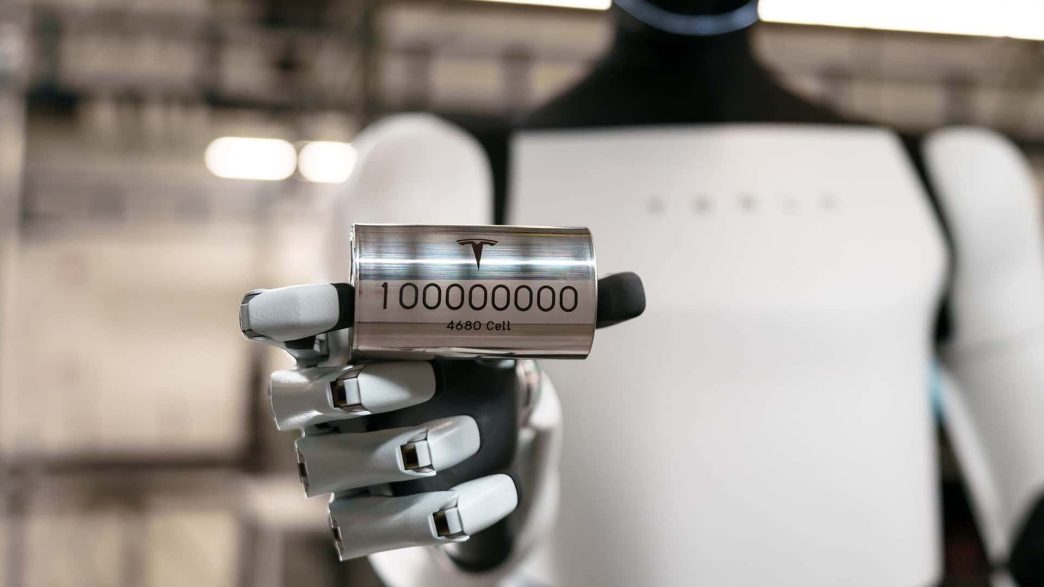

Tesla’s ambitious push into next-generation battery technology has reached a significant milestone, with the company announcing the production of its 100 millionth 4680 battery cell. The proprietary cylindrical cell powers Tesla’s highly anticipated Cybertruck and has been featured in select Model Y crossovers.

The 4680 battery, introduced in 2020, promises higher energy density, lower manufacturing costs, and streamlined assembly compared to its predecessors, the 2170 and 1865 cells, used across Tesla’s Model 3, Model Y, Model S, and Model X. Tesla’s ramp-up to an average production rate of 495,000 cells daily is sufficient to supply 368 Cybertrucks.

Despite Tesla’s achievements, the world’s largest battery manufacturer, Contemporary Amperex Technology Limited (CATL), remains critical of the cylindrical cell format. CATL’s founder, Robin Zeng, has expressed skepticism about Tesla’s choice, describing it as a “dead end.”

Zeng, in an interview with Reuters, disclosed that he had confronted Tesla CEO Elon Musk about the viability of the 4680 cell during a meeting. “We had a very big debate, and I showed him,” Zeng said. “He was silent. He doesn’t know how to make a battery. It’s about electrochemistry. He’s good for the chips, the software, the hardware, the mechanical things.”

The CATL executive also criticized Musk’s tendency to set aggressive timelines for Tesla projects, including autonomous driving and the recently announced Cybercab robotaxi, expected in 2026. “His problem is overpromising,” Zeng remarked. “Maybe something needs five years. But he says two years. I definitely asked him why. He told me he wanted to push people.”

Despite their differing views, Zeng acknowledged Musk’s vision, saying, “The direction is right.”

While Tesla focuses on nickel-cobalt-manganese (NCM) chemistry for its 4680 cells, CATL specializes in lithium iron phosphate (LFP) prismatic cells, which are renowned for cost-effectiveness and durability. The Chinese company recently introduced sodium-ion batteries as an even cheaper alternative to LFP cells.

CATL is a key supplier for Tesla’s Shanghai Gigafactory, which produces Model 3 and Model Y vehicles for domestic and global markets. The two companies maintain close ties, with Tesla licensing CATL’s technology for a forthcoming battery facility in Nevada, set to open next year.

As Tesla continues its efforts to scale 4680 production and innovate battery technology, the debate underscores the challenges of balancing technical ambition with market practicality in the rapidly evolving EV industry.