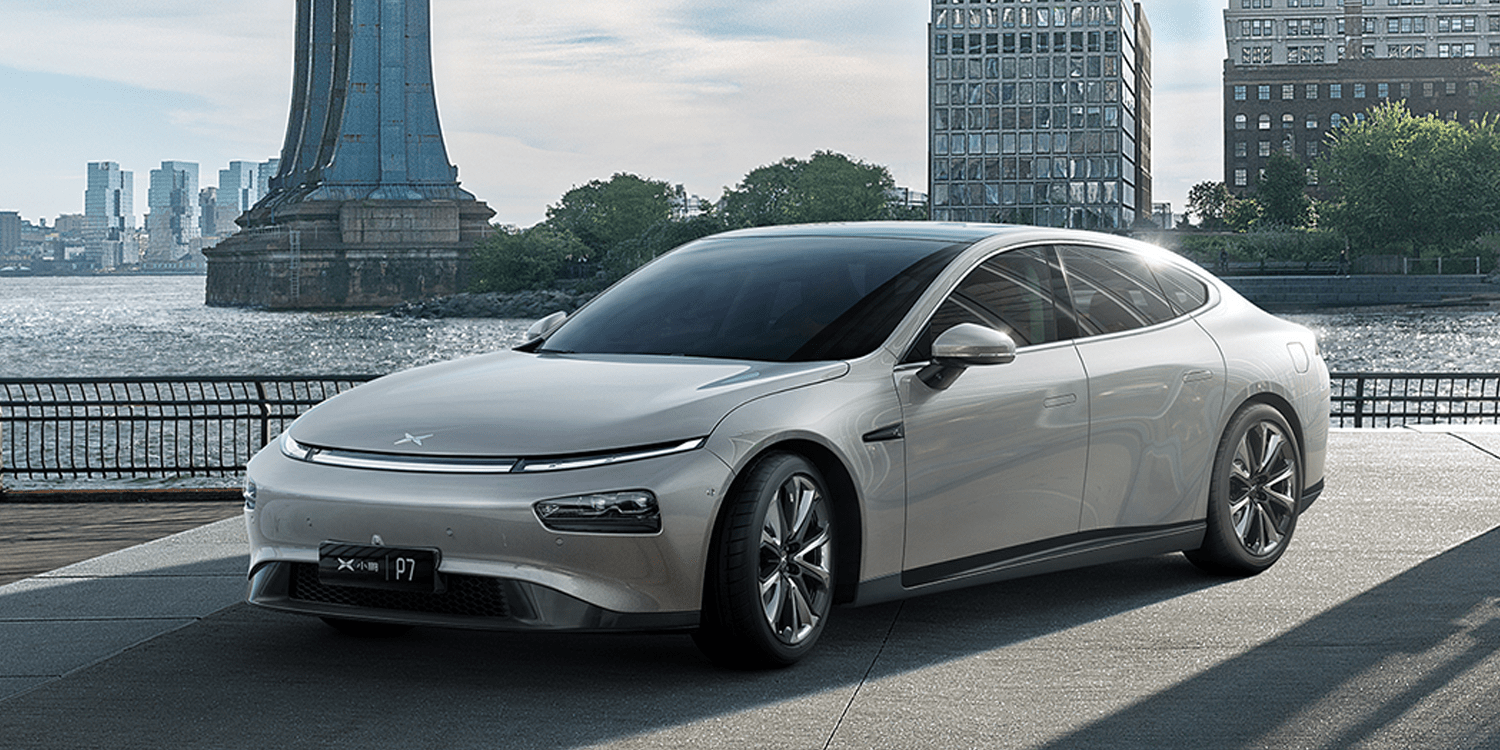

The corporate launched its first commercially accessible automobile, the G3 SUV, in December 2018. However the P7 sedan, which started deliveries final summer time, has confirmed way more widespread and accounts for greater than 77% of deliveries, in response to Gu.

Xpeng started delivering a 3rd electrical mannequin, the P5 sedan, in October. Final week, the start-up revealed a brand new electrical SUV, the G9, which Xpeng mentioned is designed for the worldwide and Chinese language markets.

[…] See also: Chinese Tesla rival Xpeng desires to promote half of its automobiles abroad […]