Chile’s President Gabriel Boric recently announced a plan to have the state take a controlling stake in the country’s lithium industry. The announcement has left business leaders feeling disconcerted, while analysts have cautioned that the proposal appears to try to strike a middle ground between competing interests.

Boric stated that private companies will have to partner with the government in exploiting Chile’s lithium, with the state taking a controlling interest in each partnership. This has led some to call it a nationalization of the industry, while others have disagreed. Nicolás Saldías, senior analyst at the Economist Intelligence Unit for Latin America and the Caribbean, explains, “Phrasing it as nationalization is too strong… it’s a quasi-nationalization in that the playing field will now be leveled in favor of the state.”

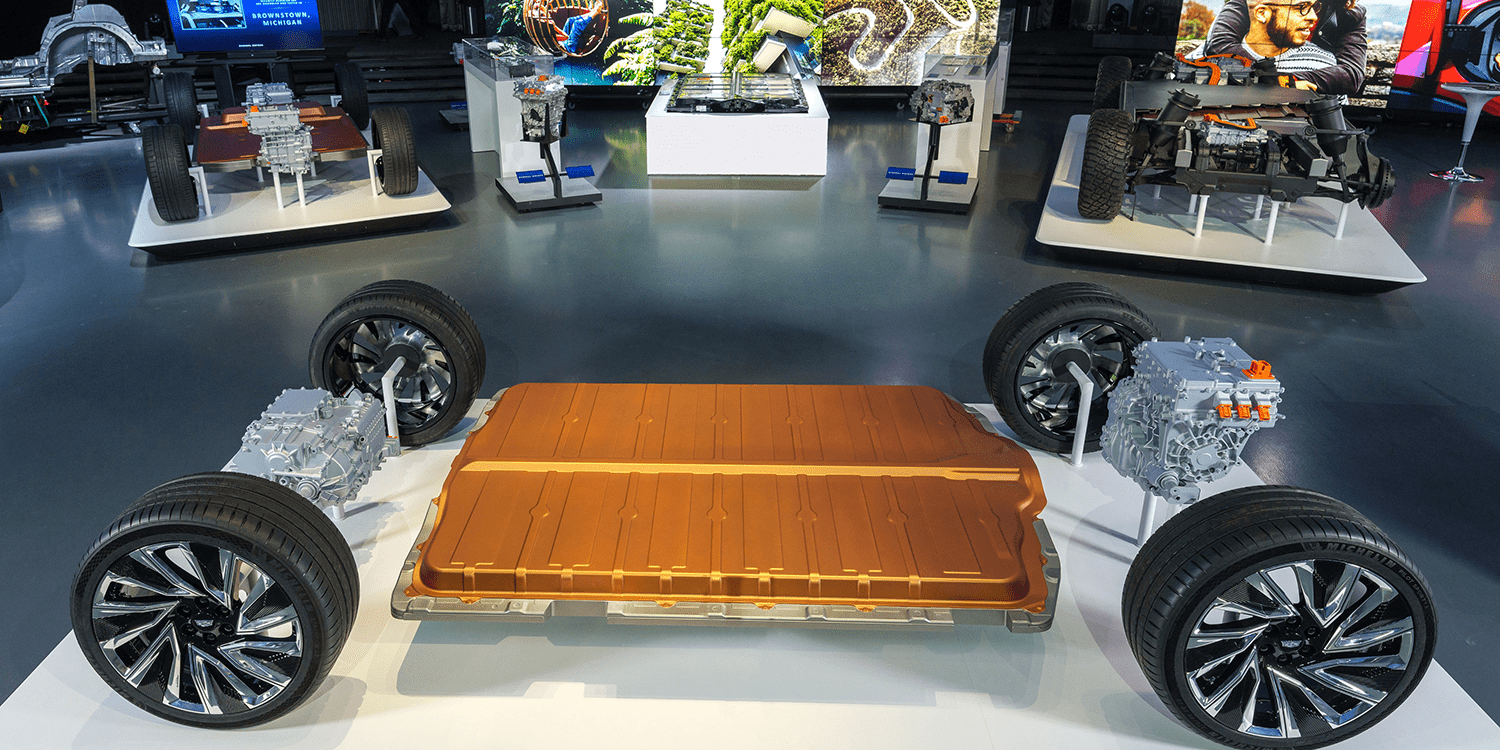

Chile is the second largest producer of lithium and holds the world’s third-largest reserves of the metal. Demand for lithium is expected to soar amid the transition to renewable energy around the world and the growth in electric vehicles that are powered by lithium batteries.

Under the plan, all companies wanting to work in Chile’s lithium sector will have to take on the yet-to-be-created National Lithium Company as a partner, with the state having control over the partnership. Existing contracts will be honored, but Boric expressed optimism that they could find a way to boost state participation in their operations before they expire.

“It’s not a theft of the concessions, it’s a changing of the rules rather than abruptly breaking them,” says Emily Hersh, CEO of Luna Lithium, a lithium exploration company with projects in the Americas.

The creation of the new company would require approval from Congress, which has already shot down several of Boric’s key initiatives. Until then, two other state-owned companies, Codelco and Enami, will figure out how the private-public partnerships will operate.

While the plan is in line with the direction that the world is going, there are still concerns. Ricardo Mewes, head of the Confederation of Production and Trade, an association that represents Chile’s business community, expressed concern that the state will be the one that will control the industry.

However, Saldías at the Economist Intelligence Unit explains that the proposal “actually provides the private sector more opportunity than the existing framework because … there would be more ability to partake in projects than currently exists.” He cautions, though, that environmental restrictions on the way lithium is produced and the push for more consultation with local communities could lead to “an increase in the costs of doing business” in Chile.

The announcement has left many wondering what message this sends to others in the region that are trying to build up nascent industries. Considering Mexico already nationalized its lithium sector, there’s a concern that there will be a rush to follow suit. Hersh at Luna Lithium says, “You kind of have a rush to the party, you can’t be seen as the uncool president who isn’t doing it.”